Question

In: Accounting

Below are the transactions and adjustments that occurred during the first year of operations at Kissick Co

Below are the transactions and adjustments that occurred during the first year of operations at Kissick Co

-

Issued 197,000 shares of $5-par-value common stock for $985,000 in cash.

-

Borrowed $520,000 from Oglesby National Bank and signed a 11% note due in three years.

-

Incurred and paid $390,000 in salaries for the year.

-

Purchased $690,000 of merchandise inventory on account during the year.

-

Sold inventory costing $590,000 for a total of $920,000, all on credit.

-

Paid rent of $220,000 on the sales facilities during the first 11 months of the year.

-

Purchased $180,000 of store equipment, paying $54,000 in cash and agreeing to pay the difference within 90 days.

-

Paid the entire $126,000 owed for store equipment and $630,000 of the amount due to suppliers for credit purchases previously recorded.

-

Incurred and paid utilities expense of $37,000 during the year.

-

Collected $825,000 in cash from customers during the year for credit sales previously recorded.

-

At year-end, accrued $57,200 of interest on the note due to Oglesby National Bank.

-

At year-end, accrued $20,000 of past-due December rent on the sales facilities.

Required:

a. Prepare an income statement (ignoring income taxes) for Kissick Co.'s first year of operations and a balance sheet as of the end of the year. (Hint: You may find it helpful to prepare T-accounts for each account affected by the transactions.)

Solutions

Expert Solution

Income statement:

The income statement helps to know the after-tax income of a company. It helps to know whether there is profit or loss during a period and indicates the company's performance. There is reporting of expenses and revenues in the company's income statement, which helps in the determination of the net income or loss during the period.

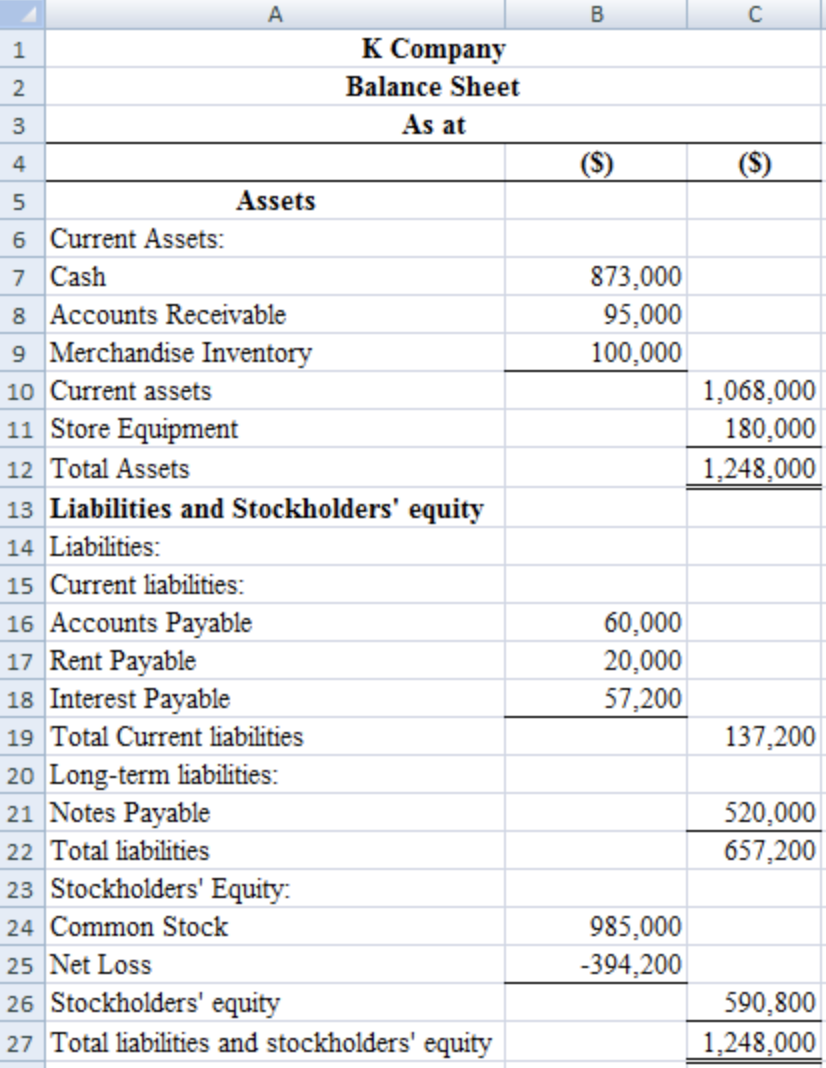

Balance Sheet:

The balance sheet is prepared to forecast the assets, liabilities, and stockholders’ equity of a company for a period of time. It is prepared to estimate the financial position of the company. The accounts receivable balance is shown in the balance sheet after deducting allowances for bad debts from the accounts receivable balance. Plant, property, and equipment are shown after adding new equipment and reducing the depreciation. Total liabilities are calculated by adding current liabilities and long term liabilities. Thus, the total liabilities and total stockholders’ equity is calculated by adding the individual total balances of total liabilities and total stockholders’ equity.

Sales:

Sales refer to the amount earned by a company by selling or providing the company's products and services to the customers. It is reported in the income statement of the company. The net sales revenue is calculated by reducing the sales returns, sales allowances, and sales discount from the gross sales revenue.

Cost of goods sold:

The cost of goods sold shows the total manufacturing costs incurred in a period that is direct materials cost, direct labor cost, and manufacturing overhead cost.

Gross Profit:

Gross Profit is the profit that a company earns after reducing the costs related to the production and sale of its products. Gross profit is computed by deducting the cost of goods sold from sales revenue.

Operating income:

The operating income refers to the income which is generated through the business operations. The operating expenses are deducted from the gross margin to compute the operating income of the company. It refers to the income which a company generates from its core or main operations.

Operating expenses:

The operating expenses are the expenses that a company incurs to continue its main and core activities. The operating expenses have no direct relationship with the company's production, but a company incurs operating expenses for its day to day operations. The example of operating expenses includes rent, depreciation, sales commission, etc. The operating expenses include selling expenses, administrative expenses, and it does not consider the finance-related costs like interest expense, bank charges, etc.

Net Income:

The net income or net loss is computed by deducting the operating expenses from the gross profit. Net income is considered as of most importance by the investors in financial statements of any year. The reason is that the net income represents the increase in the investors’ wealth resulting from the company's profitable activities.

Property, plant, and equipment:

Property, plant, and equipment are tangible assets with physical substance—for example, Equipment, Machinery, and Buildings, etc. The plant assets are long-lived as the useful life of the assets is more than one year.

Accumulated Depreciation:

The accumulated depreciation method represents the amount of the asset's cost, which is charged as an expense. The balance in the accumulated depreciation shows the amount of depreciation charged in the asset's estimated useful life. The accumulated depreciation is recorded by debiting depreciation expense and crediting accumulated depreciation.

Current assets:

The current assets are shown in the balance sheet of the company. The assets which in a year is expected to be turned into cash are the current assets. Such assets include cash, inventory, accounts receivable, prepaid expenses, etc.

Accounts receivable:

Accounts receivable is a current asset for the company. It represents the amount required to be collected by the company from its customers when the goods are sold on credit to the customers. Accounts receivable are referred to as persons from whom cash is receivable for credit sales made, and it is expected that it will be received within one year from the date and thus are referred to as current assets.

Inventory:

Inventory represents the inventory purchased by a firm for re-sale, which has not been sold as on the balance sheet's date. The inventory is disclosed on the assets side of the balance sheet under the head Current Assets. Inventory is also disclosed in the credit side of the trading account of the firm.

Cash:

Cash is considered a current asset for the company. It is reported in the assets section of the balance sheet. It is a real account. When there is an inflow of cash, there is an increase in the current assets' balance. When there is an outflow of cash, there is a decrease in the balance of current assets.

Current liabilities:

The current liabilities are shown in the balance sheet of the company. The liabilities which are to be paid by the company in one year of cash are the current liabilities. Such liabilities include salaries payable, interest payable, accounts payable, short-term debt, etc.

Notes Payable:

There is issuing of notes payable when the loans are taken from the bank. The acquisition of the equipment, which is costly, or inventory purchases also result in the issuance of notes payable. The notes payable are considered as a current liability for the company.

Accounts Payable:

Accounts payable is a current liability for the company. It represents the amount required to be paid by the company to the suppliers when the goods are purchased on credit from the suppliers.

Long-term liabilities:

The long-term liabilities are shown in the balance sheet of the company. The liabilities which are to be paid by the company after one year are the long-term liabilities. Such liabilities include debentures, bonds payable, etc.

Shareholders’ equity:

The balance sheet's shareholders’ equity section presents the amount of the total stockholders’ equity when the balance sheet is prepared. In the stockholders’ equity section of the balance sheet, the total stockholders’ equity is computed by adding the capital stock, additional paid-in capital, and retained earnings.

Accrued Expense:

Accrued expenses are those expenses that have been incurred but for which no payment has been made. Adjusting entries regarding accrued expenses is made by debiting the accrued expense that is increasing the expense and making a credit to liabilities, increasing the liabilities. Examples of accrued expenses are accrued expense for taxes, interest, insurance, and salaries.

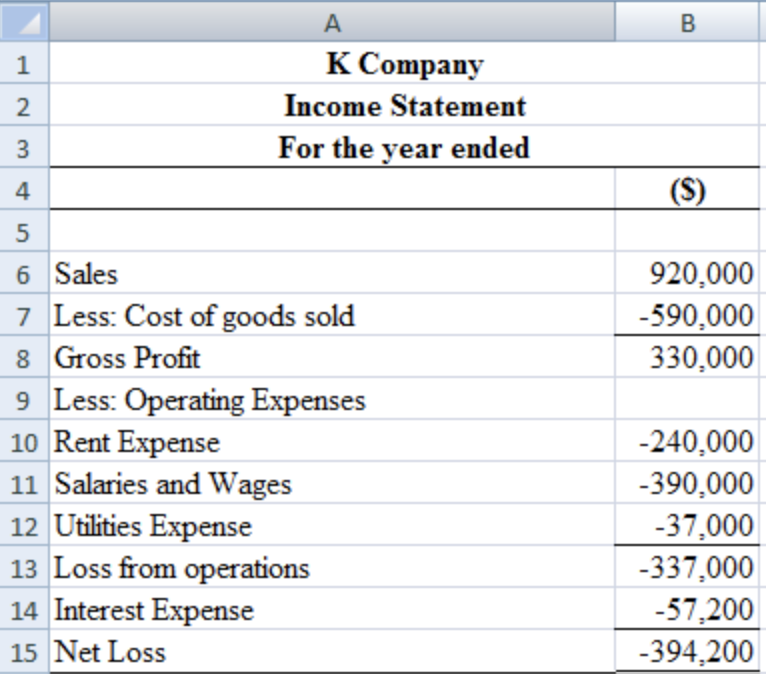

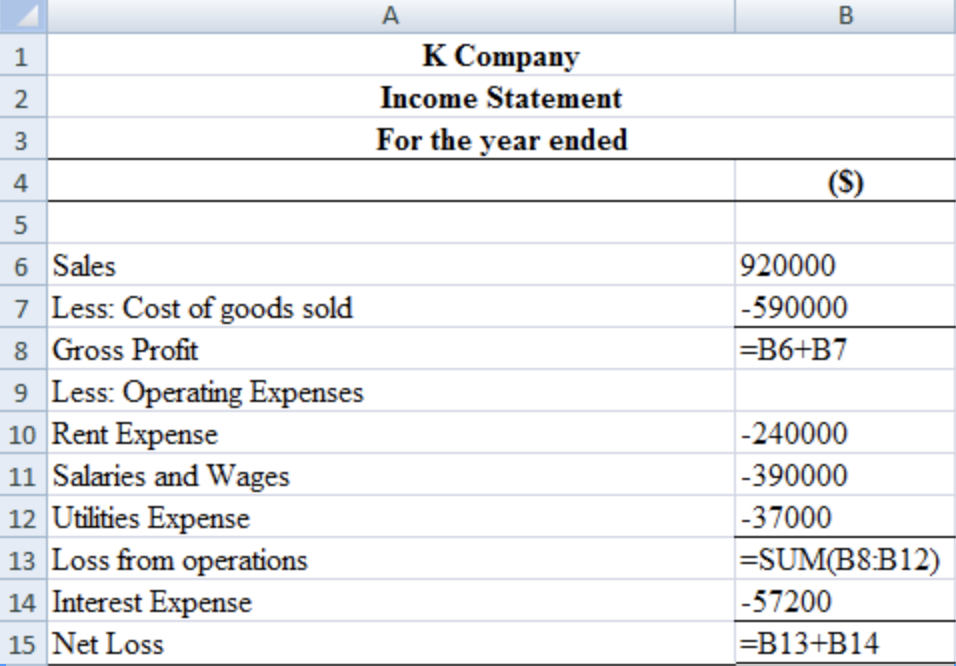

a.

1.

Prepare the income statement of K Company for the first year of operation.

Following schedule shows the income statement of K Company for the first year of operation:

The amount of net loss of the company is $394,200.

Following schedule shows the calculation:

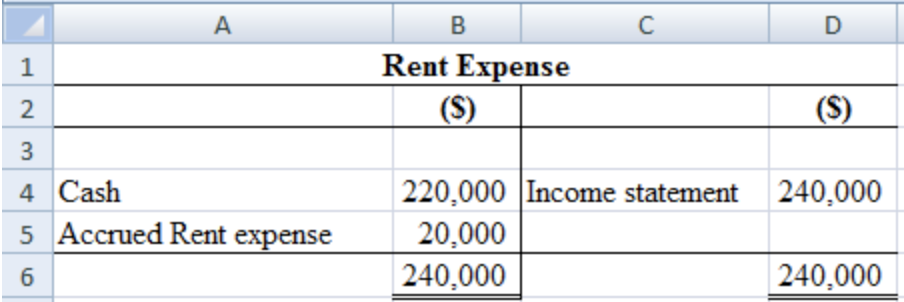

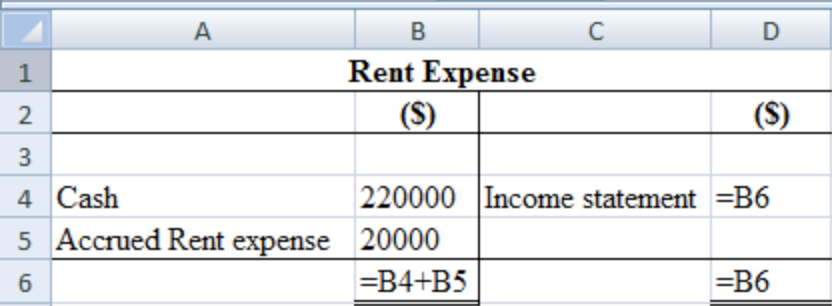

Working Note:

Calculate the amount of rent expense to be reported in the income statement.

Following schedule shows the amount of rent expense to be reported in the income statement:

The rent expense to be reported in the income statement is $240,000.

Following schedule shows the calculation:

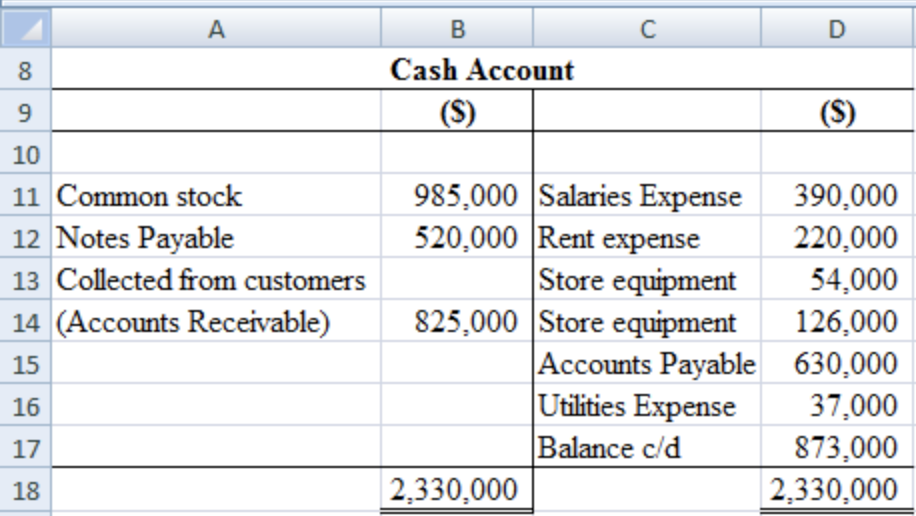

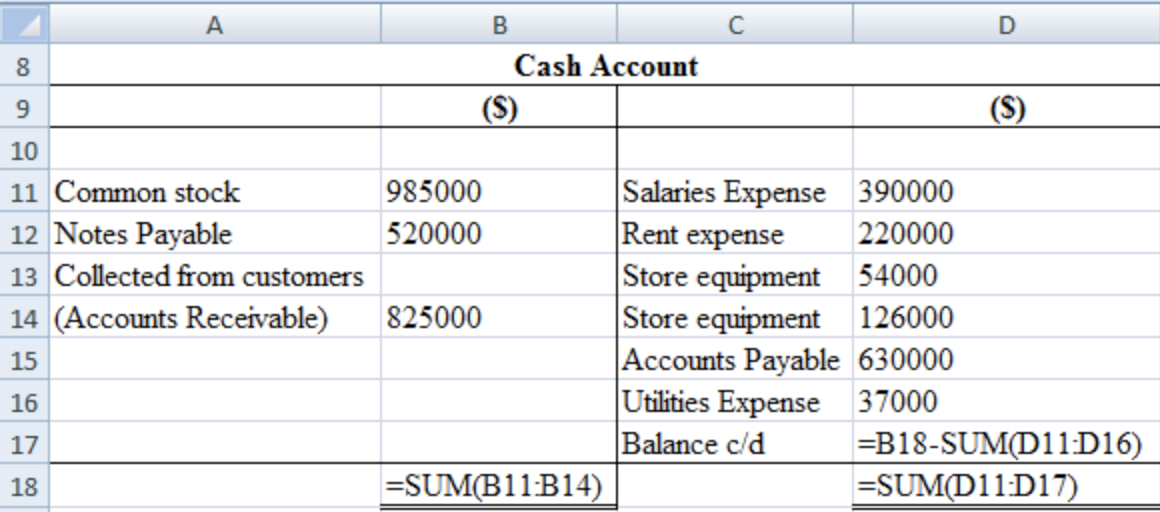

Prepare the cash account.

Following schedule shows the cash account:

The balance of the cash account at the end of the year is $873,000.

Following schedule shows the calculation:

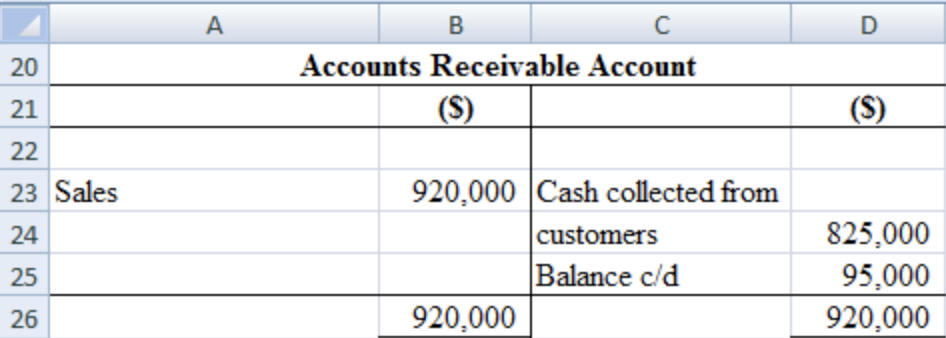

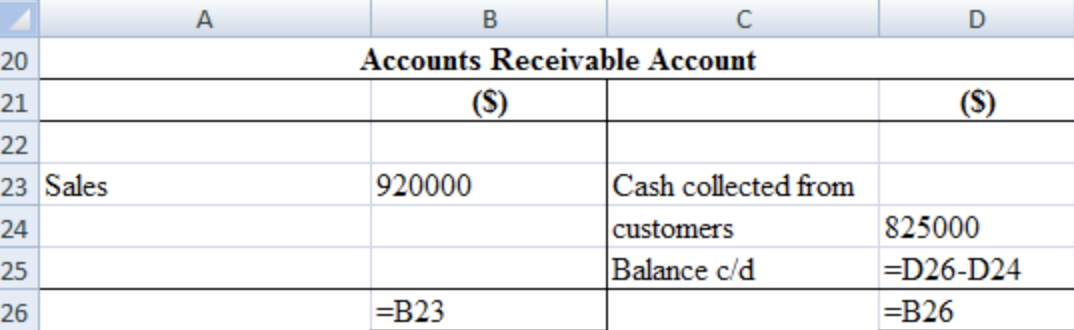

Prepare the accounts receivable account.

Following schedule shows the accounts receivable account:

The balance of accounts receivable account at the end of the year is $95,000.

Following schedule shows the calculation:

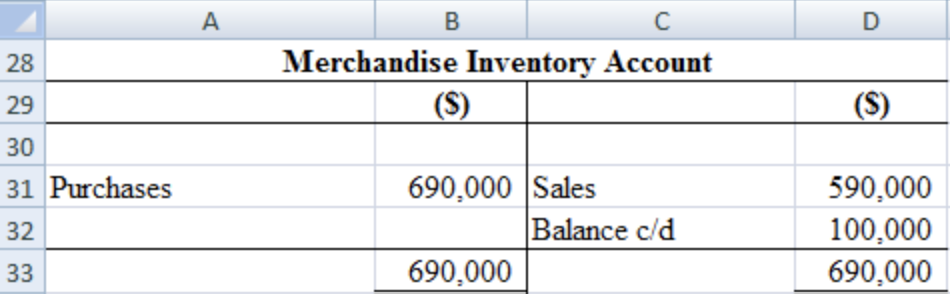

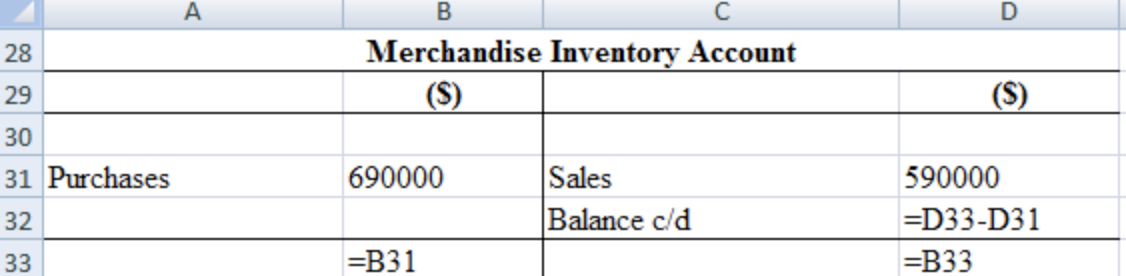

Prepare the merchandise inventory account.

Following schedule shows the merchandise inventory account:

The balance of merchandise inventory at the end of the year is $100,000.

Following schedule shows the calculation:

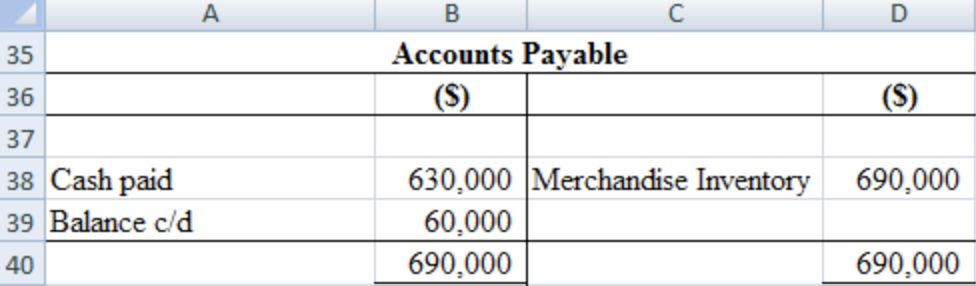

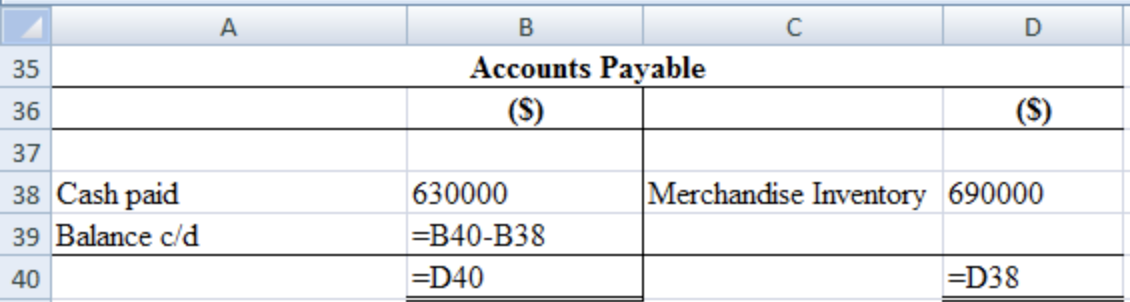

Prepare the accounts payable account.

Following schedule shows the accounts payable account:

The balance of accounts payable at the end of the year is $60,000.

Following schedule shows the calculation:

2.

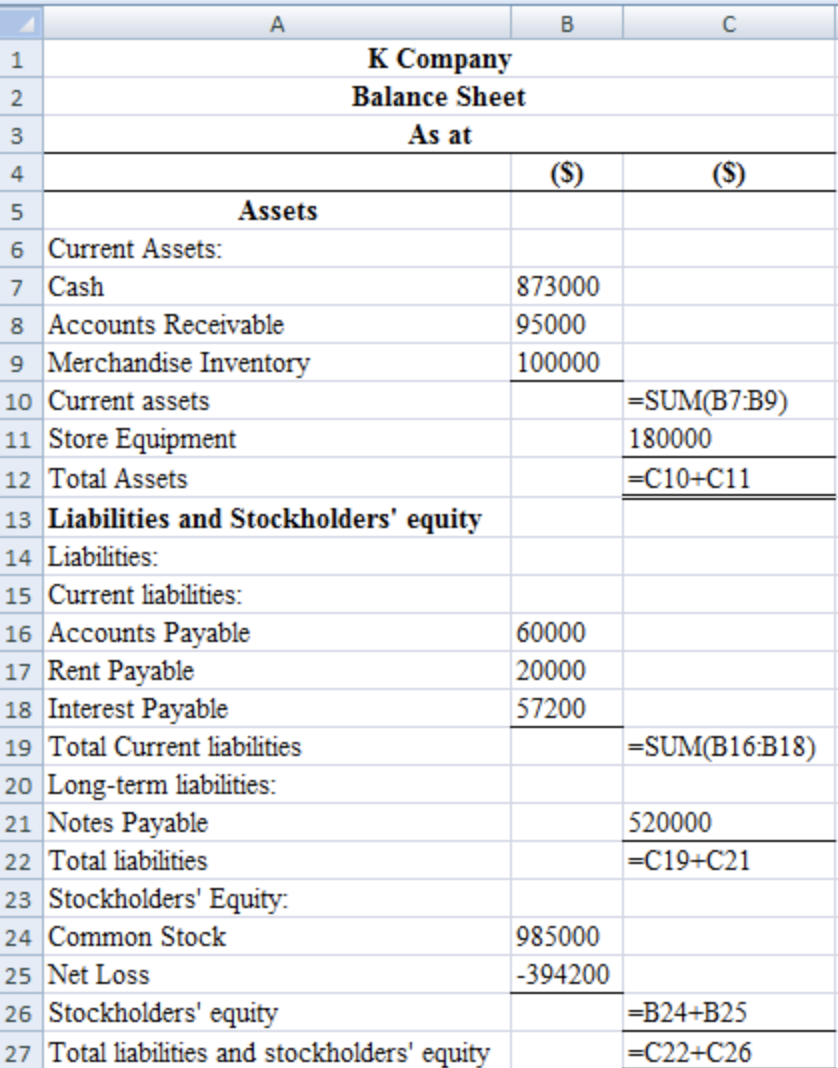

Prepare the balance sheet of the company.

The following schedule shows the balance sheet of the company.

The total of the balance sheet's assets section is $1,248,000, and the total of the liabilities and equity section of the balance sheet is $1,248,000.

Following schedule shows the calculation:

The amount of net loss of the company is $394,200.

The total of the assets section of the balance sheet is $1,248,000 and the total of the liabilities and equity section of the balance sheet is $1,248,000.

Related Solutions

Below are the transactions and adjustments that occurred during the first year of operations at Kissick...

Following are the transactions and adjustments that occurred during the first year of operations at Kissick...

Following are the transactions and adjustments that occurred during the first year of operations at Kissick...

Use the horizontal model, or write the journal entry, for each of the following transactions and adjustments that occurred during the first year of operations at Kissick Co.

The following transactions occurred during the first year of operations for Cougar Corp. for each transaction...

the following transactions occurred during the first year of operations for dave's tvs,inc,. a retail company...

The following transactions occurred during December, the first month of operations for Harris Company. Prepare journal...

Prepare journal entries. The following transactions occurred during the first twelve months of operations: January 1st...

During November, the first month of operations, the following transactions occurred: Date Event 1-Nov Paid $7,200...

The following transactions occurred at Pharaoh Inc. during its first year of operation: a. Issued 100,000...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

- For this assignment you will write a program with multiple functions that will generate and save...

- How many grays is this?Part A A dose of 4.7 Sv of γ rays in a...

- how to operate a business?

Dr. OWL answered 5 years ago

Dr. OWL answered 5 years ago