Question

In: Accounting

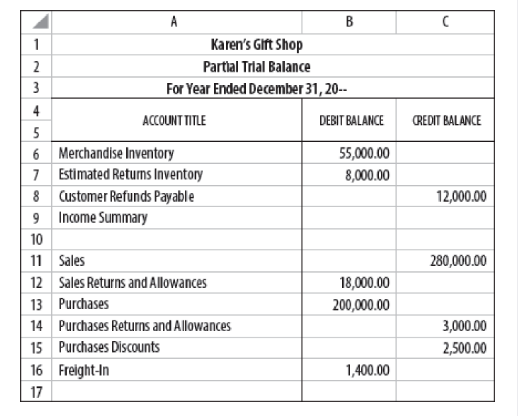

MERCHANDISE INVENTORY ADJUSTMENTS: PERIODIC INVENTORY SYSTEM WITH SALES RETURNS AND ALLOWANCES

MERCHANDISE INVENTORY ADJUSTMENTS: PERIODIC INVENTORY SYSTEM WITH SALES RETURNS AND ALLOWANCES

Use the information provided below to prepare a partial end-of-period spreadsheet for Karen’s Gift Shop for the year ended December 31, 20--. The ending merchandise inventory is $60,000. Karen estimates that customers will be granted $15,000 in refunds next year for merchandise sold this year. The estimated cost of the returned inventory is $10,000.

1. Complete the Adjustments columns for merchandise Inventory and related accounts.

2. Extend all accounts to the Adjusted Trial Balance columns.

3. Prepare the cost of goods sold section from the spreadsheet.

Solutions

Expert Solution

Merchandise inventory is the item that is purchased to resell to the customers. The amount of merchandise inventory at the start of a period is known as the beginning balance of inventory.

The inventory is purchased from the suppliers and sold to the customer during the accounting period. After buying and selling the inventory, some inventory may remain unsold. The unsold inventory is known as the ending inventory of the firm.

At the end of the year, it is expected that an inventory amounting to $15,000 will be returned by the customer in the next year. The estimated inventory return must be adjusted in the books with the cost of the returned inventory.

The estimated return inventory will affect the estimated return inventory account and customer refund payable account, and income summary. The estimated returns inventory will be adjusted with the cost of the estimated returns inventory. The customer refund payable will be adjusted with the estimated refund amount. The difference between the two will affect the income summary.

The trial balance will be adjusted as follows:

| Unadjusted | Adjustments | |||

| Debit | Credit | Debit | Credit | |

| Merchandise inventory | 55,000 | |||

| Estimated returns inventory | 8,000 | 10,000 | ||

| Customer refund payable | 12,000 | 15,000 | ||

| Income Summary | 5,000 | |||

| Sales | 280,000 | |||

| Sales returns and allowances | 18,000 | |||

| Purchases | 200,000 | |||

| Purchase returns and allowances | 3,000 | |||

| Purchase discounts | 2,500 | |||

| Freight-in | 1,400 | |||

The adjusted trial balance can be prepared by adapting to the unadjusted trial balance. The new account balance will be reported on the adjusted trial balance. The adjusted trial balance can be prepared as follows:

| Unadjusted | Adjustments | Adjusted | ||||

| Debit | Credit | Debit | Credit | Debit | Credit | |

| Merchandise inventory | 55,000 | 55,000 | ||||

| Estimated returns inventory | 8,000 | 10,000 | 18,000 | |||

| Customer refund payable | 12,000 | 15,000 | 27,000 | |||

| Income Summary | 5,000 | 5,000 | ||||

| Sales | 280,000 | 280,000 | ||||

| Sales returns and allowances | 18,000 | 18,000 | ||||

| Purchases | 200,000 | 200,000 | ||||

| Purchase returns and allowances | 3,000 | 3,000 | ||||

| Purchase discounts | 2,500 | 2,500 | ||||

| Freight-in | 1,400 | 1,400 | ||||

The cost of goods sold section can be prepared by adjusting the beginning inventory, purchases, return and allowances, purchase discount, and ending list. It can be designed as follows:

| Beginning inventory | $55,000 | |

| Net purchase | ||

| Purchase | $200,000 | |

| Less: Purchase returns and allowances | -3,000 | |

| Less: Purchase discounts | -2,500 | 194,500 |

| Less: ending inventory | -60,000 | |

| Cost of goods sold | 189,500 |

Therefore, the cost of goods sold is $189,500

Answers can be found in the Explanation section.

Related Solutions

Work Sheet Extensions for Merchandise Inventory Adjustments: Periodic Inventory System 1. Complete the Adjustments columns for...

If the beginning merchandise inventory was $1,750, the purchases were $92,515, the purchase returns and allowances...

Alpha Company used the periodic inventory system for purchase & sales of merchandise. Discount terms for...

Alpha Company uses the periodic inventory system for purchase & sales of merchandise. Discount terms for...

Alpha Company uses the periodic inventory system for purchase & sales of merchandise. Discount terms for...

Inventory Costing Methods - Periodic Method Fortune Stores uses the periodic inventory system for its merchandise...

Fortune Stores uses the periodic inventory system for its merchandise inventory. The April 1 inventory for...

In the periodic inventory system, purchases of merchandise for resale are debited to the purchases account....

he Kali Company uses the periodic inventory system for its merchandise inventory. The June 1 inventory...

1) Assuming a periodic inventory system is used, the entry to record a purchase of merchandise...

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

DogeShow answered 4 years ago

DogeShow answered 4 years ago