Question

In: Accounting

Prepare the journal entries for the following transactions. Paris Cosmetics issues €2,500 shares of €200 par...

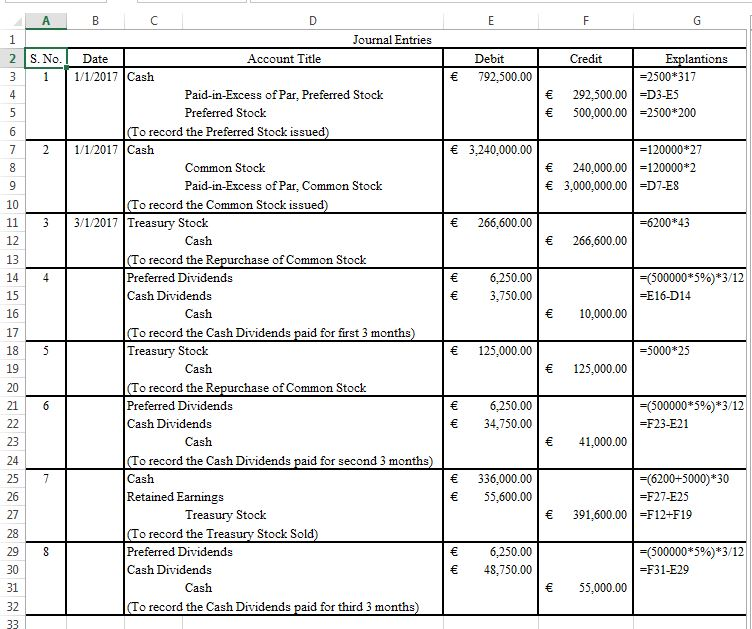

Prepare the journal entries for the following transactions.

- Paris Cosmetics issues €2,500 shares of €200 par value preference stock at €317 cash per share on 1/1/2017. The shares are 5% and cumulative.

- Paris Cosmetics issues 120,000 shares of €2 par value share of ordinary stock at €27 cash per share on 1/1/2017.

- On March 1, Paris Cosmetics repurchases 6,200 shares of the previously issued ordinary shares at €43 cash per share.

- The company declares and pays cash dividends amounting to €10,000. (the company is new, so no arrearage exists at this point).

- How much is paid per share to the preference shares? To the ordinary shares?

- The company repurchases 5,000 shares of the previously issued ordinary shares at €25 per share.

- The company declares and pays cash dividends amounting to €41,000.

- How much is paid per share to the preference shares? To the ordinary shares?

- The company sells all of the treasury stock for €30 cash per share.

- The Company declares and pays a cash dividend of €55,000.

- How much is paid per share to the preference shares? To the ordinary shares?

Show all your work.

Solutions

Related Solutions

Prepare journal entries for the transactions

Presented below are selected transactions of Molina Company. Molina sells in large quantities to other companies and also sells its product in a small retail outlet.

March 1 Sold merchandise on account to Dodson Company for $10,400, terms 3/10, n/30.

March 3 Dodson Company returned merchandise worth $200 to Molina.

March 9 Molina collected the amount due from Dodson Company from the March 1 sale.

March 15 Molina sold merchandise for $1,000 in its retail outlet. The customer used...

Prepare General Journal Entries for the following transactions. Then post the journal entries to the General...

Prepare General Journal Entries for the following

transactions. Then post the journal entries to the General Ledger

provided and then prepare an Unadjusted Trial Balance. March

1Dunlop invested $30,000 cash and buildings worth $150,000 in the

company March 2The company rented equipment by paying $2,000 cash

for the first month’s (March) rent. March 5The company purchased

$2,400 of office supplies for cash. March 10The company paid

$7,200 cash for the premium on a 12-month insurance policy.

Coverage begins on March...

Prepare Journal Entries in good form for the following (unrelated) equity transactions: 1) Billbo Company issues...

Prepare Journal Entries in good form for the following

(unrelated) equity transactions:

1) Billbo Company issues 1,000 $.01 par stock for $10 cash per

share on February 1st.

2) Conner's directors declare a 10% stock dividend on December

31st. This stock dividend of 500 shares, computed as %10 of its

5,000 outstanding shares, is to be distributed on January 20 to

stockholders of record on January 15th. The market price of the

stock on December 31st. is $15.

3) David...

Prepare journal entries in general journal format to record the following transactions for the City of...

Prepare journal entries in general journal format to record the

following transactions for the City of Dallas General Fund

(subsidiary detail may be omitted)

1. The budget prepared for the fiscal year included total

estimated revenues of $4,693,000, appropriations of $4,686,000 and

estimated other financing uses of $225,000.

2. Purchase orders in the amount of $451,000 were mailed to

vendors.

3. The current year’s tax levy of $4,005,000 was recorded;

uncollectible taxes were estimated to be 2% of the tax...

Provide journal entries for the following transactions: 1. The Cheung Company issues 10 000 ordinary shares...

Provide journal entries for the following transactions:

1. The Cheung Company issues 10 000 ordinary shares for $30 per

share. The investors are required to pay $12 on application, $10 on

allotment and an $8 call. Applications are received by 1st January.

Allotments are made on 14th January with all allotment money

received by 30th January. The call was made on 1st May and payment

was due by 14th May. On 14th May it was discovered that a holder of...

prepare journal entries for the following transactions Transactions for Eagle View for the Month of December...

prepare journal entries for the following transactions

Transactions for Eagle View for the Month of December 2018

Purchases

Eagle View receives the utility bill for the month. The total

amount due is $500, payable net 20. Eagle View also purchases 50

units of inventory at $500 each and 50 more toolkits at $4

each.

Payroll

Eagle View pays its employees for the fifth two weeks of

business (November 26 through December 9). The gross pay is $2,200,

the employee taxes...

Prepare journal entries for the following transactions: The following selected transactions relate to liabilities of Chicago...

Prepare journal entries for the following transactions:

The following selected transactions relate to liabilities of

Chicago Glass Corporation for 2018. Chicago's fiscal year ends on

December 31.

1. On January 15, Chicago received $7,000 from Henry

Construction toward the purchase of $66,000 of plate glass to be

delivered on February 6.

2. On February 3, Chicago received $6,700 of refundable deposits

relating to containers used to transport glass components,

3. On February 6, Chicago delivered the plate glass to Henry...

Prepare journal entries in general journal format to record the following transactions for the 2020 fiscal...

Prepare journal entries in general journal format to record the

following transactions for the 2020 fiscal year for the City of

Portage General Fund (Subsidiary detail may be omitted.).

The budget prepared for the fiscal year included estimated

revenues of $3,774,000, appropriations of $3,695,000 and estimated

other financing uses of $35,000.

Purchase orders in the amount of $838,000 were mailed to

vendors

The current year’s tax levy of $3,005,000 was recorded;

uncollectibles taxes were estimated to be 2% of the...

Prepare journal entries for the following transactions: a. A machine that cost $10,000 with a residual...

Prepare journal entries for the following transactions: a. A

machine that cost $10,000 with a residual value of $2,000 is fully

depreciated and discarded. b. A machine purchased on January 1,

2020 for $20,000, with a useful life of 4 years, and a residual

value of $4,000, is sold on April 1, 2020 for $8,000. Use the

straight-line method. c. A machine that cost $15,000, has

accumulated depreciation of $12,000 is sold for $5,000.

Prepare journal entries to record the following transactions entered into by Glaser Company:

Prepare journal entries to record the following transactions

entered into by Glaser Company:

2010

June 1 Received a $30,000, 12%, 1-year note

from Ann Duff as full payment on her account.

Nov. 1 Sold merchandise on account to

Malone, Inc. for $13,000, terms 2/10, n/30.

Nov. 5 Malone, Inc. returned merchandise

worth $500.

Nov. 9 Received payment in full from

Malone, Inc.

Dec. 31 Accrued interest on Duff's

note.

2011

June 1 Ann Duff honored her promissory

note by sending...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

ADVERTISEMENT

ekkarill92 answered 4 months ago

ekkarill92 answered 4 months ago