Question

In: Accounting

1. A corporation has 71,376 shares of $24 par stock outstanding that has a current market...

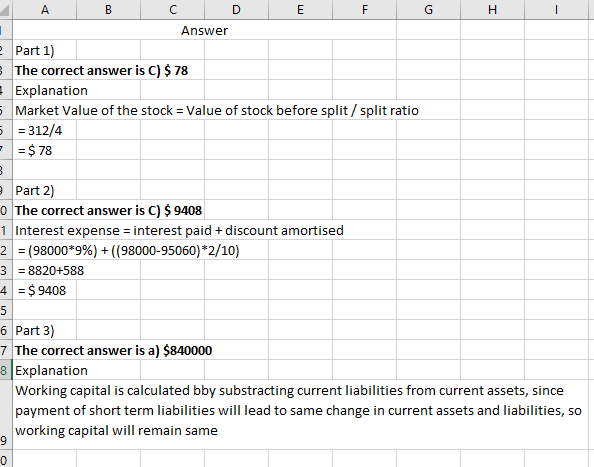

1. A corporation has 71,376 shares of $24 par stock outstanding that has a current market value of $312 per share. If the corporation issues a 4-for-1 stock split, the market value of the stock will fall to approximately

a.$17,844

b.$288

c.$78

d.$6

2. On January 1 of the current year, the Barton Corporation issued 9% bonds with a face value of $98,000. The bonds are sold for $95,060. The bonds pay interest semiannually on June 30 and December 31 and the maturity date is December 31, five years from now. Barton records straight-line amortization of the bond discount. The bond interest expense for the year ended December 31 is

a.$2,940

b.$735

c.$9,408

d.$8,820

3. A company with working capital of $840,000 and a current ratio of 4 pays a $135,000 short-term liability. The amount of working capital immediately after payment is

a.$840,000

b.$705,000

c.$135,000

d.$975,000

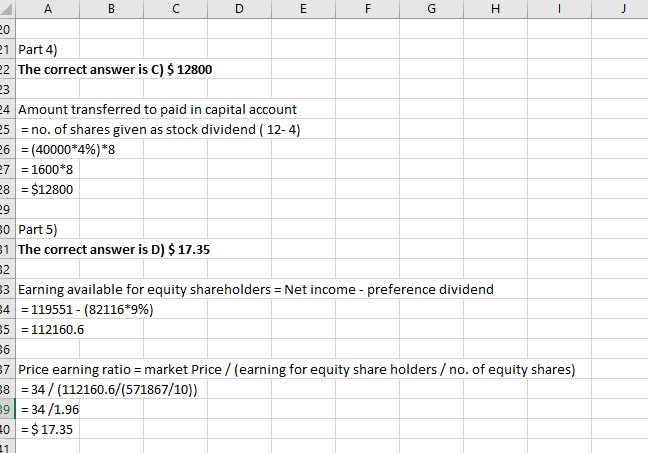

4. A company with 100,000 authorized shares of $4 par common stock issued 40,000 shares at $8. Subsequently, the company declared a 4% stock dividend on a date when the market price was $12 a share. What is the amount transferred from the retained earnings account to paid-in capital accounts as a result of the stock dividend?

a.$19,200

b.$32,000

c.$12,800

d.$48,800

5. The balance sheets at the end of each of the first two years of operations indicate the following:

|

Kellman Company |

||

|

Year 2 |

Year 1 |

|

|

Total current assets |

$627,334 |

$563,517 |

|

Total investments |

61,933 |

43,071 |

|

Total property, plant, and equipment |

946,792 |

708,418 |

|

Total current liabilities |

113,967 |

87,707 |

|

Total long-term liabilities |

287,103 |

225,002 |

|

Preferred 9% stock, $100 par |

82,116 |

82,116 |

|

Common stock, $10 par |

571,867 |

571,867 |

|

Paid-in capital in excess of par-common stock |

60,515 |

60,515 |

|

Retained earnings |

520,491 |

287,799 |

Using the balance sheets for Kellman Company, if net income is $119,551 and interest expense is $31,114 for Year 2, and the market price of common shares is $34, what is the price-earnings ratio on common stock for Year 2 (rounded to two decimal places)?

a.1.96

b.10.69

c.10.21

d.17.35

Solutions

Expert Solution

The answer has been presenetd in the supporting sheet. For detailed answer refer to the supporting sheet.

Related Solutions

1) XYZ Corporation has outstanding 1,000 shares of $100 par, 10% preferred stock, and 6,000 shares...

Abbott Corporation has 40,000 shares outstanding at a market price per share of $24. Baxter Corporation...

Entries for Stock Dividends Paris Corporation has 23,000 shares of $70 par common stock outstanding. On...

Entries for Stock Dividends Madrid Corporation has 25,000 shares of $80 par common stock outstanding. On...

Flounder Corporation has outstanding 517,000 shares of $10 par value common stock. The corporation declares a...

Tamarisk Corporation has outstanding 125,000 shares of $10 par value common stock. The corporation declares the...

Nottebart Corporation has outstanding 10,000 shares of $100 par value, 6% preferred stock and 60,000 shares...

Wilson Corporation issued and has outstanding 134,400 shares of $10 par-value common stock and 2,800 shares...

Green Day Corporation has outstanding 400,000 shares of $10 par value common stock.

Problem #4 Pedroni Corporation has outstanding 3,000,000 shares of common stock with a par value of...

- MINIMUM MAIN.CPP CODE /******************************** * Week 4 lesson: * * finding the smallest number * *********************************/...

- Do you think President Eisenhower had a successful presidency?

- Barbour Corporation, located in Buffalo, New York, is a retailer of high-tech products and is known...

- C PROGRAMMIMG I want to check if my 2 input is a number or not all...

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

ekkarill92 answered 3 weeks ago

ekkarill92 answered 3 weeks ago