Question

In: Finance

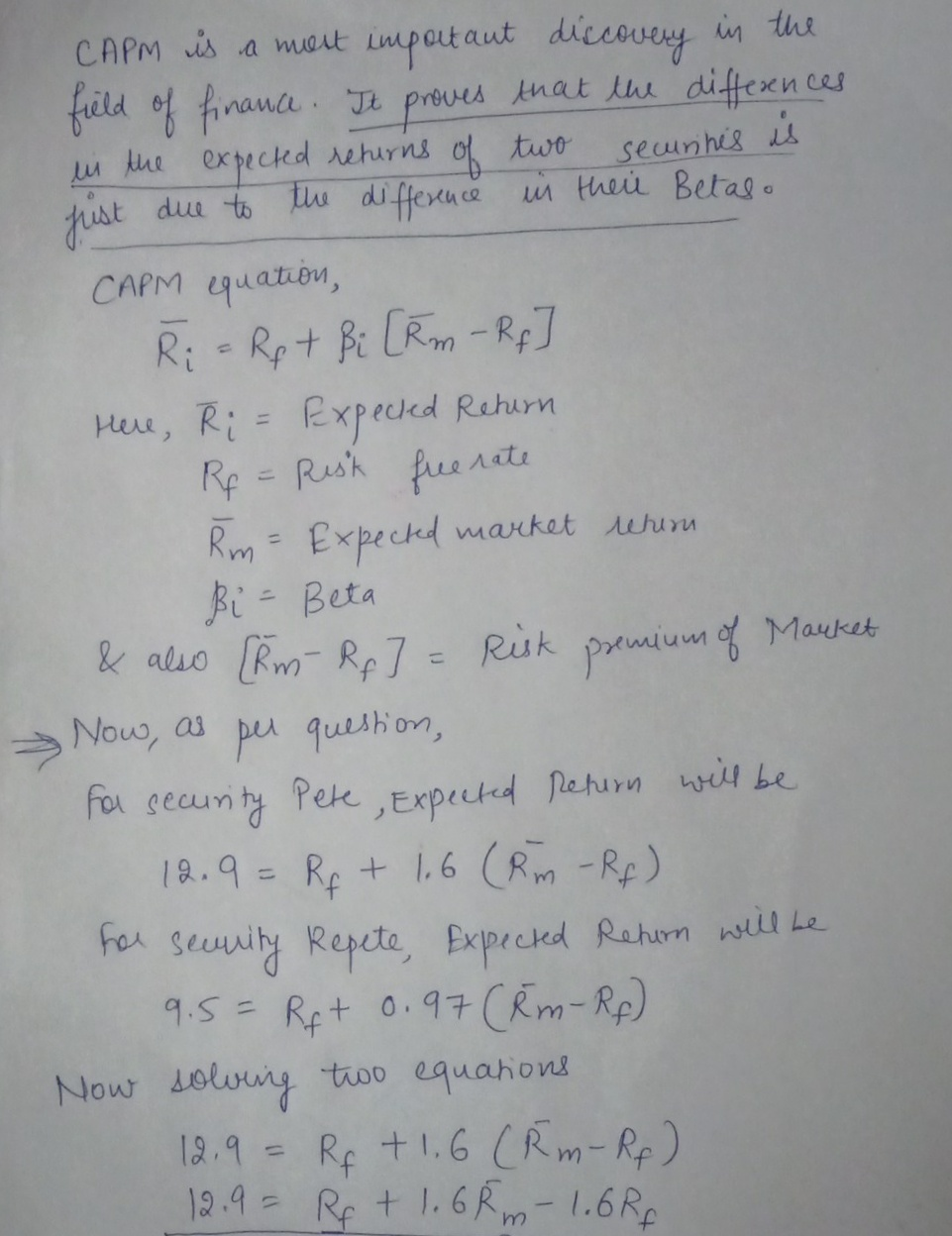

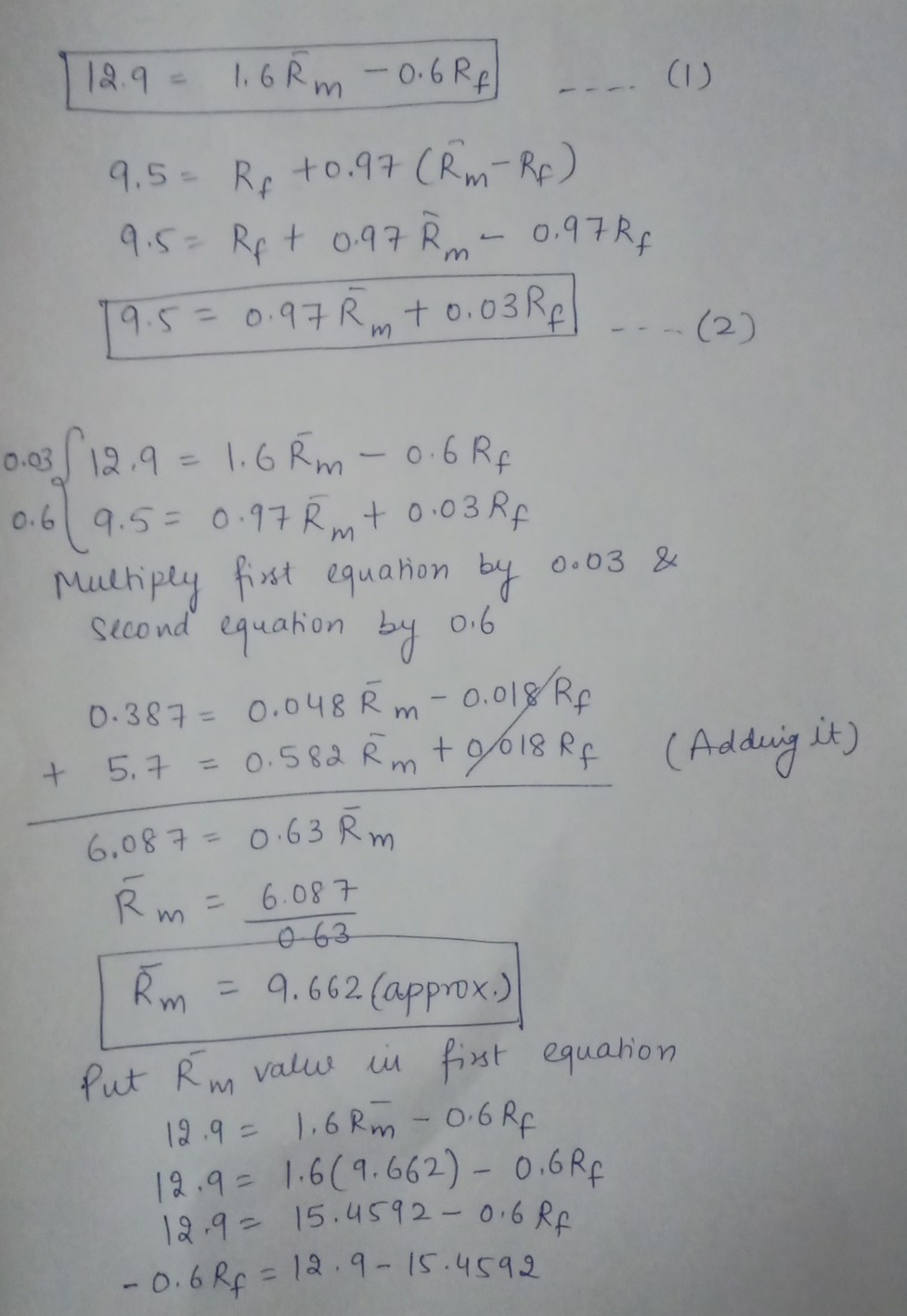

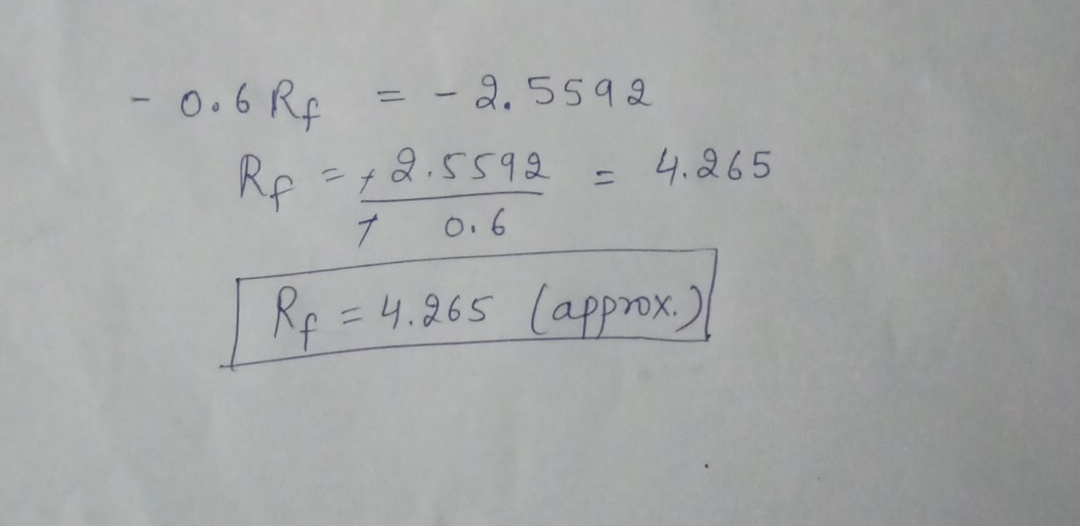

Suppose you observe the following situation: Security Beta Expected Return Pete 1.60 12.9% Repete 0.97 9.5%...

Suppose you observe the following situation:

|

Security |

Beta |

Expected Return |

|

Pete |

1.60 |

12.9% |

|

Repete |

0.97 |

9.5% |

Assume these securities are correctly priced. Based on the CAPM,

what is the expected return on the market? What is the risk-free

rate?

Shows all the step and formula. Don't round off until you get the

answer.

Solutions

Related Solutions

(4) Suppose you observe the following situation: Security Beta Expected Return Pete Corp. 1.15 12.90% Repete...

(4) Suppose you observe the following situation:

Security Beta Expected Return

Pete Corp. 1.15 12.90%

Repete Co. 0.84 10.20%

Assume the two securities are correctly priced. Based on CAPM, what

is the expected return on the market? What is the risk-free rate?

(15 points)

Suppose you observe the following situation: Security Beta Expected Return Assume these securities are correctly priced....

Suppose you observe the following situation:

Security Beta Expected Return

Assume these securities are correctly priced. peat co. 1.20

11.0

Repeat co. 0.65 9.9

Based on the CAPM, what is the expected return on the market?

What is the risk-free rate? (Do not round intermediate

calculations. Enter your answers as a percent rounded to 2 decimal

places.)

Expected return on market %

Risk-free rate %

Suppose you observe the following situation: Security Beta Expected Return Cooley, Inc. 1.6 19% Moyer Co....

Suppose you observe the following situation:

Security

Beta

Expected Return

Cooley, Inc.

1.6

19%

Moyer Co.

1.2

16%

If the risk-free rate is 8 %, are the securities correctly

priced? What would the risk-free rate have to be if they are

correctly priced?

Suppose you observe the following situation: Standard Deviation Beta Expected Return Stock A 33% 1.2 0.13...

Suppose you observe the following situation:

Standard Deviation

Beta

Expected Return

Stock A

33%

1.2

0.13

Stock B

38%

0.8

0.12

Stock C

30%

1.1

0.11

T-Bill

-

-

0.03 + 0.5×9

Which one(s) has the highest

systematic risk? (Stock A, Stock B, Stock C, Hard to

Say)

Which one(s) has the highest

unsystematic risk? (Stock A, Stock B, Stock C, Hard to

Say)

If Stock C is correctly priced, what

is the reward-to-risk ratio (Sharpe ratio) for Stock A...

Suppose you observe the following situation: Rate of Return If State Occurs State of Probability...

Suppose you observe the following situation:

Rate of Return If State Occurs

State of

Probability of

Economy

State

Stock A

Stock B

Bust

.30

−.10

−.08

Normal

.50

.11

.11

Boom

.20

.46

.26

a.

Calculate the expected return on each stock. (Do not

round intermediate calculations. Enter your answers as a percent

rounded to 2 decimal places, e.g., 32.16.)

Expected return

Stock A

%

Stock B

%

b.

Assuming the capital asset pricing model holds and Stock...

Suppose you observe the following situation: Rate of Return If State Occurs State of Probability...

Suppose you observe the following situation:

Rate of Return If State Occurs

State of

Probability of

Economy

State

Stock A

Stock B

Bust

.25

−.07

−.05

Normal

.45

.14

.14

Boom

.30

.49

.29

a.

Calculate the expected return on each stock. (Do not

round intermediate calculations. Enter your answers as a percent

rounded to 2 decimal places, e.g., 32.16.)

Expected return

Stock A

%

Stock B

%

b.

Assuming the capital asset pricing model holds and Stock...

Suppose you observe the following situation: State of Economy Probability of State Return if State Occurs...

Suppose you observe the following situation:

State of

Economy

Probability

of State

Return if State Occurs

Stock A

Stock B

Bust

.15

−.08

−.10

Normal

.60

.11

.09

Boom

.25

.30

.27

a.

Calculate the expected return on each stock.

(Do not round intermediate calculations

and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

b.

Assuming the capital asset pricing model holds and Stock A’s

beta is greater than Stock B’s beta by...

Evaluating risk and return. Stock X has an expected return of 9.5 percent, a beta coefficient...

Evaluating risk and return. Stock X has an expected return of

9.5 percent, a beta coefficient of 0.9, and a 30 percent standard

deviation of expected returns. Stock Y has a 13 percent expected

return, a beta coefficient of 1.3, and a 20 percent standard

deviation. The risk-free rate is 5 percent, and the market risk

premium is 5.5 percent.

a) Calculate the coefficient of variation of each stock.

b) Which stock is riskier for diversified investors? Which stock

is...

Stock X has a 9.5% expected return, a beta coefficient of 0.8, and a 30% standard...

Stock X has a 9.5% expected return, a beta coefficient of 0.8,

and a 30% standard deviation of expected returns. Stock Y has a

12.0% expected return, a beta coefficient of 1.1, and a 25.0%

standard deviation. The risk-free rate is 6%, and the market risk

premium is 5%.

Calculate each stock's coefficient of variation. Round your

answers to two decimal places. Do not round intermediate

calculations.

CVx =

CVy =

Which stock is riskier for a diversified investor?

For...

Stock X has a 9.5% expected return, a beta coefficient of 0.8, and a 40% standard...

Stock X has a 9.5% expected return, a beta coefficient of 0.8,

and a 40% standard deviation of expected returns. Stock Y has a

12.0% expected return, a beta coefficient of 1.1, and a 25%

standard deviation. The risk-free rate is 6%, and the market risk

premium is 5%.

Calculate each stock's coefficient of variation. Do not round

intermediate calculations. Round your answers to two decimal

places.

CVx =

CVy =

Which stock is riskier for a diversified investor?

For...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- This week, we are focusing on Management and Motivation (Chapter 3). Be sure to read chapter...

- A 2.00 m long horizontal uniform beam is supported by a wire as shown in the...

- State two reasons why it is advisable to place the transaction log on a separate disk...

- ( Posting the same question for third time. Can I please get answer in C++.( and...

- Write a Java program to do the following with your name. This can all be done...

- When preparing government-wide statements, which of the following is not true? Multiple Choice Entries are necessary...

- Hawaiian Location (e.g., what can be grown there because of the climate, soils, etc.) Culture (e.g.,...

ADVERTISEMENT

jeff jeffy answered 3 weeks ago

jeff jeffy answered 3 weeks ago