Question

In: Finance

Froogle Enterprises is evaluating an unusual investment project. What makes the project unusual is the stream...

Froogle Enterprises is evaluating an unusual investment project. What makes the project unusual is the stream of cash inflows and outflows shown in the following table:

Year 1 $210,000

Year 2 -$966,000

Year 3 $1,661,100

Year 4 -$1,265,460

Year 5 $360,360

.

1. Why is it difficult to calculate the payback period for this project?

2. Calculate the investment's net present value at each of the following discount rates: 0%, 5%, 10%, 15%, 20%, 25%, 30%, 35%.

3. What does your answer to part b tell you about this project's IRR?

4. Should Froogle invest in this project if its cost of capital is 5%? What if the cost of capital is 15%?

5. In general, when faced with a project like this, how should a firm decide whether to invest in the project or reject it?

1. Why is it difficult to calculate the payback period for this project? (Select the best answer below.)

A.The huge amount of cash outflow in year 3 makes the calculation difficult.

B.The oscillating cash flows make it difficult to compute the payback period.

C.The short life of the project makes it difficult to compute the payback period.

D.It is unreal for a project to have a cash inflow as an initial investment.

2. If the discount rate is 0%, the investment's NPV is . $______(Round to two decimal places.)

If the discount rate is 5%, the investment's NPV is . $________(Round to two decimal places.)

If the discount rate is 10%, the investment's NPV is $________(Round to two decimal places.)

If the discount rate is 15%, the investment's NPV is $________(Round to two decimal places.)

If the discount rate is 20%, the investment's NPV is $________(Round to two decimal places.)

If the discount rate is 25%, the investment's NPV is $________(Round to two decimal places.)

If the discount rate is 30%, the investment's NPV is $________(Round to two decimal places.)

If the discount rate is 35%, the investment's NPV is $________(Round to two decimal places.)

3. What does your answer to part b tell you about this project's IRR? (Select the best answer below.)

A. There are multiple IRRs for this project.

B. There are infinite IRRs for this project.

C. There is no IRR for such cash flows.

D. There is only one IRR for this project.

4. Should Froogle invest in this project if its cost of capital is 5%?

A. Yes

B. No

Should Froogle invest in this project if its cost of capital is 15%?

A.Yes

B.No

5. In general, when faced with a project like this, how should a firm decide whether to invest in the project or reject it? (Select the best answer below.)

A.It is best to use the IRR method.

B.It is best to use the payback period method.

C.It is best to use the NPV method.

D.None of the methods is suitable.

Solutions

Expert Solution

Answer 1) Correct option is (b) The oscillating cashflows will make it very difficult for calculating the payback period.

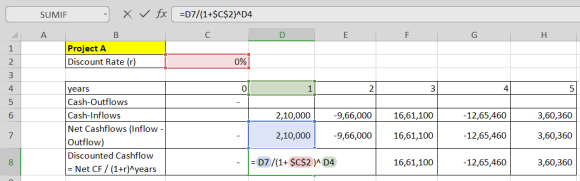

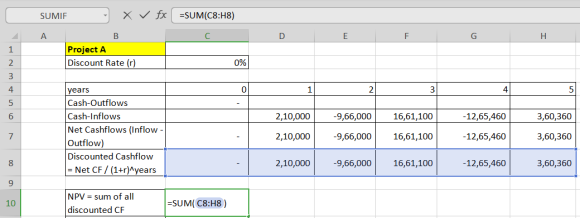

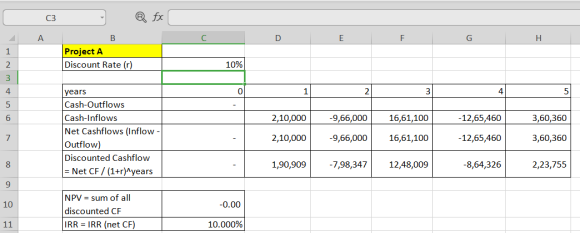

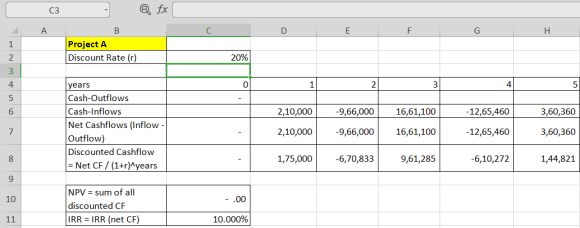

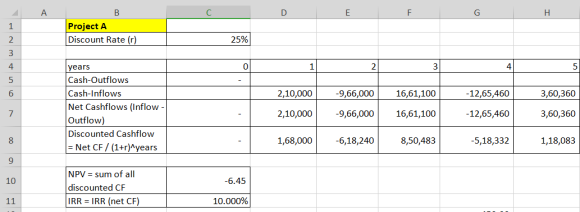

Answer 2)

NPV is given by:

Also,

IRR is the discount rate at which NPV = 0

We can use excel function "IRR" for the same.

Using this and discounted cash flows:

Hence,

using these formula:

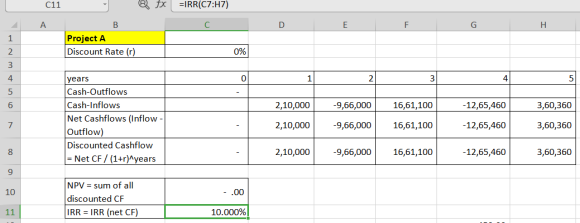

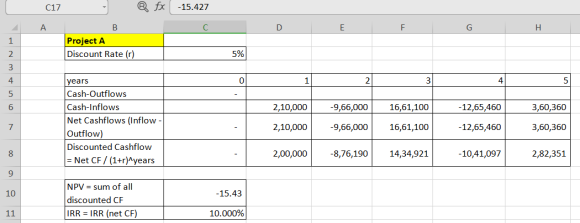

Similarly calculating for other discount rates, we can derive the following table:

| Discount Rate | NPV | IRR |

| 0% | 0 | 10% |

| 5% | -15.43 | 10% |

| 10% | 0 | 10% |

| 15% | 5.87 | 10% |

| 20% | 0 | 10% |

| 25% | -6.45 | 10% |

| 30% | 0 | 10% |

| 35% | 30.73 | 10% |

--------------------------

Answer 3)

From the above calculation we can see that project's IRR is always 10%. Hence correct option is (D) there is only one IRR of the project

--------------------------------------------------------------

Answer 4)

At cost of capital = 5%

This means company is getting money @5% and minimum this much return should we get from the project.

However, from the table we can see that for 5% discount rate, we have NPV as negative. Hence, company should not invest is cost of capital is 5%.

At cost of capital = 15%

This means company is getting money @15% and minimum this much return should we get from the project.

However, from the table we can see that for 15% discount rate, we have NPV as positive. But, IRR < WACC (discount rate). hence this project should not be accepted

---------------------------------------------------------------

Related Solutions

KK Enterprises is evaluating a project with the following characteristics: Fixed capital investment is $2,000,000. The...

AS is evaluating a project that is expected to generate the following cash flow stream: Expected...

This is the predicted cash flow stream of an investment project related to the launch of...

Acme Oscillators is considering an investment project that has the following rather unusual cash flow pattern....

If a project requires $10 million investment at year 0, and creates a stream of annual...

TPG Inc. is evaluating an investment project that lasts for four years. The project has the...

QUESTION 17 TPG Inc. is evaluating an investment project that lasts for four years. The project...

QUESTION 10 ABC Inc. is evaluating an investment project that lasts for three years. The project...

Bil‐A‐Bong Enterprises is considering taking on a new project. The project itself requires a net investment...

A). You are evaluating a project with the following cash flows: initial investment is $-12, and...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

jeff jeffy answered 1 year ago

jeff jeffy answered 1 year ago