Question

In: Finance

Suppose you invest in 100 shares of Harley-Davidson (HOG) at $40 per share and 200 shares...

Suppose you invest in 100 shares of Harley-Davidson (HOG) at $40 per share and 200 shares of Yahoo (YHOO) at $25 per share. If the price of HOG increases to $50 and the price of YHOO decreases to $12 per share, what is the return on your portfolio? (Assume no dividends on either stock).

Solutions

Expert Solution

Solution :

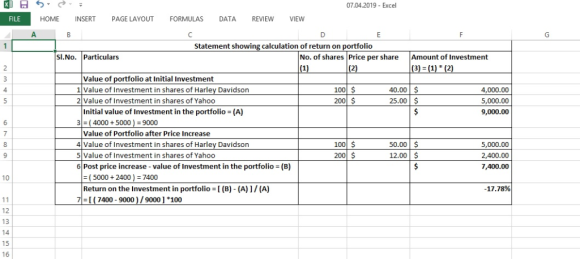

The return on the portfolio is = - 17.78 %

Please find the attached screenshot of the excel sheet containing the detailed calculation for the above solution.

Related Solutions

If Harley Davidson stock is trading for $25/share and you want to buy 100 shares in...

If Harley Davidson stock is trading for $25/share and you want

to buy 100 shares in your brokerage account which has an initial

margin requirement of 50%, what dollar amount will the stock

purchase cost you?

Select one:

a. $25

b. $1,250

c. $2,500

d. $5,000

Clear my choice

Question 3

Refer again to question 2 (see below) supposing that you bought

the Harley Davidson (HOG) stock on margin and then sold it for

$30/share. What would be your return...

You bought 200 shares of Microsoft at $50 per share. 100 shares of IBM for $100...

You bought 200 shares of Microsoft at $50 per share. 100 shares

of IBM for $100 per share, and $300 shares of Amazon. com for $35

per share. what is the portfolio weight on the Amazon.com

holding?

Suppose you short-sell 100 shares of IBM, now selling at $200 per share.

Suppose you short-sell 100 shares of IBM, now selling at $200 per share.

a. What is your maximum possible loss?

b. What happens to the maximum loss if you simultaneously place a stop-buy order at $210?

2. Old Economy Traders opened an account to short-sell 1,000 shares of Internet Dreams at $40. The initial margin requirement was 50%. (The margin account pays no interest.) A year later, the price of Internet Dreams has risen from $40 to $50,...

An investor purchased 200 shares of stock at $100 per share on 65% margin. Suppose the...

An

investor purchased 200 shares of stock at $100 per share on 65%

margin. Suppose the maintance margin is 40% at what price does the

investor get a margin call?

Regarding the previous question, if the price declines to $70 per

share whats the return to the investors equity? What if the stock

price rises to $150 per share? ignore interest and transaction

costs.

a) Suppose that you buy 200 shares of XYZ at $80 per share and that you...

a) Suppose that you buy 200 shares of XYZ at $80 per share and

that you finance $6,000 of your investment with a margin loan at 6%

interest. What is your initial margin?

b) Suppose that you buy 200 shares of XYZ at $80 per share and

that you finance $6,000 of your investment with a margin loan at 6%

interest. If the price of one share of Company XYZ goes up 8% over

the course of a year, what...

You buy 100 shares of stock at $20 per share on margin of 40 percent. If the...

You buy 100 shares of stock at $20 per share on margin of 40

percent. If the price of the stock rises to $40 per

share, what is your percentage gain in equity? Disregard

interest costs.

PLEASE TYPE OUT

You purchase 200 shares of LPT Company at $100 per share using a 60% margin. The...

You purchase 200 shares of LPT Company at $100 per share using a

60% margin. The minimum initial margin is 50% and your maintenance

margin is 25%. How low can the stock price fall before you receive

a margin call?

Suppose you buy 200 shares of stock ABC at $50 per share and sell it in...

Suppose you buy 200 shares of stock ABC at $50 per share and

sell it in a year. The initial margin is 40%. The call money rate

is 7%. One year later, stock price decreases 20% to $40. What's the

rate of return of buying on margin?

A.

-57.5%

B.

-60.5%

C.

-62.5%

D.

-70%

1) Assume you buy 100 shares of stock at $40 per share on margin. The initial...

1) Assume you buy 100 shares of stock at $40 per share on

margin. The initial margin is 50%. If the price rises to $55 per

share, what is your percentage gain on the initial equity?

Suppose you bought 100 shares of stock at an initial price of $37 per share. The...

Suppose you bought 100 shares of stock at an initial price of

$37 per share. The stock paid a dividend of $0.28 per share during

the following year, and the share price at the end of the year was

$41. (1) What is your total dollar return on this investment? (2)

What is the percentage return on the investment?

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

ADVERTISEMENT

jeff jeffy answered 2 years ago

jeff jeffy answered 2 years ago