Question

In: Finance

Suppose you are wondering whether to invest in the shares of Amazon (Security 1) or Southwest...

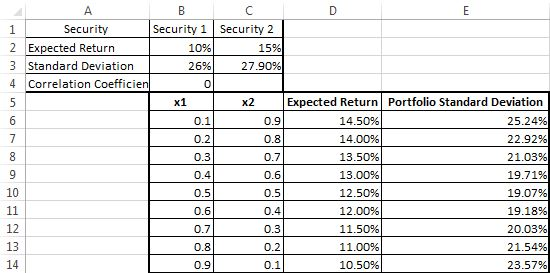

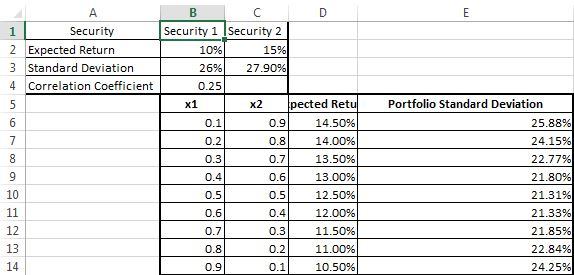

Suppose you are wondering whether to invest in the shares of Amazon (Security 1) or Southwest (Security 2). You decide that Security 1 offers an expected return of 10.0% and Security 2 offers an expected return of 15.0%. After looking back at the past variability of the two stocks, you also decide that the standard deviation of returns is 26.6% for Security 1 and 27.9% for Security 2.

Calculate the expected portfolio return and standard deviation for different values of x1 and x2, assuming the correlation coefficient ρ12 = 0. Repeat the problem for ρ12 = +0.25. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.)

Solutions

Expert Solution

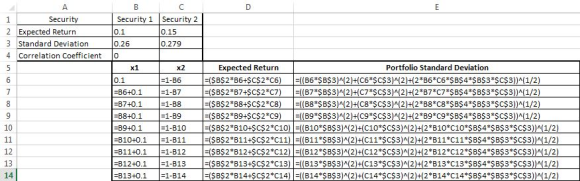

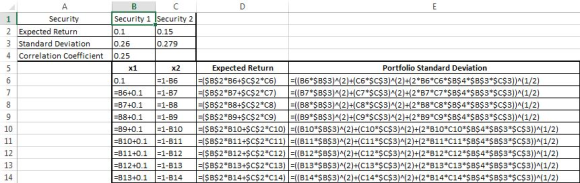

For two securities, namely: Security 1 and Security 2, the expected portfolio return = Portfolio Weight of Security 1 x Expected Return of Security 1 + Portfolio Weight of Security 2 x Expected Return of Security 2

Standard Deviation of Portfolio = [(Portfolio Weight of Security 1 x Standard Deviation of Security 1)^(2) + (Portfolio Weight of Security 2 x Standard Deviation of Security 2)^(2) + (2 x Portfolio Weight of Security 1 x Portfolio Weight of Security 2 x Standard Deviation of Security 1 x Standard Deviation of Security 2 x Correlation Coefficient)]^(1/2)

Related Solutions

1. Suppose that you are thinking about whether to invest in a new business venture. You...

1d) You have $100 to invest and are wondering where to put it. You are considering...

Would you invest in Amazon? Why or why not?

Suppose you invest in 100 shares of Harley-Davidson (HOG) at $40 per share and 200 shares...

Suppose you are deciding how to invest $2,000. There are two options: shares in an airline...

If you buy shares of Amazon on the primary market: a. You buy the shares from...

You are a frequent flyer and you have been wondering whether the number of flights delayed...

would you recommend to invest in amazon? what your recomendation is based on

Assume that you have $5,000 that you would like to invest. The company is AMAZON. Evaluate...

1 Suppose you are a U.S. investor who is planning to invest $125,000 in Japan. You...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

jeff jeffy answered 1 year ago

jeff jeffy answered 1 year ago