Question

In: Accounting

The December 31, 20X8, balance sheets for Pint Corporation and its 70 percent-owned subsidiary Saloon Company...

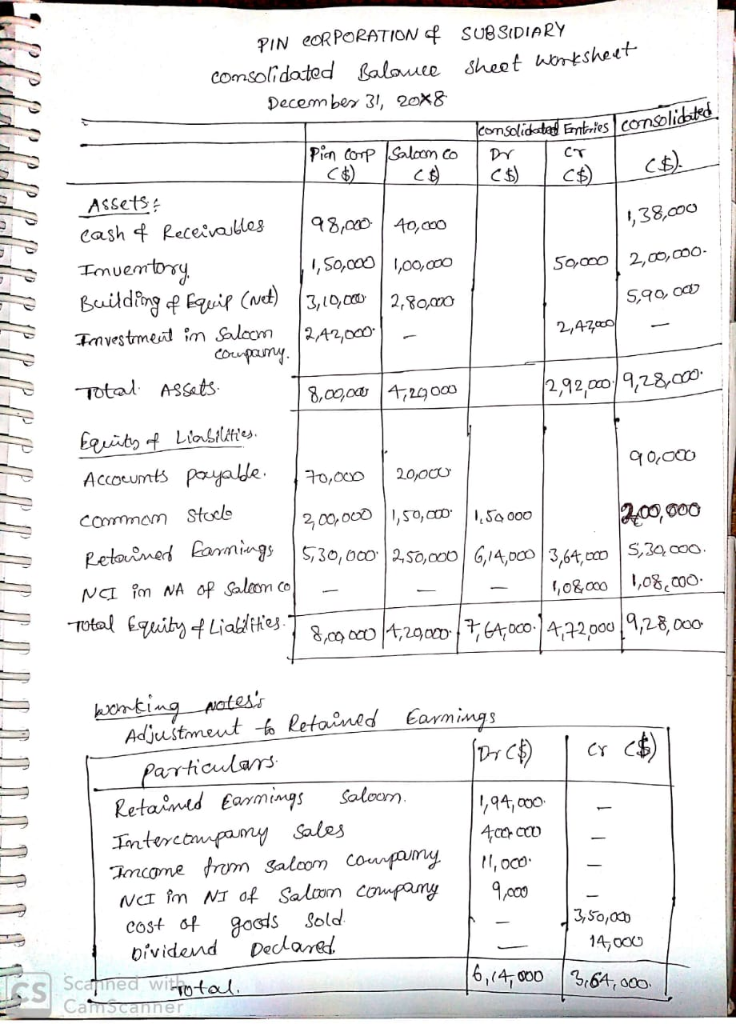

The December 31, 20X8, balance sheets for Pint Corporation and

its 70 percent-owned subsidiary Saloon Company contained the

following summarized amounts:

| PINT CORPORATION AND SALOON COMPANY | |||||||

| Balance Sheets December 31, 20X8 |

|||||||

| Pint Corporation | Saloon Company | ||||||

| Assets | |||||||

| Cash & Receivables | $ | 98,000 | $ | 40,000 | |||

| Inventory | 150,000 | 100,000 | |||||

| Buildings & Equipment (net) | 310,000 | 280,000 | |||||

| Investment in Saloon Company | 242,000 | ||||||

| Total Assets | $ | 800,000 | $ | 420,000 | |||

| Liabilities & Equity | |||||||

| Accounts Payable | $ | 70,000 | $ | 20,000 | |||

| Common Stock | 200,000 | 150,000 | |||||

| Retained Earnings | 530,000 | 250,000 | |||||

| Total Liabilities & Equity | $ | 800,000 | $ | 420,000 | |||

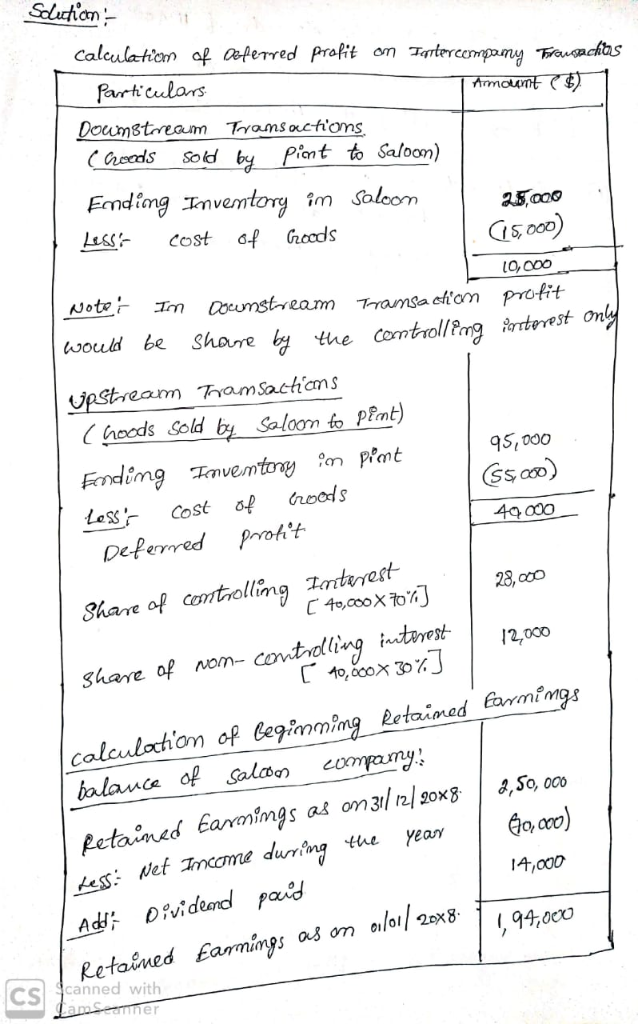

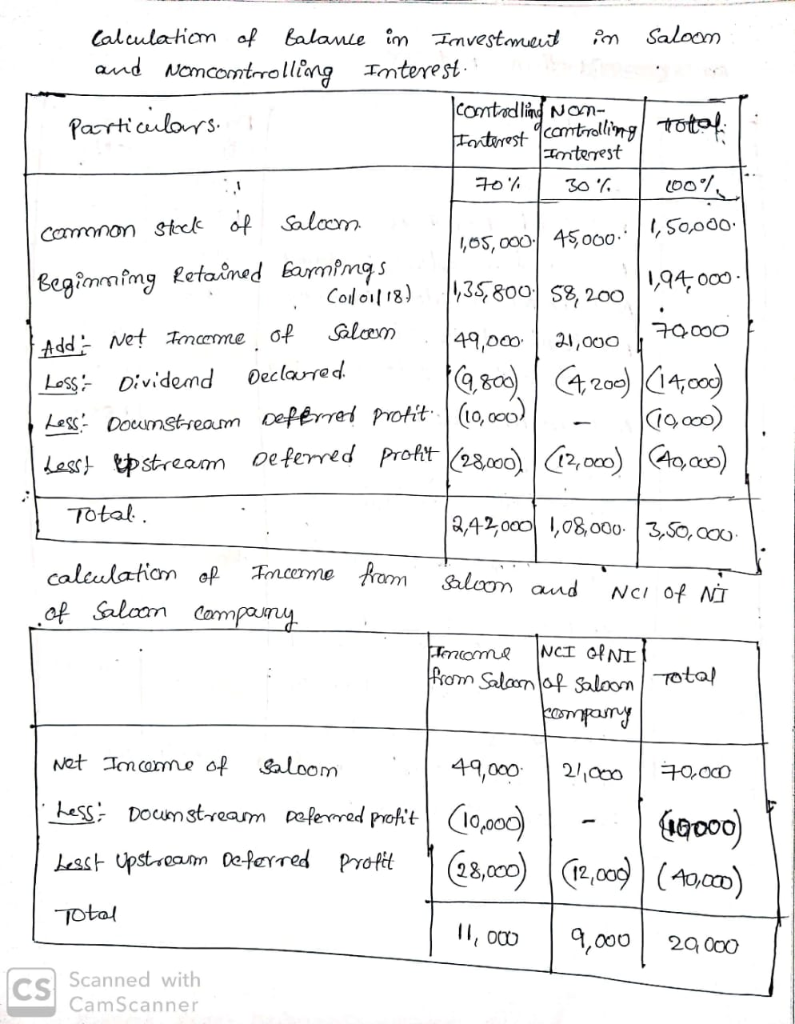

Pint acquired the shares of Saloon Company on January 1, 20X7. On

December 31, 20X8, assume Pint sold inventory to Saloon during 20X8

for $100,000 and Saloon sold inventory to Pint for $300,000. Pint’s

balance sheet contains inventory items purchased from Saloon for

$95,000. The items cost Saloon $55,000 to produce. In addition,

Saloon’s inventory contains goods it purchased from Pint for

$25,000 that Pint had produced for $15,000. Assume Saloon reported

net income of $70,000 and dividends of $14,000.

Required:

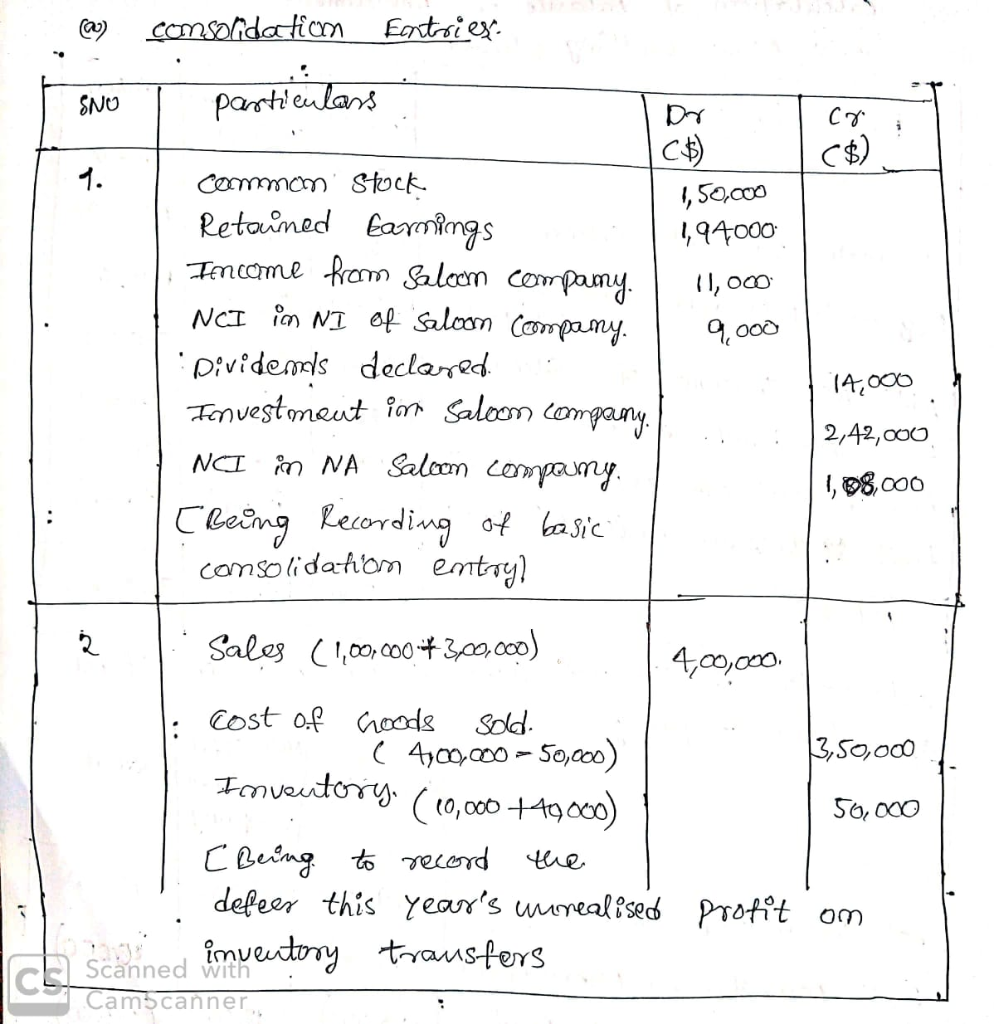

a. Prepare all consolidation entries needed to complete a

consolidated balance sheet worksheet as of December 31, 20X8.

(If no entry is required for a transaction/event, select

"No journal entry required" in the first account field. Do not

round intermediate calculations.)

Record the basic consolidation entry.

Record the entry to defer this year's unrealized profit on inventory transfers.

Solutions

Related Solutions

The December 31, 20X8, balance sheets for Pint Corporation and its 70 percent-owned subsidiary Saloon Company...

The December 31, 20X8, balance sheets for Pint Corporation and its 70 percent-owned subsidiary Saloon Company...

The December 31, 20X8, balance sheets for Pint Corporation and its 80 percent-owned subsidiary Saloon Company...

The separate condensed balance sheets of Patrick Corporation and its wholly-owned subsidiary, Sean Corporation, are as...

The separate condensed balance sheets of Patrick Corporation and its wholly owned subsidiary, Sean Corporation, are...

The separate condensed balance sheets of Patrick Corporation and its wholly owned subsidiary, Sean Corporation, are...

In preparing the consolidation worksheet for Pencil Corporation and its 60 percent–owned subsidiary, Stylus Company, the...

Here are the consolidated financial statements of Post Ranch Resort and its 70 percent owned subsidiary,...

Shown below are comparative balance sheets for Flint Corporation. Flint Corporation Comparative Balance Sheets December 31...

Traynor Corporation reports its 40 percent investment in Victor Company on its December 31, 2020 balance...

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

ekkarill92 answered 1 month ago

ekkarill92 answered 1 month ago