Question

In: Physics

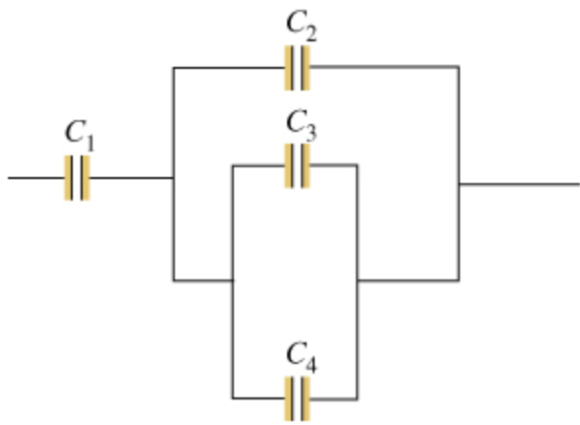

Consider the combination of capacitors shown in the diagram, where C1 = 3.00uF , C2 = 11.0uF , C3 = 3.00uF , and C4 = 5.00uF .

Consider the combination of capacitors shown in the diagram, where C1 = 3.00uF , C2 = 11.0uF , C3 = 3.00uF , and C4 = 5.00uF .

Find the equivalent capacitance CA of the network of capacitors.

Express your answer in microfarads.

Solutions

Expert Solution

in series \(\frac{1}{C_{\mathrm{eq}}}=\frac{1}{C_{1}}+\frac{1}{C_{2}}\)

and in parallel \(C_{\mathrm{eq}}=C_{1}+C_{2}\)

equivalent capacitance = here \(\mathrm{c} 3\) and \(\mathrm{c} 4\) are parallel and combined parallel to \(\mathrm{C} 2\),

\((\mathrm{C} 2+\mathrm{C} 3+\mathrm{C} 4)\) in series with \(\mathrm{C} 1\)

\(=19\) in series with \(3=19^{*} 3 /(19+3)\)

\(=57 / 22\)

Related Solutions

U(C1, C2, C3, C4, C5) = C1∙C2∙C3∙C4∙C5 As a mathematical function, does U have a maximum...

U(C1, C2, C3, C4, C5) = C1∙C2∙C3∙C4∙C5

As a mathematical function, does U have a maximum or minimum

value? What values of Ci correspond to the minimum value of U? What

values of Ci correspond to the maximum value of U? Do these values

of Ci make sense from an economic standpoint?

Now let us connect the idea of economic utility to actual dollar

values. To keep the values more manageable, we will use household

income rather than the entire...

U(C1, C2, C3, C4, C5) = C1∙C2∙C3∙C4∙C5 As a mathematical function, does U have a maximum...

U(C1, C2, C3, C4, C5) = C1∙C2∙C3∙C4∙C5

As a mathematical function, does U have a maximum or minimum

value? What values of Ci correspond to the minimum value of U? What

values of Ci correspond to the maximum value of U? Do these values

of Ci make sense from an economic standpoint?

Now let us connect the idea of economic utility to actual dollar

values. To keep the values more manageable, we will use household

income rather than the entire...

U(C1, C2, C3, C4, C5) = C1∙C2∙C3∙C4∙C5 As a mathematical function, does U have a maximum...

U(C1, C2, C3, C4, C5) = C1∙C2∙C3∙C4∙C5

As a mathematical function, does U have a maximum or minimum

value? What values of Ci correspond to the minimum value of U? What

values of Ci correspond to the maximum value of U? Do these values

of Ci make sense from an economic standpoint?

Now let us connect the idea of economic utility to actual dollar

values. To keep the values more manageable, we will use household

income rather than the entire...

Consider the following cash flows: C0 / C1/ C2 /C3 /C4 ? $ 27 / +...

Consider the following cash flows:

C0 / C1/ C2 /C3 /C4

? $ 27 / + $ 24 / + $ 24 / + $ 24 / ? $ 46

a. Which two of the following rates are the IRRs of this

project? (You may select more than one answer. Single click the box

with the question mark to produce a check mark for a correct answer

and double click the box with the question mark to empty the box...

Calculate the values "c1, c2, c3, c4, c5" with superposition 6(c1) – (c3)=50 -3(c1) + 3(c2)=0...

Calculate the values "c1, c2, c3, c4, c5" with

superposition

6(c1) – (c3)=50

-3(c1) + 3(c2)=0

9(c3) – (c2)= 160

-(c2) – 8(c3) – 2(c5) + 11(c4)=60

-3(c1) – (c2) + 4(c5)=10

Consider the following information: Cash Flows ($) Project C0 C1 C2 C3 C4 A –6,300 2,300...

Consider the following information:

Cash Flows ($) Project C0 C1 C2 C3 C4

A –6,300 2,300 2,300 2,000 0

B –1,600 0 1,000 3,300 4,300

C –3,700 2,300 1,000 1,800 1,300

a. What is the payback period on each of the above projects?

(Round your answers to 2 decimal places.)

Project Payback Period

A year(s)

B year(s)

C year(s)

b. Given that you wish to use the payback rule with a cutoff

period of two years, which projects would you...

Consider the following projects: Cash Flows ($) Project C0 C1 C2 C3 C4 C5 A −2,000...

Consider the following projects:

Cash Flows ($) Project C0 C1 C2 C3 C4 C5

A −2,000 2,000 0 0 0 0

B −4,000 2,000 2,000 5,000 2,000 2,000

C −5,000 2,000 1,300 0 2,000 2,000

a. If the opportunity cost of capital is 12%, which project(s)

have a positive NPV?

Positive NPV project(s)

Project A

Project B

Project C

Projects A and B

Projects A and C

Projects B and C

Projects A, B, and C

No project

b. Calculate...

Consider the following projects: Cash Flows ($) Project C0 C1 C2 C3 C4 C5 A −2,500...

Consider the following projects:

Cash Flows ($)

Project

C0

C1

C2

C3

C4

C5

A

−2,500

2,500

0

0

0

0

B

−5,000

2,500

2,500

5,500

2,500

2,500

C

−6,250

2,500

2,500

0

2,500

2,500

a. If the opportunity cost of capital is 9%,

which project(s) have a positive NPV?

Positive NPV project(s)

Project A

Project B

Project C

Projects A and B

Projects A and C

Projects B and C

Projects A, B, and C

No project

b. Calculate...

Consider the following information: Cash Flows ($) Project C0 C1 C2 C3 C4 A –6,200 2,200...

Consider the following information:

Cash Flows ($)

Project

C0

C1

C2

C3

C4

A

–6,200

2,200

2,200

2,900

0

B

–1,500

0

1,000

3,200

4,200

C

–3,800

2,200

1,300

1,700

1,200

a. What is the payback period on each of the

above projects? (Round your answers to 2 decimal

places.)

Project

Payback Period

A

year(s)

B

year(s)

C

year(s)

b. Given that you wish to use the payback rule

with a cutoff period of two years, which projects would you...

Consider the following projects: Cash Flows ($) Project C0 C1 C2 C3 C4 C5 A −2,800...

Consider the following

projects:

Cash Flows ($)

Project

C0

C1

C2

C3

C4

C5

A

−2,800

2,800

0

0

0

0

B

−5,600

2,800

2,800

5,800

2,800

2,800

C

−7,000

2,800

2,500

0

2,800

2,800

If the opportunity

cost of capital is 12%, which project(s) have a positive NPV?

Positive NPV Projects

Calculate the payback

period for each project.

Project A

years

Project B

years

Project C

years

Which project(s) would

a firm using the payback rule accept...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

ADVERTISEMENT

Dr. OWL answered 5 years ago

Dr. OWL answered 5 years ago