Question

In: Finance

Mary Poppins, a friend of yours, has recently set up a small business making curtains. She...

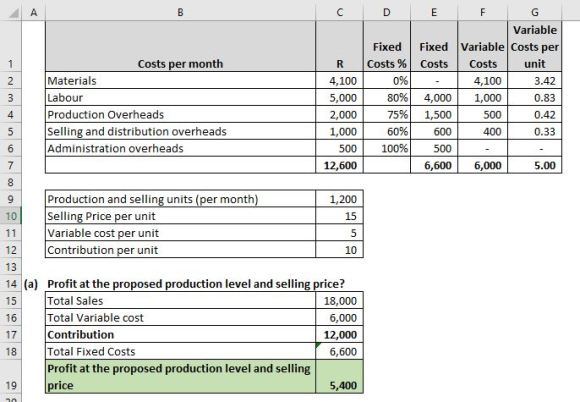

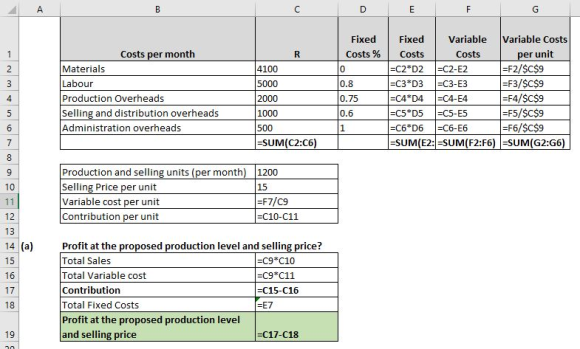

Mary Poppins, a friend of yours, has recently set up a small business making curtains. She has supplied you with the following figures, and has asked your advice on a number of issues:

|

Costs per month |

R |

|

Materials |

4 100 |

|

Labour |

5 000 |

|

Production overheads |

2 000 |

|

Selling and distribution overheads |

1 000 |

|

Administration overheads |

500 |

The above costs are based on producing and selling 1 200 pairs of curtains per month at a selling price of R15 each.

80% of labour costs are fixed, as are 75% of production overheads, 60% of selling and distribution overheads, and 100% of administration overheads. All other costs vary directly with output.

Mary wants to know:

- How much profit she will make at the proposed production level and selling price?(3)

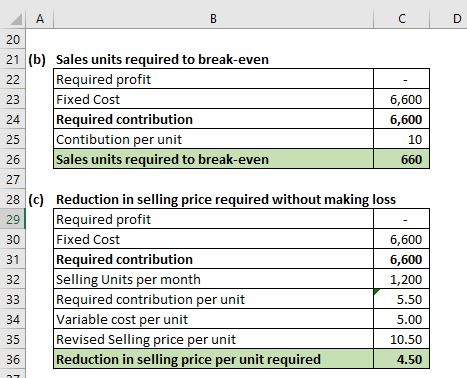

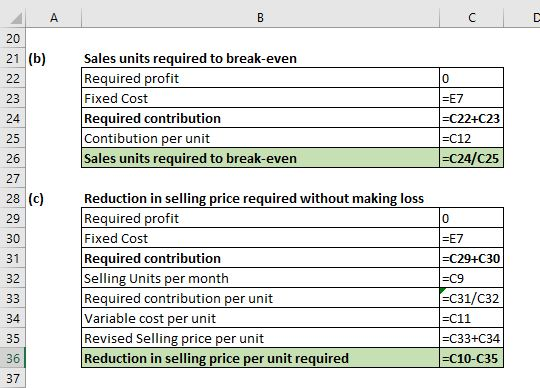

b) How many pairs of curtains she needs to sell to break even at this price? (3)

c) If sales are slower than expected, by how much can she reduce her selling price in order to maintain the budgeted level of sales without making a loss? (4)

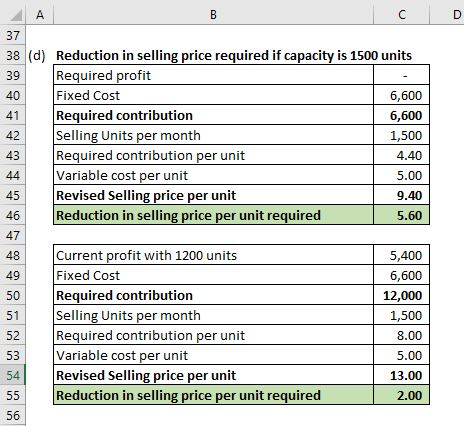

d) Mary estimates her maximum capacity as 1 500 curtains: would it be worthwhile to drop the price in order to increase sales to capacity? If so, by how much? (5)

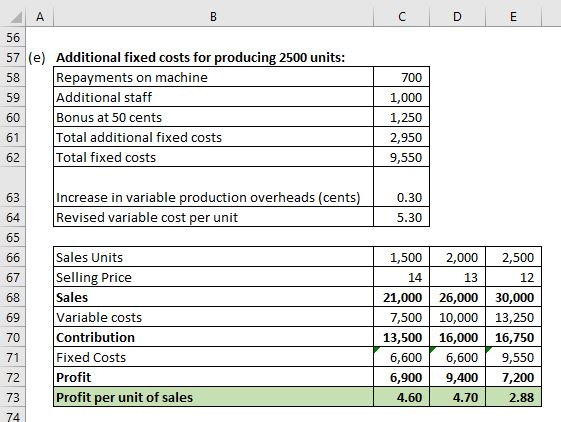

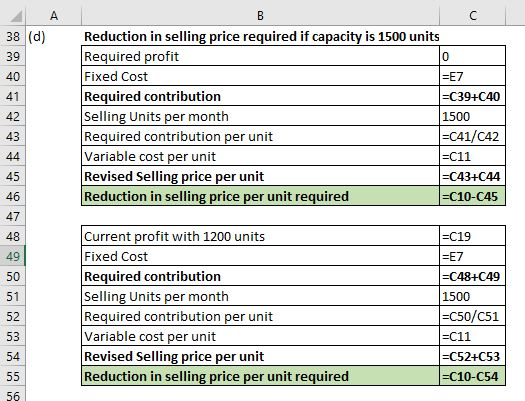

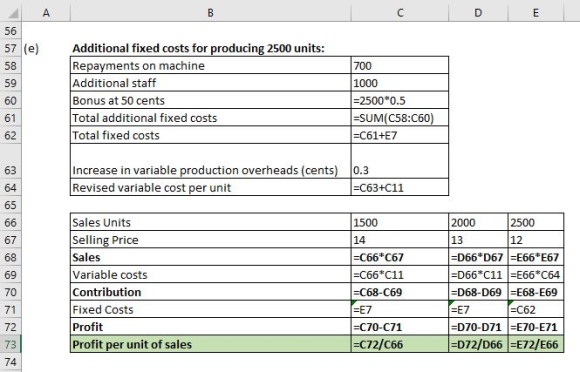

e) If Mary bought another machine, she could increase her production capacity to 2 500 curtains. Repayments on the machine would be R700 per month, and she would need an extra member of staff, costing R1 000 per month. She would also have to pay a bonus to all staff of 50 cents per pair of curtains, over and above their current wages, and variable production overheads would increase by 30 cents per pair of curtains.

In order to increase sales, she would have to reduce the price: she estimates demand at different price levels to be as follows:

|

Price |

Estimated monthly demand |

|

R14 |

1 500 |

|

R13 |

2 000 |

|

3R12 |

2 500 |

What would be the optimum price? (10)

Required:

Advise Mary on each of the above points, showing your calculations, explaining both the financial and non-financial implications of each where appropriate.

Solutions

Expert Solution

The entire question is solved using the equations:

Sales - Variable cost = Contribution

Contirbution - Fixed costs = Profit.

(a) Profit at the proposed production level and selling price? = 5,400

(b) Sales units required to break-even = 660

(c) Reduction in selling price required without making loss = 4.50

(d) Reduction in selling price required if capacity is 1500 units without making loss = 5.60

Reduction in selling price required if capacity is 1500 units for making estimated profit of 5,400= 2

It will be worthwhile to drop the selling price to increase sales to 1500 units. Reduction by 2 per unit will result in the same profit of 5,400. A reduction of 5.60 will result in no profit and no loss.

(e) Profit per unit of sales is highest for sale units of 2000 at selling price of 13.

Thus, this is the optimum price.

(1,500 and 2,000 units are considered can be produced without incurring additional fixed cost or variable cost per unit and also this sub-question (e) is considered indepedent of other sub-questions).

Workings:

Related Solutions

Mary Poppins, a friend of yours, has recently set up a small business making curtains. She...

Mary Poppins, a friend of yours, has recently set up a small business making curtains. She...

Mary Poppins, a friend of yours, has recently set up a small business making curtains. She has supplied you with the following figures, and has asked your advice on a number of issues:

A friend of yours is analyzing an investment in a small peach orchard. He has estimated...

A friend of yours is analyzing an investment in a small peach orchard. He has estimated...

A friend is interested in installing a wireless LAN in her small business. She has about...

A friend of yours recently said they came in contact with an antigen that is known...

A friend of yours says that she has found a lump in her breast. List steps...

A good friend of yours hears you are taking a course in "positive psychology." He/she has...

The mother of a close friend of yours is diagnosed with moderate osteoporosis. She is prescribed...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

jeff jeffy answered 3 years ago

jeff jeffy answered 3 years ago