Question

In: Finance

Discussion 1 – due 23 February 2020, 11:55 PM ECT (5% of coursework marks) Provide Sue...

Discussion 1 – due 23 February 2020, 11:55 PM ECT (5% of coursework marks)

Provide Sue with financial advice on which option has the potential to yield the highest monetary value. Support your rational with calculations using time value of money and comment on the risk return relationship for each option, assume interest rate on savings is 4% and is compounded semi-annually.

Sue James is a 55-year old accountant who works at Ernst and Young (EY) who is about to retire. She has the following decision to make:

Option A – Select a lump sum gratuity payment of $120,000 with a reduced pension of $1,750 per month.

Option B – Select a monthly pension of $3,300 with no lump sum gratuity payment.

In addition, Sue has a loan of $72,000 with loan payments of $1,200 per month for the next five years.

word limit 200 words

Solutions

Expert Solution

EAR=(1+4%/2)^2-1=4.04%

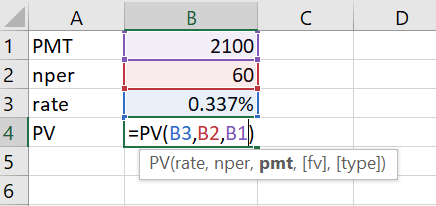

Monthly interest rate= 4.04%/12=0.337%

Option A:

He could repay the loan with the lumpsum amount of $120,000 and enjoy $1750/month pension

Value of lumpsum amount after re-payment of loan= (120000-72000)=$48,000

Present Value of $1750/month annuity in perpetuity= cash flow/interest rate= 1750/0.337%=$519802

Present Value of total net pension benefit=48000+519802=$567802

Option B:

He will repay $1200 each month for his loan and he will have (3300-1200)=$2100 after loan cash inflow

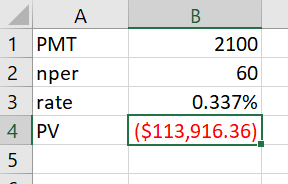

The present value of $2100 per month for 5 year is $113,916.35. Calculation is given below:

After 5 year he will get $3300 in full per month. After 5 year,Present Value of this perpetuity amount= 3300/0.337%=$980,198

Present Value of total benefit=113916.36+980198/(1+4.04%)^5=$918020.1

As the net present value of Option B is more than Option A. He should choose Option B.

Related Solutions

Please give C++ code ASAP Matrix Multiplication Due Friday 30th October 2020 by 23:55. (2 marks)...

Please give Java Code ASAP Matrix Multiplication Due Friday 30th October 2020 by 23:55. (2 marks)...

Due Sept 25th at 11:55 pm You are going to make an advanced ATM program When...

HOMEWORK ASSIGNMENT # 1 Due Date: Tuesday, February 20, 2018 by 5:15 pm Required format: This...

Econ 335: Assignment 4 Due: April 20th by 11:59 PM 1. To protect American jobs, the...

The Kingbird Company issued $360,000 of 11% bonds on January 1, 2020. The bonds are due...

Question 1 25 Marks Malali Traders had the following transactions for 29 February 2020 financial year....

Due Friday Oct. 30th, 11:59pm (10 marks total): 1. Explain the purpose of a sequence diagram....

QUESTION 1 5 MARKS What are “insolvent transactions”? Provide an example. Explain the “presumption of...

3. [5+5+1=11 pts] a. Draw a frequency histogram for “Temp” variable from “airquality” data. Use breaks=seq(55,...

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

jeff jeffy answered 4 months ago

jeff jeffy answered 4 months ago