Question

In: Finance

Instruction: The table consists of information about 2 competing investments. ...

Instruction: The table consists of information about

2 competing investments.

Economy Probability Project A

Project B

Profit Expected

Value Profit

Expected Value

Weak 15.0% $10.00

-$25.00

OK 55.0% $30.00

$0.00

Good 20.0% $50.00

$100.00

Excellent 10.0% $70.00

$200.00

100%

Part 1 - calculate the expected value for each project.

3 points per

answer

part 2 - which do you select?

Why?

Solutions

Expert Solution

Expected Value (EV) of Project = RP1 + RP2 + RP3 + RP4 , where, R = Profitability and P = Probability

EV of project A = 10 (0.15) + 30 (0.55) + 50 (0.20) + 70 (0.10) = 1.5 + 16.5 + 10 + 7 = $ 35

EV of project B = -25 (0.15) + 0 (0.55) + 100 (0.20) + 200 (0.10) = -3.75 + 0 + 20 + 20 = $ 36.25

The expected value of project B is more than that of project A. However, the difference between EVs is quite less, i.e. only 1.25 $ and hence, to select the most profitable project, we need to consider the risk associated with each of them.

Thus, we compute standard deviation for each of these projects:

| Returns (Project A) XA | (XA - MeanA)2 | Returns (Project B) XB | (XB - MeanB)2 |

|---|---|---|---|

| 10 | 900 | 25 | 3164.0625 |

| 30 | 100 | 0 | 6601.5625 |

| 50 | 100 | 100 | 351.5625 |

| 70 | 900 | 200 | 14101.5625 |

| Total - 160 | Total - 2000 | Total - 325 | Total - 24218.75 |

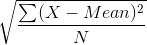

Standard Deviation (SD) =

SD of project A =

SD of project A = 22.36

SD of project B =

SD of project B = 77.81

Therefore, as the Standard Deviation of Project B is much higher than Project A, it means that the risk associated with Project B is quite high. Considering only negligible margin in expected values of both the projects and a much higher risk associated with investment in project B, I would select Project A for investing.

Related Solutions

Selected information for two companies competing in the catering industry is presented in the table below:...

Suppose you manage a $2 million fund that consists of four stocks with the following investments:...

EXERCISE 2 The following table contains information about top 5 causes of death in the United...

Consider the capital budgeting decision to be made with the following data about 2 competing projects....

Consider the capital budgeting decision to be made with the following data about 2 competing projects....

Patterson Company is considering two competing investments. The first is for a standard piece of production...

Question 2: The following table provides earnings information about two companies, A Ltd and B Ltd:...

Encode the following instruction (1) identify the instruction format that will be used (2) indicate the...

Naive Bayes Theorem See the dataset D in Table 1. It consists of clinical data about...

Write the logical expression for the control signal RF_Write assuming the instruction set consists only of...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

jeff jeffy answered 4 months ago

jeff jeffy answered 4 months ago