Question

In: Accounting

Schedule of cost of goods manufactured

Schedule of Cost of Goods Manufactured

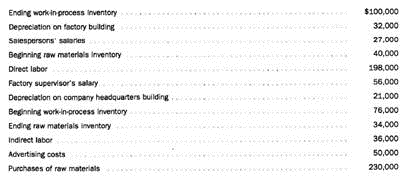

The company reported the following information for the year:

Prepare a schedule of cost of goods manufactured for the year.

Solutions

Expert Solution

Cost of goods includes all direct costs and indirect costs related to the factory. It will exclude all indirect costs related to office and administrative activities and selling and distribution activities.

Prepare Schedule of Cost of Goods Manufactured for the Year Ended December 31:

|

Direct materials: Beginning raw materials inventory 40,000 Add: Purchases of raw materials 230,000 Cost of raw materials in use 270,000 Less: Ending raw materials inventory (34,000)

Raw materials used in production Direct labor Manufacturing overhead: Depreciation of factory building 32,000 Factory supervisor’s salary 56,000 Indirect labor 36,000 Total manufacturing cost Add: Beginning work in process inventory Less: Closing work in process inventory Cost of goods manufactured |

$236,000 198,000 124,000 558,000 76,000 634,000 (100,000) 534,000 |

Notes: salespersons' salary and Advertising costs are indirect costs incurred for selling the product.

Depreciation of company headquarters building is an indirect administration cost. So these items will not be included in the cost of goods manufactured.

Related Solutions

Prepare a Schedule of Cost of Goods Manufactured and a Schedule of Cost of Goods Sold...

In the Schedule of Cost of Goods Manufactured and Cost of Goods Sold, the cost of...

Preparing a Schedule of Cost of Finished Goods Manufactured, Cost of Goods Sold Schedule, and an...

Preparing a Schedule of Cost of Finished Goods Manufactured, Cost of Goods Sold Schedule, and an...

An incomplete cost of goods manufactured schedule is presented below. Complete the cost of goods manufactured...

Preparation of a Schedule of Cost of Goods Manufactured and Cost of Goods Sold The following...

Exercise 14-15 Schedule of cost of goods manufactured and cost of goods sold LO P1, P2...

Which of the following accounts would not appear on a schedule of cost of goods manufactured?...

Schedule of Cost of Goods Manufactured and Sold The following amounts are available for 2016 for...

Let's discuss the format of the Schedule of Cost of Goods Manufactured. What is included in...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

Dr. OWL answered 5 years ago

Dr. OWL answered 5 years ago