Question

In: Accounting

The November 30, 2017, unadjusted trial balance of Business Solutions is found in the Trial balance...

The November 30, 2017, unadjusted trial balance of Business

Solutions is found in the Trial balance tab. Business Solutions had

the following transactions and events in December 2017.

General journal, General ledger, Trial balance, Income

statement, St Retained earnings, Balance sheet, Impact on

Income

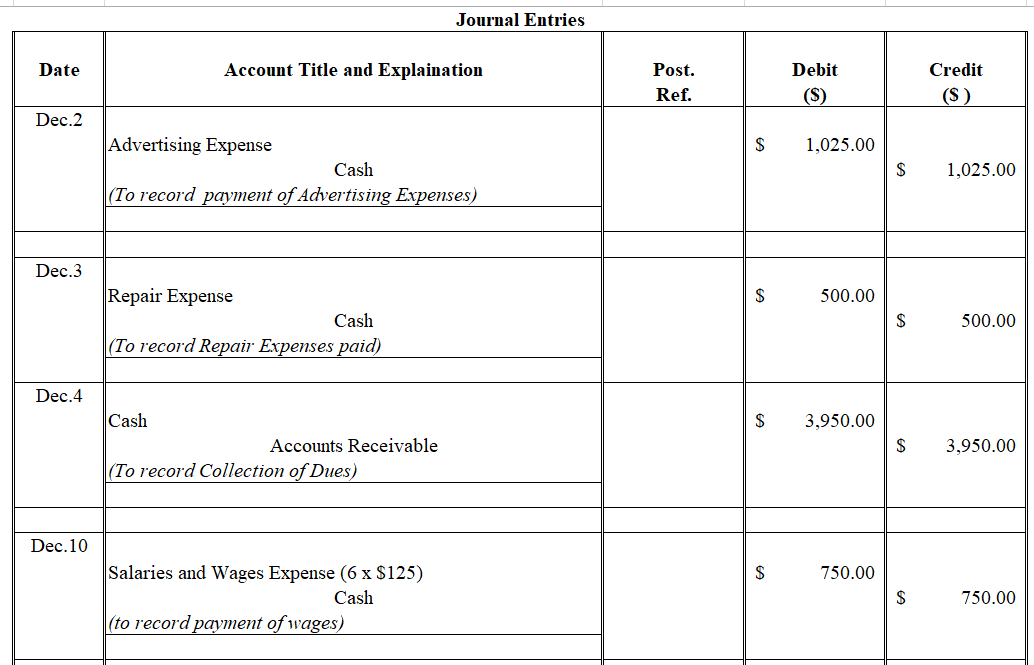

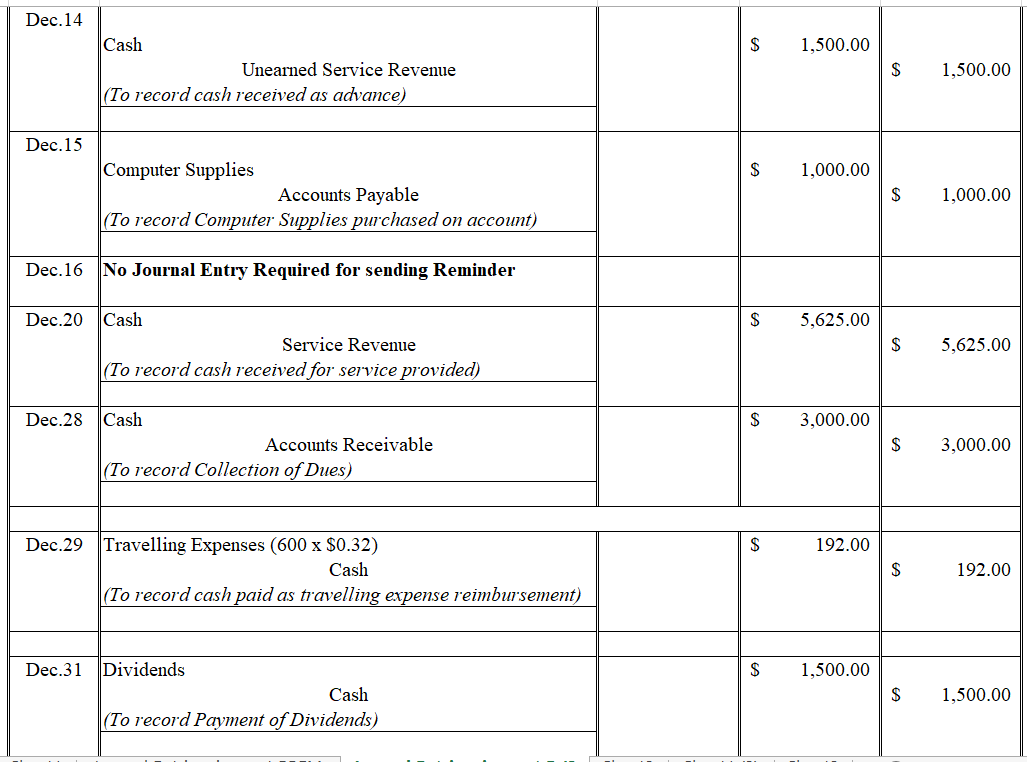

| Dec. | 2 | Paid $1,025 cash to Hillside Mall for Business Solutions’ share of mall advertising costs. | ||

| Dec. | 3 | Paid $500 cash for minor repairs to the company’s computer. | ||

| Dec. | 4 | Received $3,950 cash from Alex’s Engineering Co. for the receivable from November. | ||

| Dec. | 10 | Paid cash to Lyn Addie for six days of work at the rate of $125 per day. | ||

| Dec. | 14 | Notified by Alex’s Engineering Co. that Business Solutions’ bid of $7,000 on a proposed project has been accepted. Alex’s paid a $1,500 cash advance to Business Solutions. | ||

| Dec. | 15 | Purchased $1,100 of computer supplies on credit from Harris Office Products. | ||

| Dec. | 16 | Sent a reminder to Gomez Co. to pay the fee for services recorded on November 8. | ||

| Dec. | 20 | Completed a project for Liu Corporation and received $5,625 cash. | ||

| Dec. | 28 | Received $3,000 cash from Gomez Co. on its receivable. | ||

| Dec. | 29 | Reimbursed S. Rey for business automobile mileage (600 miles at $0.32 per mile). | ||

| Dec. | 31 | The company paid $1,500 cash in dividends. |

The following additional facts are collected for use in making

adjusting entries prior to preparing financial statements for the

company’s first three months:

- The December 31 inventory count of computer supplies shows $580 still available.

- Three months have expired since the 12-month insurance premium was paid in advance.

- As of December 31, Lyn Addie has not been paid for four days of work at $125 per day.

- The computer system, acquired on October 1, is expected to have a four-year life with no salvage value.

- The office equipment, acquired on October 1, is expected to have a five-year life with no salvage value.

- Three of the four months’ prepaid rent has expired.

Solutions

Related Solutions

The unadjusted trial balance of the Dairy Plus Company as of December 31, 2017 is found...

The unadjusted trial balance of the Dairy Plus Company as of

December 31, 2017 is found on the trial balance tab. The following

information is required to prepare the necessary adjusting entries

for the Dairy Plus Company.

1) The balance in Prepaid insurance represents a 24-month policy

that went into effect on December 1, 2017. Review the unadjusted

balance in Prepaid insurance, and prepare the necessary adjusting

entry, if any.

2) Based on a physical count, supplies on hand total...

The unadjusted trial balance of the Home Perfection Company as of December 31, 2017 is found...

The unadjusted trial balance of the Home Perfection Company as

of December 31, 2017 is found on the trial balance tab. The

following information is required to prepare the necessary

adjusting entries for the Home Perfection Company.

1) The balance in Prepaid insurance represents a 24-month policy

that went into effect on December 1, 2017. Review the unadjusted

balance in Prepaid insurance, and prepare the necessary adjusting

entry, if any.

2) Based on a physical count, supplies on hand total...

The unadjusted trial balance at November 30 is below: No. Account Name Debit Credit 101 Cash...

The unadjusted trial balance at November

30 is below:

No.

Account Name

Debit

Credit

101

Cash

$ 99,876

106

Accounts receivable

5,300

125

Supplies - inventory

10,000

128

Prepaid insurance

6,400

131

Prepaid rent

35,000

151

Office equipment

20,000

152

Accumulated depreciation - office equipment

$

0

155

Computer equipment

15,000

156

Accumulated depreciation - computer equipment

0

201

Accounts payable

0

205

Wages payable

0

221

Unearned revenue

1,500

301

Common stock

150,000

315

Retained earnings

0

401

Service...

trial balance is presented below for November 30, 2018. COOKIE CREATIONS Trial Balance November 30, 2018...

trial balance is presented below for November 30,

2018.

COOKIE

CREATIONS

Trial Balance

November 30, 2018

Debit

Credit

Cash

$245

Supplies

125

Prepaid Insurance

1,320

Equipment

1,200

Unearned Service Revenue

$30

Notes Payable

2,000

Common Stock

800

Service Revenue

125

Advertising Expense

65

$2,955

$2,955

It is the end of November and Natalie has been in touch with her

grandmother. Her grandmother asked Natalie how well things went in

her first month of business. Natalie, too, would like to...

Question 2 Alliance Property Services Corporation Unadjusted Trial Balance For the Year ended November 30, 2012...

Question 2

Alliance Property Services Corporation

Unadjusted Trial Balance

For the Year ended November 30, 2012

DR ($)

Cr ($)

Cash

240

Accounts Receivable

1800

Supplies

160

Prepaid Insurance

240

Land

3,800

Equipment

1,000

Accum. Depr. – Equipment

80

Accounts payable

720

Wages payable

A.S. Capital

5,200

A.S. Drawings

160

Fees Earned

4,000

Wages expense

2,200

Rent expense

240

Insurance expense

Utilities expense

120

Supplies expense

Depreciation expense

Miscellaneous

40

10,000

10,000...

DATA SECTION: For the Month Ended November 30, 2017 Balance Balance November 1 November 30 Raw...

DATA SECTION:

For the Month Ended November 30, 2017

Balance Balance

November 1 November 30

Raw Material Inventory $ 5,600 $ 4,100

Work in Process Inventory 10,200 12,800

Finished Goods Inventory 8,100

6,700

Purchases of Raw Materials $63,000

Direct Manufacturing Labor 15,000

Indirect Manufacturing Labor 32,000

Plant Insurance 8,000

Depreciation Expense - Plant, Building, and Equip. 22,000

Repairs and Maintenance - Plant 7,200

Marketing, Distribution, and Customer-Service Costs 24,000

General and Administrative Costs 19,200

Revenue 258,300...

The unadjusted trial balance for Forever Fitness as December 31, 2017 is provided on the trial...

The unadjusted trial balance for Forever Fitness as December 31,

2017 is provided on the trial balance tab.

Information for adjustments is as follows:

As of December 31, 2017, employees had earned $1,300 of unpaid

and unrecorded salaries. The next payday is January 4, at which

time $1,625 of salaries will be paid.

The cost of supplies still available at December 31, 2017, is

$1,700.

The notes payable requires an interest payment to be made every

three months. The amount...

JC’s Company’s unadjusted and adjusted trial balances at December 31, 2017, follow. Unadjusted trial Balance DR...

JC’s Company’s unadjusted and

adjusted trial balances at

December 31, 2017, follow.

Unadjusted trial

Balance

DR

CR

Cash

105,000

Prepaid Rent

60,000

Supplies

38,000

Office furniture

460,000

Accumulated dep office furniture

92,000

Accounts payable

102,500

Salaries payable

Unearned service revenue

15,900

SWT, Capital

453,000

SWT, Drawing

15,400

Service revenue

205,000

Salaries expense

110,000

Depreciation expense

Supplies Expense

Rent Expense

80,000

868,400

868,400

Adjusted Trial

Balance

DR

CR

Cash

105,000

Prepaid Rent

20,000

Supplies

19,500

Office furniture

460,000

Accumulated dep office...

prepare unadjusted trial balance, adjusted trial balance Accounts Receivable: April 30 1,300 Balance, April 30 1,300...

prepare unadjusted trial balance, adjusted trial balance

Accounts Receivable:

April 30

1,300

Balance, April 30

1,300

Lawn and Garden Supplies:

April 2

6,000

April 24

500

Lawn and Garden Supplies Expense

4,650

Balance, April 30

850

Office Supplies:

April 6

500

Office Supplies Expense

350

Balance, April 30

150

Prepaid Rent:

April 1

4,000

Rent Expense

1,000

Balance, April 30

3,000

Prepaid Insurance:

April 8

1,600

Insurance Expense

400

Balance, April 30

1,200

Security Deposit: Rent

April 1

1,500

Balance,...

Serial Problem Business Solutions LO P2, P3 The December 31, 2017, adjusted trial balance of Business...

Serial Problem Business Solutions LO P2, P3

The December 31, 2017, adjusted trial balance of Business

Solutions (reflecting its transactions from October through

December of 2017) follows.

No

Account

Title

Debit

Credit

101

Cash

$

50,801

106

Accounts

receivable

5,568

126

Computer

supplies

620

128

Prepaid

insurance

1,530

131

Prepaid

rent

750

163

Office

equipment

8,900

164

Accumulated

depreciation—Office equipment

$

445

167

Computer

equipment

22,400

168

Accumulated

depreciation—Computer equipment

1,400

201

Accounts

payable

2,000

210

Wages

payable

460...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- Equipment associated with manufacturing small railcars had a first cost of $210,000 with an expected salvage...

- The consult order had... A page to the Ethics on-call consultant came at 4 PM on...

- Neuroscience has been attacked by many as an invasion of privacy. Describe how marketers are using...

- Calculate the moment of inertia of a baseball bat for the following cases. (a) Assume the...

- Select a topic from below and write a 250 word (1/2 pg single-spaced, 1pg double-spaced) answer...

- Astronauts use a centrifuge to simulate the acceleration of a rocket launch. The centrifuge takes 30.0...

- Suppose the following data are product weights for the same items produced on two different production...

ADVERTISEMENT

ekkarill92 answered 4 hours ago

ekkarill92 answered 4 hours ago