Question

In: Accounting

Activity-Based Costing, Unit Cost, Ending Work-in-Process Inventory Salazar Company is a job-order costing firm that uses...

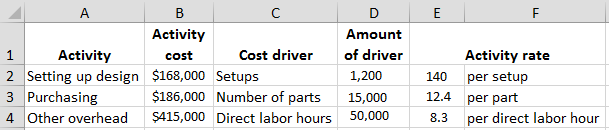

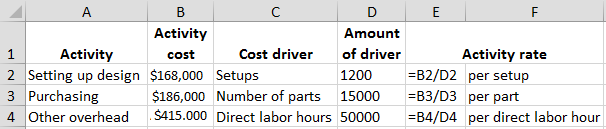

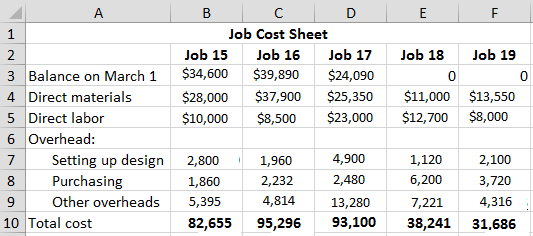

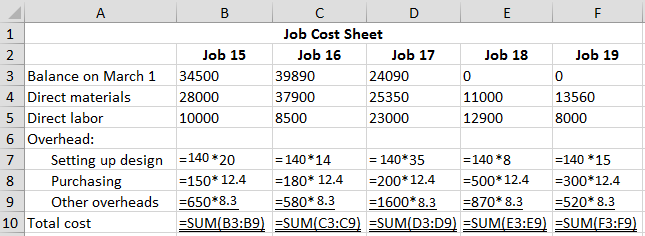

Activity-Based Costing, Unit Cost, Ending Work-in-Process Inventory Salazar Company is a job-order costing firm that uses activity-based costing to apply overhead to jobs. Salazar identified three overhead activities and related drivers. Budgeted information for the year is as follows: Activity Cost Driver Amount of Driver Setting up design $168,000 Setups 1,200 Purchasing 186,000 Number of parts 15,000 Other overhead 415,000 Direct labor hours 50,000 Salazar worked on five jobs in March. Data are as follows: Job 15 Job 16 Job 17 Job 18 Job 19 Balance, March 1 $34,600 $39,890 $24,090 $0 $0 Direct materials $28,000 $37,900 $25,350 $11,000 $13,550 Direct labor $10,000 $8,500 $23,000 $12,700 $8,000 Setups 20 14 35 8 15 Number of parts 150 180 200 500 300 Direct labor hours 650 580 1,600 870 520 By March 31, Jobs 15, 16, and 17 were completed and sold. The remaining jobs were in process. Required: 1. Calculate the activity rates for each of the three overhead activities. If required, round your answers to the nearest cent. Setup rate $ 140 per set up Purchasing rate $ 12.4 per part Other overhead rate $ 8.3 per direct labor hour Feedback 1. Remember OH rate = estimated annual OH ÷ by the related driver. 2. Prepare job-order cost sheets for each job showing all costs through March 31. What is the cost of each job by the end of March?. If an amount is zero, enter "0". Salazar Company Job-Order Cost Sheets Job 15 Job 16 Job 17 Job 18 Job 19 Balance, March 1 $ 34,600 $ 39,890 $ 24,090 $ 0 $ 0 Direct materials 28,000 37,900 25,350 11,000 13,550 Direct labor 10,000 8,500 23,000 12,700 8,000 Applied overhead: Setups Purchasing Other overhead Total cost $ $ $ $ $ Feedback 2. The job-order cost sheet must include a unique number or name for this particular job, all direct costs, and all overhead costs associated with the job. 3. Calculate the balance in Work in Process on March 31. $ 4. Calculate the cost of goods sold for March. $

Solutions

Expert Solution

ANSWER

1)

Activity rates should be calculated as follows:

Above figures have been calculated in the following manner:

2)

Above figures have been calculated in the following manner:

Above figures are calculated in the following manner:

3.

Jobs 15, 16, and 17 have been completed and sold in March. Therefore, work in process on March 31 will contain only Jobs 18 and 19.

Work in process on March 31 = Job 18 + Job 19 = $38,241 + $31,686= $69,927

4.

Cost of goods sold for March = Job 15 + Job 16 + Job 17 = $82,655 + $95,296 + $93,100 = $271,051

===========================================

DEAR STUDENT,

If you have any query or any Explanation please ask me in the comment box, i am here to helps you.please give me positive rating

*****************THANK YOU**************

Related Solutions

Activity-Based Costing, Unit Cost, Ending Work-in-Process Inventory, Journal Entries Feldspar Company uses an ABC system to...

Job Costs Using Activity-Based Costing Heitger Company is a job-order costing firm that uses activity-based costing...

Job Costs Using Activity-Based Costing Heitger Company is a job-order costing firm that uses activity-based costing...

Job Costs Using Activity-Based Costing Heitger Company is a job-order costing firm that uses activity-based costing...

Heitger Company is a job-order costing firm that uses activity-based costing to apply overhead to jobs....

Heitger Company is a job-order costing firm that uses activity-based costing to apply overhead to jobs....

Lamour Corporation is a job order costing company that uses activity-based costing to apply overhead to...

Lamour Corporation is a job order costing company that uses activity-based costing to apply overhead to...

Explain overhead for the different methods, for process costing, activity-based costing, job order costing.

Job-Order Cost Sheets, Balance in Work in Process and Finished Goods Prull Company, a job-order costing...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

ekkarill92 answered 3 months ago

ekkarill92 answered 3 months ago