Question

In: Finance

Alouette Inc.

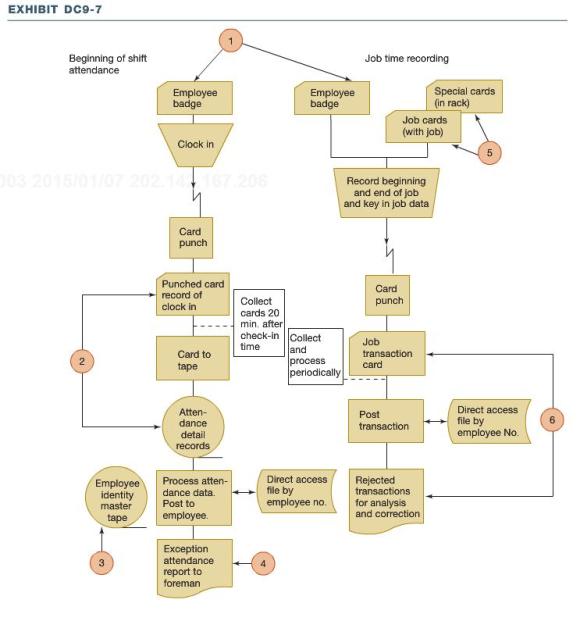

Each number of the flow chart in Exhibit DC9-7 locates a control point in the labor processing system of your auditee,

Alouette Inc.

Required:

a. Make a list of the control points, and, for each point, describe the type or kind of internal control procedure that ought to be specified.

b. Assume that Exhibit DC9-7 is the system description in Alouette’s prior year’s audit file. During the current year, the company converted to an electronic security card system. Each employee is issued a security card with a magnetic stripe containing his or her identity code. At the start of the shift the employee swipes his or her security card to enter the factory floor. Using an internal clock, the scanner generates a start time entry in the system’s attendance detail records file. The employee then reports to the floor supervisor to be assigned to a job for his or her shift. The supervisor uses a terminal that displays a real-time list of checked-in employees, and enters the job number assignment beside the employee’s name. The job costing system automatically creates an open daily job transaction entry. At the end of the shift the employee swipes his or her card to exit the factory floor and the total shift time is entered to the open job transaction. The daily job transaction entry is then closed and a labor charge entry for the employee’s shift is generated in the job costing system and in the payroll file.

You have been assigned to assess controls for the current year audit. Update Exhibit DC9-7 to reflect the new employee attendance and job costing systems described above. Identify control points in the new systems, and indicate control procedures that should be used to prevent errors in payroll and job costing.

Solutions

Expert Solution

a)

1.

Control over issuance and retirement of badges.

2.

Control totals developed from input card punch (read electronically) operation with comparison to detail records to ensure that all cards are processed accurately.

3.

Control over authority for master file changes and over custody of the master file.

4.

Controls to ensure that exceptions are resolved by the foreman (e.g., review procedures or a surprise audit, if necessary.)

5.

Control over authority to issue special and indirect labour charges to maintain integrity of cost accounting system.

6.

Control totals developed for input job transaction cards and output error listing to ensure that all cards are processed and reprocessed accurately.

7.

Controls to ensure that all rejected and erroneous transactions are cleared promptly (e.g., review procedures and a surprise audit, if necessary).

b)

The question requires one to study a flowchart and update it to reflect adoption of a new automated procedure for employee access and generation of hours-worked entries in a job costing system. Principles of control need to be applied to consider the control strength and efficiencies the new procedure can provide, as well as the new control risks that need to be addressed by control procedures to avoid errors in payroll and job costing.

Related Solutions

Operating Leverage Beck Inc. and Bryant Inc. have the following operating data: Beck Inc. Bryant Inc....

Operating Leverage Beck Inc. and Bryant Inc. have the following operating data: Beck Inc. Bryant Inc....

perating Leverage Beck Inc. and Bryant Inc. have the following operating data: Beck Inc. Bryant Inc....

Operating Leverage Beck Inc. and Bryant Inc. have the following operating data: Beck Inc. Bryant Inc....

Operating Leverage Beck Inc. and Bryant Inc. have the following operating data: Beck Inc. Bryant Inc....

Operating Leverage Beck Inc. and Bryant Inc. have the following operating data: Beck Inc. Bryant Inc....

Orange Inc. is a division of Fruits Inc. Orange Inc produces juice and sells it to...

About Caterpillar Inc. The following is derived from the Caterpillar Inc. website: Caterpillar Inc. is a...

GAP Inc. DESCRIPTION The Gap, Inc. (Gap Inc.), incorporated on April 15, 1988, is an apparel...

Kittner, Inc.

- Draw the supply and demand graph for coffee below assuming the market operates at an equilibrium...

- How fast, in rpm, would a 130 g , 58-cm-diameter beach ball have to spin to...

- C++ ! Create a Stash class specifically for storing Rect objects and call it RectStash. Add...

- How did the expansion of the public sphere and a new language of rights offer oppurtunities...

- P company purchased a 70% interest in S company on January 1, 2015 for $2,000,000. The...

- How to run the following code in ecclipse IDE? MQTT PUBLISH - SUBSCRIBE MODEL CODE IN...

- 1. A corporation has 71,376 shares of $24 par stock outstanding that has a current market...

Raffay answered 3 years ago

Raffay answered 3 years ago