Question

In: Accounting

1. Do you thing that variable costing is useful for controlling company costs? Defend your response...

1. Do you thing that variable costing is useful for controlling company costs? Defend your response with examples.

2. Explain why variable costing and absorption costing can result in different period incomes. Support your argument by an example which spans more than one accounting period.

(Please provide examples with detailed explanation)

Solutions

Expert Solution

Answer 1 - Variable cost change with activity or production volume. Hence the variable cost is directly linked with the levels of production/working done by the company, as variable cost increases/ decreases as level of activity changes and doesnot incurr if no activity is performed.

For example, if a manager is deciding between keeping production levels constant or increasing production, the primary factors in this decision will be the variable or incremental costs of the production of additional units of output.

Hence Variable cost is useful for controlling comapny cost.

The basic examples of variable cost is direct material direct labour cost. Other than that if a telephone company charges a per-minute rate, then that would be a variable cost. A twenty minute phone call would cost more than a ten minute phone call

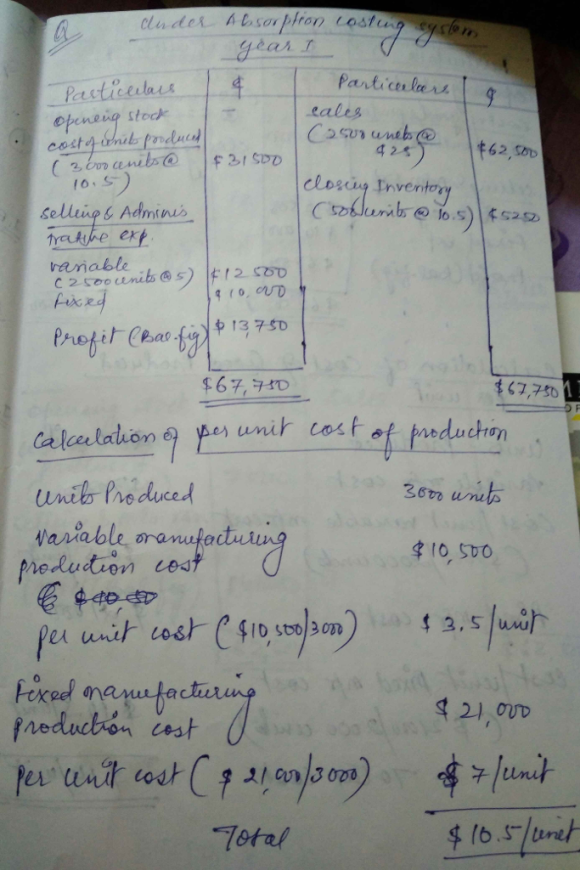

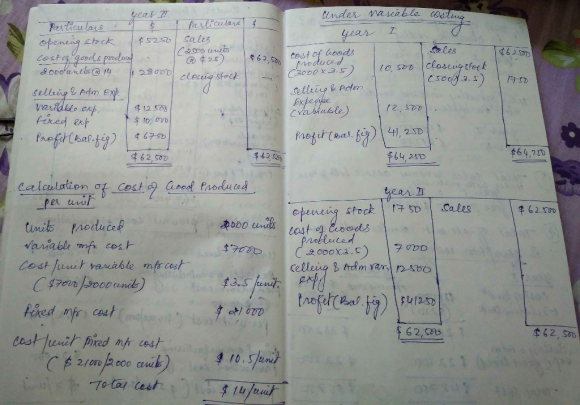

Answer 2 - Variable costing and absorption costing are two different methods to allocate cost to products and services.The difference between two is treatment of fixed manufacturing overhead cost.

Under variable costing system the fixed manufacturing overhead are expensed in the period in which they are incurred.Whereas in absorption costing method the fixed manufacturing overhead are expensed in the period in which the product is sold.

Example of variable and absorption costing is attached below

-

Related Solutions

PLEASE ANSWER -TRUE OR FALSE and then…defend your response. 1. You are a patient and seriously...

How do costs vary in response to changes in the quantity of a variable input? In...

Explain the difference between absorption costing and variable costing and which you think is more useful.

Variable Costing and Absorption Costing – Questions 1 – 8. Production Costs

Controlling production costs are critical to any manufacturing company. Explain the difference between fixed and variable...

Is there such a thing as "reverse discrimination? Provide examples to support your response.

1. Is social media a good thing or a bad thing? 2. Do you think that...

Just need a response thank you! Define variable costs and fixed costs, and use an example...

Variable costing versus absorption costing. The Garvis Company uses an absorption-costing system based on standard costs....

WEEK 5: RELEVANT COSTS Do you think that variable costs are always relevant? What do you...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

ekkarill92 answered 2 years ago

ekkarill92 answered 2 years ago