Question

In: Math

During a 10-year period, the standard deviation of annual returns on a portfolio you are analyzing...

- During a 10-year period, the standard deviation of annual returns on a portfolio you are analyzing was 15 percent a year. You want to see whether this record is sufficient evidence to support the conclusion that the portfolio’s underling variance of return was less than 400, the return variance of the portfolio’s benchmark.

- Formulate null and alternative hypotheses consistent with the verbal description of or objective.

- Identify the test statistics for conducting a test of the hypothesis in part A

- Identify the rejection point or point at the 0.05 significance level for the hypothesis tested in Part A

- Determine whether the null hypothesis is rejected or not rejected at the 0.05 level of significance.

please show work

Solutions

Expert Solution

Solution:

Given:

Sample Size = n = Number of years = 10

the standard deviation of annual returns on a portfolio you are analyzing was 15 percent a year.

that is : s = 15%

We have to test whether this record is sufficient evidence to support the conclusion that the portfolio’s underling variance of return was less than 400.

Part a) Formulate null and alternative hypotheses consistent with the verbal description of or objective.

Vs

Part b) Identify the test statistics for conducting a test of the hypothesis in part A

We use Chi-square test of variance:

Part c) Identify the rejection point or point at the 0.05 significance level for the hypothesis tested in Part A

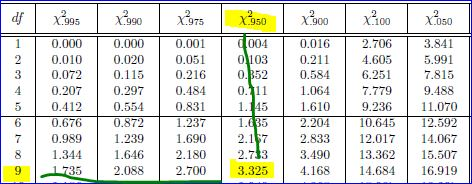

df = n - 1= 10 - 1 = 9

significance level =  = 0.05

= 0.05

since this is left tailed test we look for Area = 1-  =

1-0.05=0.95

=

1-0.05=0.95

Thus

Chi-square critical value =3.325

Thus rejection region is:

Reject null hypothesis H0, if  test

statistic < 3.325,

test

statistic < 3.325,

otherwise we fail to reject H0.

Part d) Determine whether the null hypothesis is rejected or not rejected at the 0.05 level of significance.

Since Chi-square test statistic value =  > Chi-square critical value = 3.325, we fail to reject H0.

> Chi-square critical value = 3.325, we fail to reject H0.

Thus there is NOT sufficient evidence to support the conclusion that the portfolio’s underling variance of return was less than 400

Related Solutions

What is the (population) standard deviation of portfolio returns?

What is the standard deviation of the returns on a portfolio that is invested in stocks...

Table 2 shows regressions of the standard deviation and Sharpe ratio of household portfolio annual returns...

Table 2 shows regressions of the standard deviation and Sharpe ratio of household portfolio annual returns...

1. What is the expected standard deviation of the returns of a portfolio that is invested...

Given the following information, what is the standard deviation of the returns on a portfolio that...

With respect to performance measures, the use of the standard deviation of portfolio returns is a...

You are analyzing the returns of a mutual fund portfolio for the past 5 years. Year...

You are analyzing the returns of a mutual fund portfolio for the past 5 years. Year...

You have $1M to invest. You want to maximize returns subject to a portfolio standard deviation...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

milcah answered 4 months ago

milcah answered 4 months ago