Question

In: Finance

After months of study and spending $60,000 in researching its options, Black & Decker Company purchased...

After months of study and spending $60,000 in researching its options, Black & Decker Company purchased and installed a made-to-order machine tool for fabricating parts for small appliances this morning. The machine cost $286,000. This afternoon, Square D Company offered a similar machine tool that will do exactly the same work, but costs only $176,000 and could be installed in less than two hours. There will be no differences in either revenues or operating costs between the machines. The only annual cash flow difference will be the income tax savings due to the depreciation tax shield.

Both machines will last for six years (don’t worry about the few hours that have elapsed). Black & Decker would depreciate either machine on a straight-line basis to a $15,000 salvage value for income tax purposes. However, each machine is expected to be worth $20,000 at the end of its useful life year. The relevant income tax rate is 40%, and Black & Decker earns sufficient income from its other operations so that it can utilize any annual operating losses or losses on disposal of equipment.

The after-tax discount rate, also known as the hurdle rate or MARR, is 16%.

Required:

Using after-tax cash flow analysis, determine the minimum resale value of the “old” machine tool (“old” because it was purchased this morning) that would justify Black & Decker’s purchase of the Square D machine tool at this time.

Hint: If Black & Decker could sell the “old” machine for $1,000,000 and buy the Square D machine, they would do it in a heartbeat. On the other hand, if they could sell the “old’ machine for only $1, they would not do it. Clearly, there is a selling price between $1 and $1,000,000 where it makes sense to sell the “old” machine -- find that value. If they sell the “old” machine, there will be income tax consequences at the time of the sale (time zero).

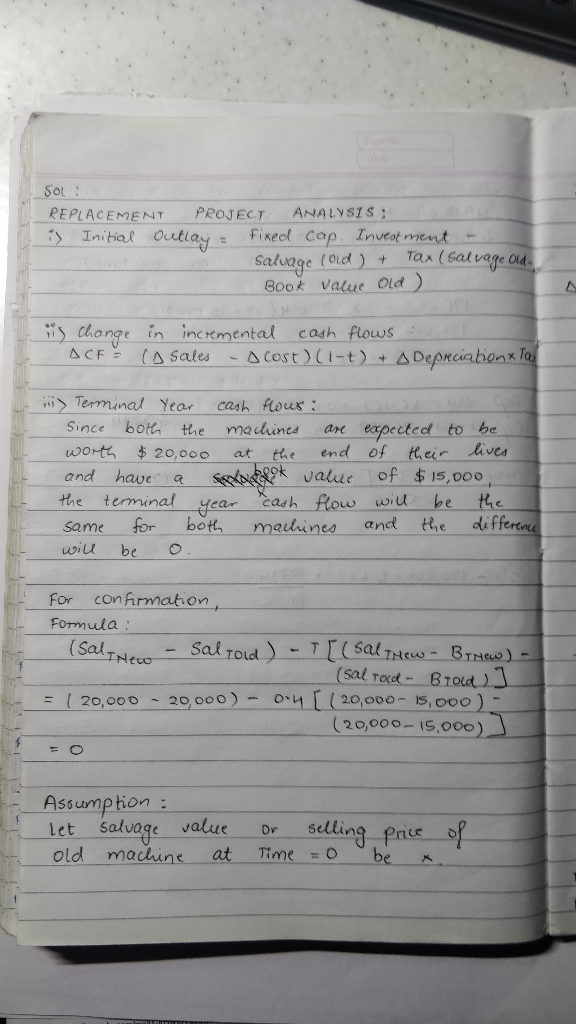

Solutions

Expert Solution

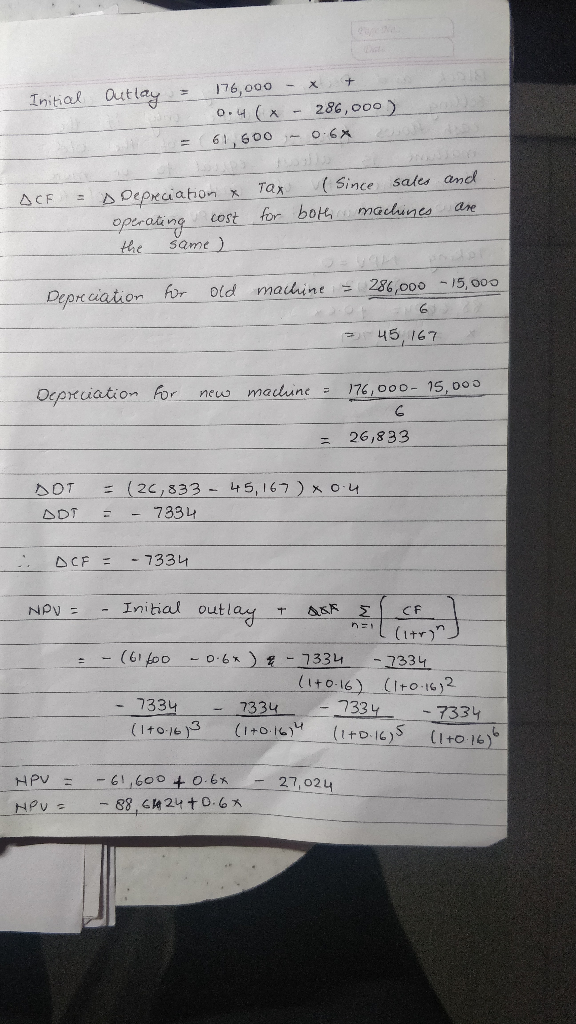

Black and Decker Company would consider selling the old machine only if the present value of cash flows of the old machine is atleast equal to or more than the present value of the cash flows of the new machine, i.e., NPV=0

Taking NPV=0,

0= -88624+0.6x

x = 147707

The minimum resale value of the old machine should be $147,707

Related Solutions

Black & Decker, Inc. – A Case Study Black & Decker operates globally and is divided...

Case study: Danté After months of searching for a weekend job, Danté, who is Black, finally...

Bombardier, after spending $250,000 on a feasibility study, has determined that its customers will be willing...

Bombardier, after spending $250,000 on a feasibility study, has determined that its customers will be willing...

Bombardier, after spending $250,000 on a feasibility study, has determined that its customers will be willing...

1. A company purchased equipment for $60,000 on January 1 of its first year. The equipment’s original...

Case study: The problem of the case , a company that specialized in researching in numerous...

After months of searching for a weekend job, Danté, who is Black, finally got an interview...

You just purchased a vacant lot for $60,000. You financed thatamount over 180 months. What...

John purchased 100 shares of Black Forest Inc. stock at a price of $151.53 three months...

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

jeff jeffy answered 1 year ago

jeff jeffy answered 1 year ago