Question

In: Accounting

On July 1, 2017, Novak Inc. made two sales. 1. It sold land having a fair...

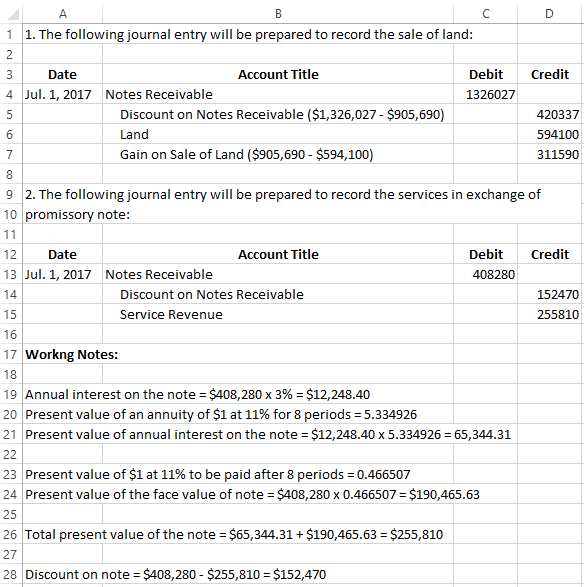

On July 1, 2017, Novak Inc. made two sales. 1. It sold land having a fair value of $905,690 in exchange for a 4-year zero-interest-bearing promissory note in the face amount of $1,326,027. The land is carried on Novak's books at a cost of $594,100. 2. It rendered services in exchange for a 3%, 8-year promissory note having a face value of $408,280 (interest payable annually). Novak Inc. recently had to pay 8% interest for money that it borrowed from British National Bank. The customers in these two transactions have credit ratings that require them to borrow money at 10% interest. Record the two journal entries that should be recorded by Novak Inc. for the sales transactions above that took place on July 1, 2017.

Solutions

Related Solutions

On July 1, 2017, Monty Inc. made two sales. 1. It sold land having a fair...

On July 1, 2017, Monty Inc. made two sales.

1.

It sold land having a fair value of $915,830 in exchange for a

3-year zero-interest-bearing promissory note in the face amount of

$1,252,520. The land is carried on Monty's books at a cost of

$597,600.

2.

It rendered services in exchange for a 5%, 6-year promissory

note having a face value of $402,550 (interest payable

annually).

Monty Inc. recently had to pay 8% interest for money that it

borrowed from...

On July 1, 2020, Buffalo Inc. made two sales. 1. It sold land having a fair...

On July 1, 2020, Buffalo Inc. made two sales.

1.

It sold land having a fair value of $904,970 in exchange for a

4-year zero-interest-bearing promissory note in the face amount of

$1,423,984. The land is carried on Buffalo's books at a cost of

$596,000.

2.

It rendered services in exchange for a 3%, 8-year promissory

note having a face value of $409,570 (interest payable

annually).

Buffalo Inc. recently had to pay 8% interest for money that it

borrowed from...

On July 1, 2020, Culver Inc. made two sales. 1. It sold land having a fair...

On July 1, 2020, Culver Inc. made two sales.

1.

It sold land having a fair value of $917,020 in exchange for a

4-year zero-interest-bearing promissory note in the face amount of

$1,442,944. The land is carried on Culver's books at a cost of

$590,500.

2.

It rendered services in exchange for a 3%, 8-year promissory

note having a face value of $408,520 (interest payable

annually).

Culver Inc. recently had to pay 8% interest for money that it

borrowed from...

On July 1, 2020, Metlock Inc. made two sales. 1. It sold land having a fair...

On July 1, 2020, Metlock Inc. made two sales.

1.

It sold land having a fair value of $908,350 in exchange for a

4-year zero-interest-bearing promissory note in the face amount of

$1,429,302. The land is carried on Metlock's books at a cost of

$593,500.

2.

It rendered services in exchange for a 3%, 8-year promissory

note having a face value of $403,990 (interest payable

annually).

Metlock Inc. recently had to pay 8% interest for money that it

borrowed from...

On July 1, 2020, Metlock Inc. made two sales: 1. It sold excess land in exchange...

On July 1, 2020, Metlock Inc. made two sales:

1.

It sold excess land in exchange for a four-year,

non–interest-bearing promissory note in the face amount of

$1,094,530. The land’s carrying value is $560,000.

2.

It rendered services in exchange for an eight-year promissory

note having a face value of $470,000. Interest at a rate of 3% is

payable annually.

The customers in the above transactions have credit ratings that

require them to borrow money at 11% interest. Metlock recently...

On July 1, 2020, Skysong Inc. made two sales: 1. It sold excess land in exchange...

On July 1, 2020, Skysong Inc. made two sales: 1. It sold excess

land in exchange for a four-year, non–interest-bearing promissory

note in the face amount of $1,147,860. The land’s carrying value is

$620,000. 2. It rendered services in exchange for an eight-year

promissory note having a face value of $500,000. Interest at a rate

of 3% is payable annually. The customers in the above transactions

have credit ratings that require them to borrow money at 10%

interest. Skysong recently...

On July 1, 2020, Skysong Inc. made two sales: 1. It sold excess land in exchange...

On July 1, 2020, Skysong Inc. made two sales:

1.

It sold excess land in exchange for a four-year,

non–interest-bearing promissory note in the face amount of

$1,147,860. The land’s carrying value is $620,000.

2.

It rendered services in exchange for an eight-year promissory

note having a face value of $500,000. Interest at a rate of 3% is

payable annually.

The customers in the above transactions have credit ratings that

require them to borrow money at 10% interest. Skysong recently...

Mike Greenberg opened Novak Window Washing Inc. on July 1, 2017. During July, the following transactions...

Mike Greenberg

opened Novak Window Washing Inc. on July 1, 2017. During July, the

following transactions were completed.

1-Jul

Issued 11,300 shares of common stock for $11,300 cash.

1

Purchased used truck for $7,520, paying $1,880 cash and the

balance on account.

3

Purchased cleaning supplies for $850 on account.

5

Paid $1,680 cash on a 1-year insurance policy effective July

1.

12

Billed customers $3,480 for cleaning services performed.

18

Paid $940 cash on amount owed on truck and...

Journal Entry July 1 - Grass Corp. sold to Blossom Company merchandise having a sales price...

Journal Entry

July

1 - Grass Corp. sold to Blossom Company merchandise having a

sales price of $8,500, terms 2/10, n/60. Grass records its sales

and receivables net.

3 - Blossom Company returned defective merchandise having a

sales price of $800.

5 - Accounts receivable of $20,000 (gross) are factored with

Novak Corp. without recourse at a financing charge of 8%. Cash is

received for the proceeds and collections are handled by the

finance company. (These accounts were subject to...

Novak Corporation made the following purchases of investments during 2017, the first year in which Novak...

Novak Corporation made the following purchases of investments

during 2017, the first year in which Novak invested in equity

securities:

1.

On January 15, purchased 7,470 shares of Nirmala Corp.’s common

shares at $27.81 per share plus commission of $1,643.

2.

On April 1, purchased 4,150 shares of Oxana Corp.’s common

shares at $43 per share plus commission of $2,797.

3.

On September 10, purchased 5,810 shares of WTA Corp.’s

preferred shares at $22.00 per share plus commission of

$2,415....

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- Sketch a simple pendulum displaced at a small angle. Draw and label all forces acting on...

- The four methods needed for the assignment are specified in the Main class. Include a documentation...

- In 2004 astronomers reported the discovery of a large Jupiter-sized planet orbiting very close to the...

- How can you predict industry changes using supply and demand? Elaborate. What are the sources of...

- (I need an answer in c++ please / assignment question) In a double linked chain, each...

- Jeeler's Netballs is a manufacturer of high-quality basketballs and volleyballs. Setup costs are driven by the...

- a. You are conducting a lab experiment on the promoter regions of genes. In one experiment...

ADVERTISEMENT

ekkarill92 answered 3 weeks ago

ekkarill92 answered 3 weeks ago