Question

In: Economics

There is a market operating for two periods. In the first period, there is only an...

There is a market operating for two periods. In the first period, there is only an incumbent firm, and an entrant may enter in the second period. The demand function each period is p = 20 − Q, where Q is the total quantity in the market. The per period cost function of each firm is c(q) = 9 + 4q. There is no discounting. Firms choose quantities.

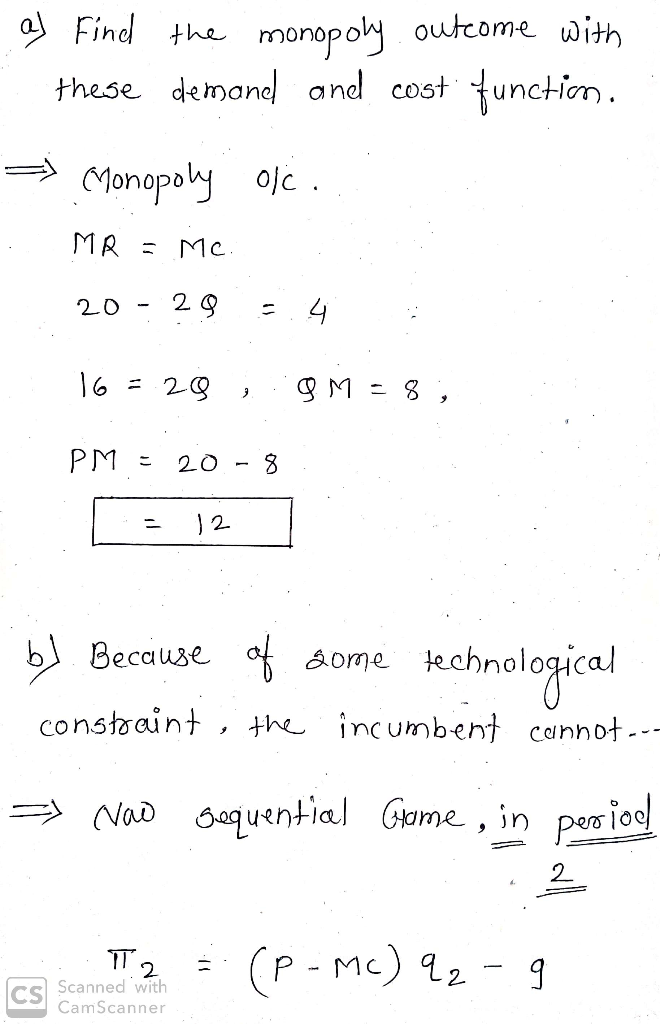

(a) Find the monopoly outcome with these demand and cost

functions.

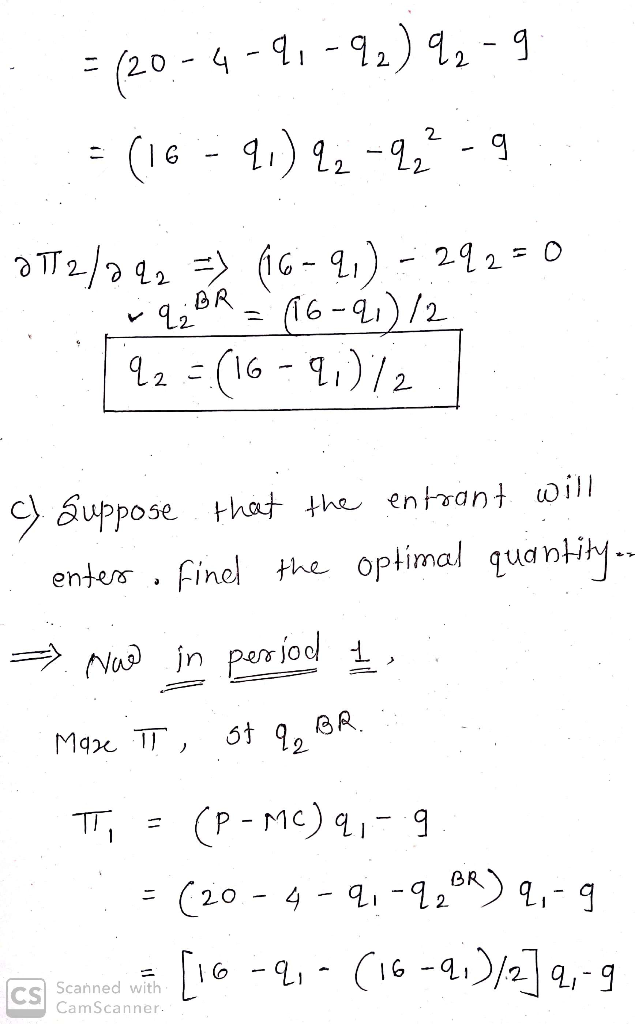

(b) Because of some technological constraint, the incumbent cannot

choose different quantitie in the two periods: qI = qI = qI . The

entrant observes the incumbent’s quantity qI and decides if to

enter and, if yes, how much to produce. Find the optimal choice of

the entrant for any q.

(c) Suppose that the entrant will enter. Find the optimal quantity

of the incumbent.

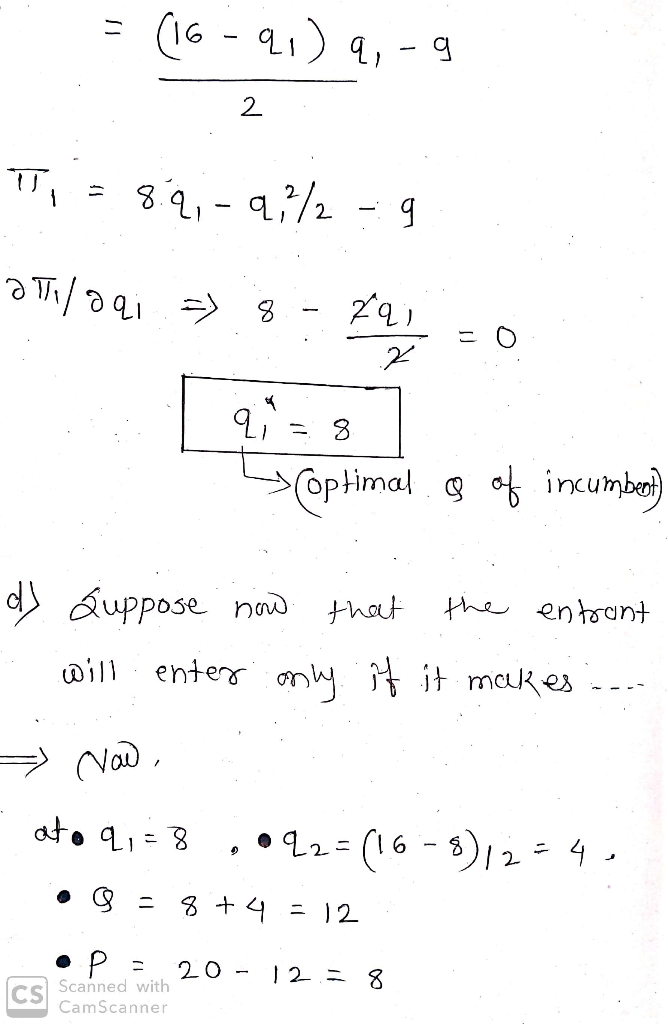

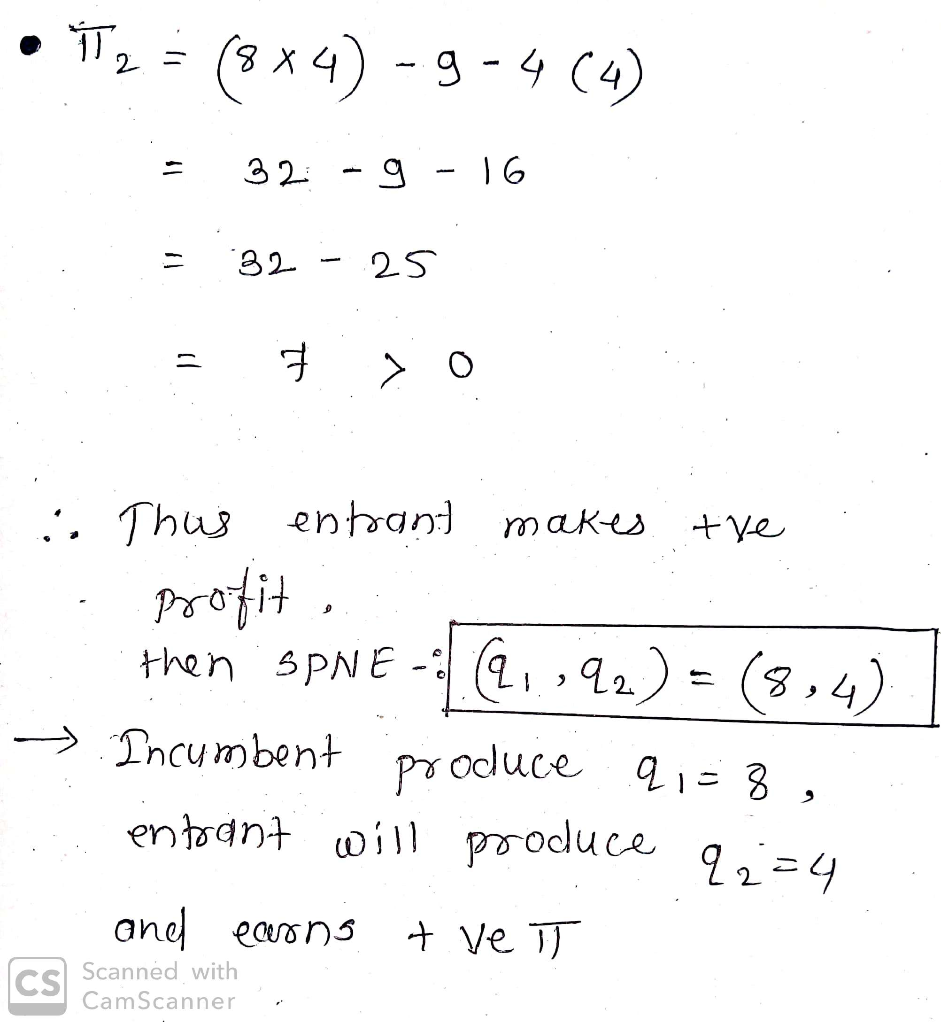

(d) Suppose now that the entrant will enter only if it makes

positive profits. Find the subgame-perfect Nash equilibrium.

Solutions

Expert Solution

Where is the market operating for two periods. In the first period, there is only an incumbent firm, and an entrant may enter in second period. The demand function is period is P=20 - Q, where Q is the total quantity in the market. the par period cost function of each firm is c(q)=9+4q . There is no ...

= Given data :-

P = 20 - Q

c(q)= 9+4q

Related Solutions

Consider an individual that lives for two periods. She only works in the first period and...

Suppose there are only two time periods, today (period 1) and tomorrow (period 2), and only...

Vesta will live only for two periods. In period 0 she will earn $50,000. In period...

1. Suppose oil is only to be extracted over two periods (period 0 and period 1)...

Jenifer lives two periods. In the first period her income is fixed at $10,000; in the...

Jenifer lives two periods. In the first period her income is fixed at $10,000; in the...

Suppose I hold an asset for two periods. Its return is -20% inthe first period...

Marisol has income and consumes for two periods. Period 1 income is A1 and period 2...

Assume the existence of a two-period Diamond Model. Individuals may live for up to two periods...

5. Doogie lives for four periods. He has just completed the first period of his life...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

- For this assignment you will write a program with multiple functions that will generate and save...

- How many grays is this?Part A A dose of 4.7 Sv of γ rays in a...

Rahul Sunny answered 4 months ago

Rahul Sunny answered 4 months ago