Question

In: Economics

Firms x, y, and z produce and sell an identical product and operate in an oligopolistic...

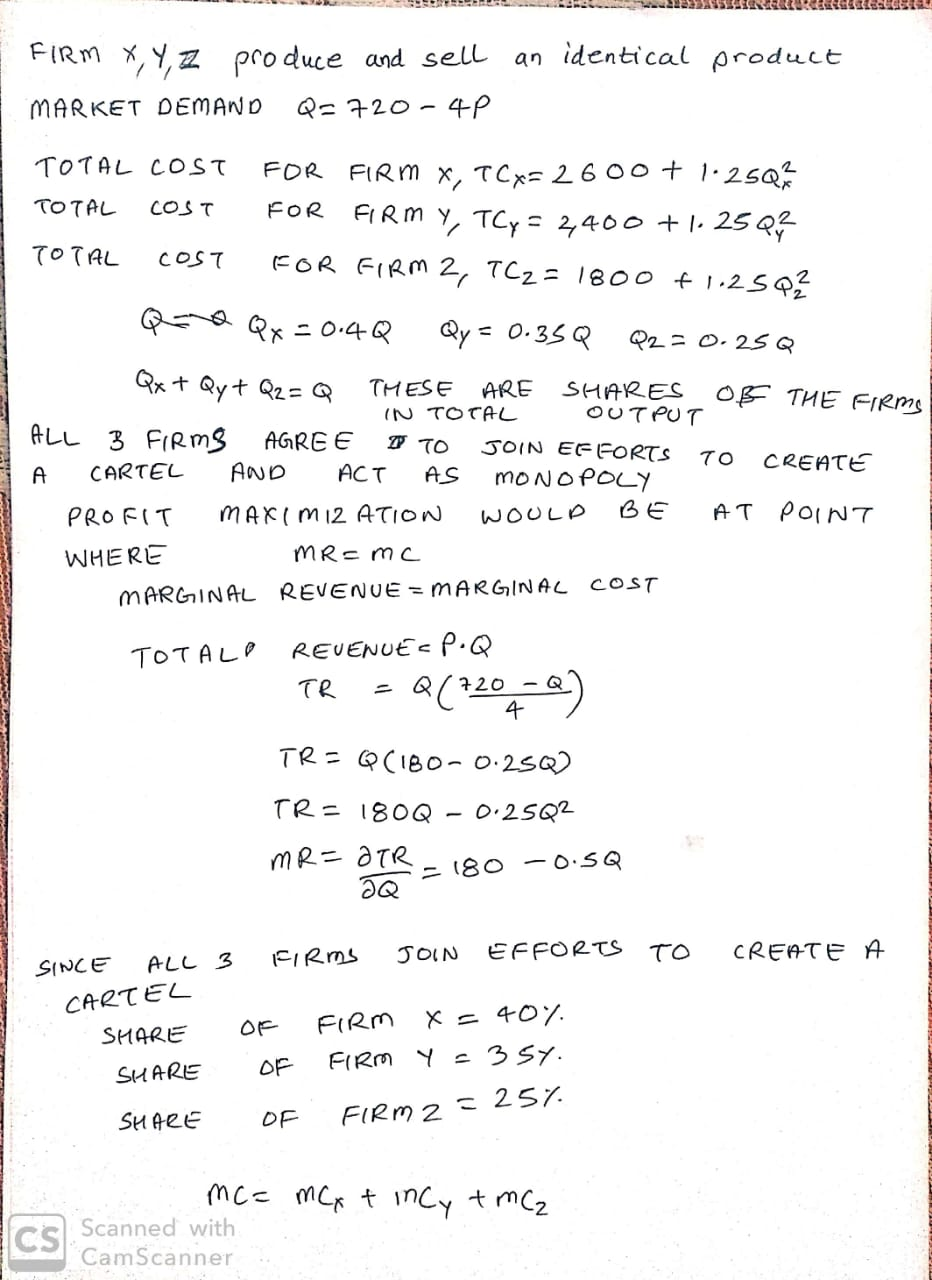

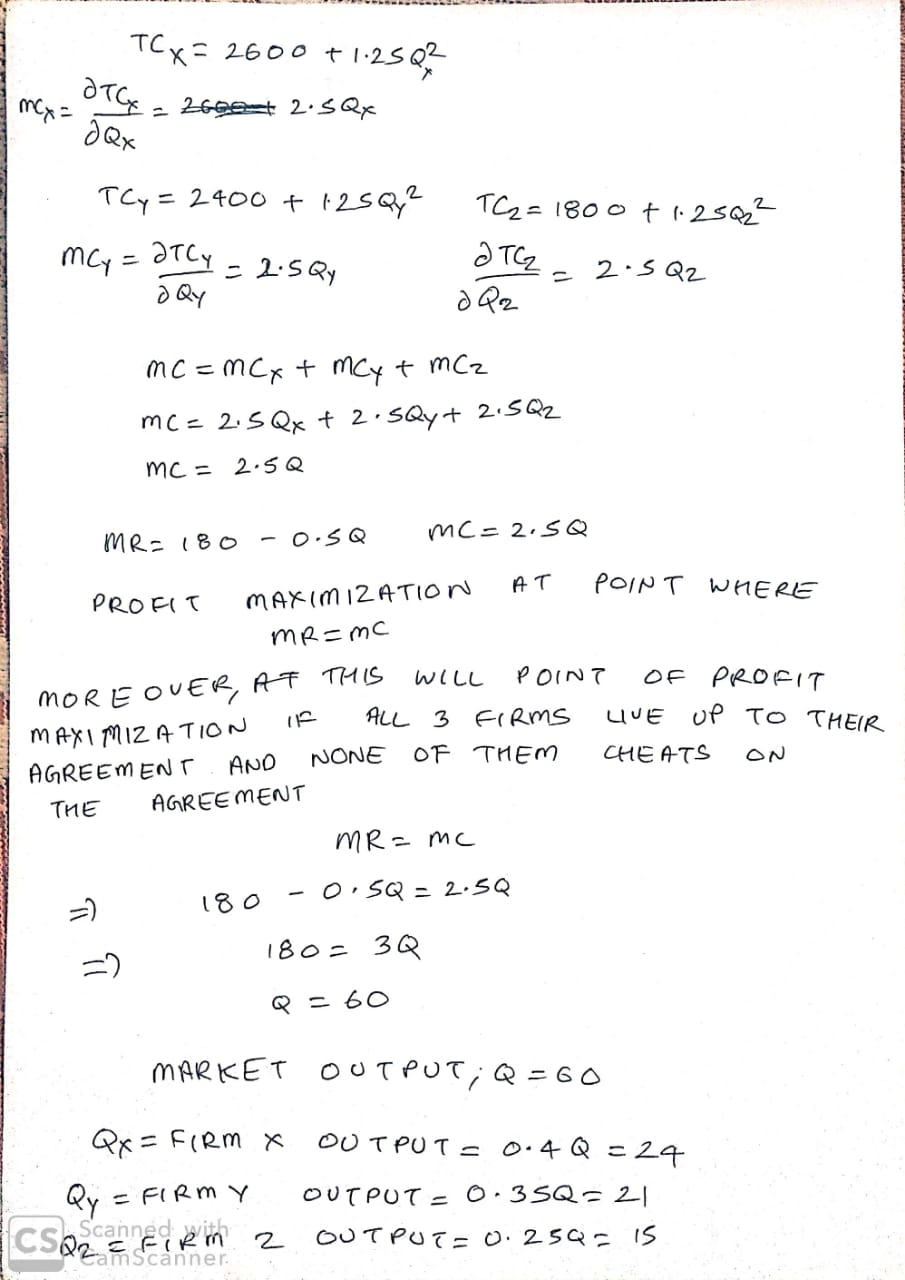

Firms x, y, and z produce and sell an identical product and operate in an oligopolistic market whose daily demand is

Q = 720 – 4P. Their respective T.C. functions per day are:

T.C.x = 2,600 + 1.25Q2, T.C.y = 2,400 + 1,25Q2, and T.C.z = 1,800 + 1.25Q2

Assume that these three firms agree to join efforts to create a cartel and act as a monopoly and agree to the following market shares of the artificially created monopoly’s optimum output or Q*: Firm x: 40%, Firm y: 35%, and Firm z: 25%. They also agree to charge the same price. Please show your work clearly in answering the following questions:

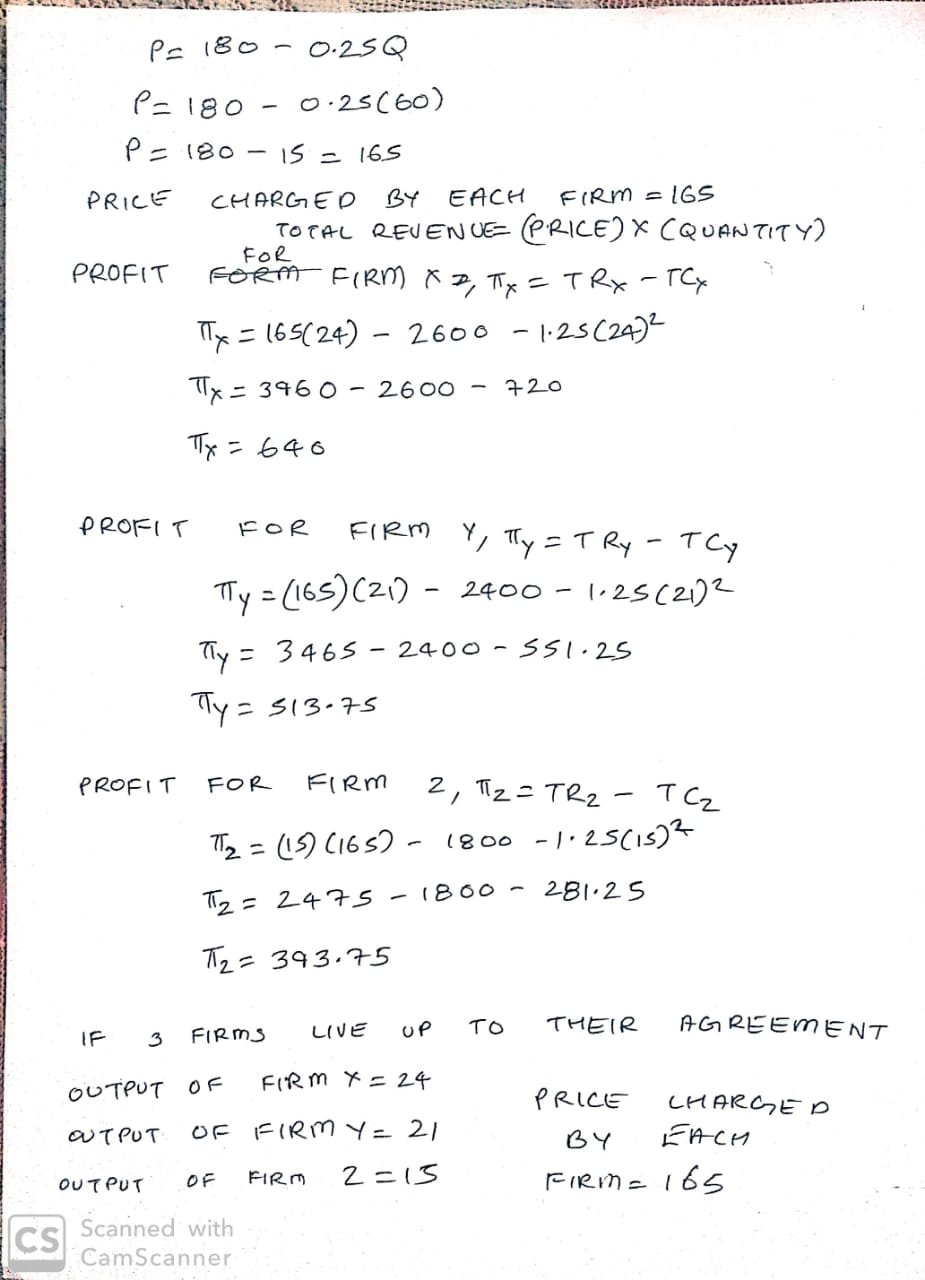

If the three firms live up to their agreement, how many units will each firm produce and what price will each firm charge?

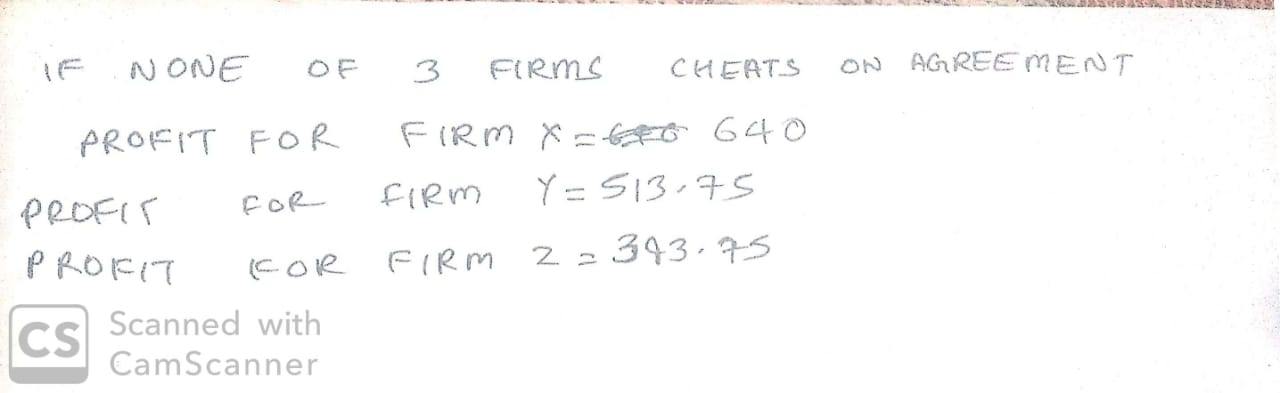

If none of the three firms cheats on the agreement, what will profits be for each of these firms?

Solutions

Related Solutions

Suppose there are two firms that produce an identical product. The demand curve for their product...

Consider two firms, X and Y, that have identical assets and generate identical cash flows. X...

There are two companies, X and Y, that produce two identical products, A and B. If...

Let X and Y be independent and identical uniform distribution on [0, 1]. Let Z=min(X, Y)....

Two identical firms compete in a Bertrand duopoly. The firms produce identical products at the same...

Consider the following one-shot Bertrand game. Two identical firms produce an identical product at zero cost....

Consider a market where two firms sell an identical product to consumers and face the following...

Perfect competition exists when •Many firms sell an identical product to many buyers. •There are no...

The curried version of let f (x,y,z) = (x,(y,z)) is let f (x,(y,z)) = (x,(y,z)) Just...

Suppose there are N firms who produce an identical product and face the demand curve P...

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

Rahul Sunny answered 1 month ago

Rahul Sunny answered 1 month ago