Question

In: Finance

Josh and his new wife Samantha are buying their first house together. They secured a loan...

Josh and his new wife Samantha are buying their first house together. They secured a loan for $435,000 at a rate of 9.275% per year for 30 years.

SHOW FORMULAS USED

1)How much are the monthly payments?

2)6 years later, the couple decides they want to refinance their home. How much do they currently owe on the home?

3)The bank is offering a special deal of 6.35% on all home refinances. What would their new monthly payment be?

4)The couple is saving money for their first child. Now that they have refinanced their home, how much will the couple save every month?

5)The couple has made significant upgrades to their home which is currently valued at $575,000. Based on how much they owe at the time of refinance, how much equity do they have?

Solutions

Expert Solution

1]

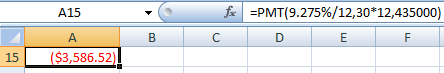

Monthly loan payment is calculated using PMT function in Excel :

rate = 9.275% / 12 (converting annual rate into monthly rate)

nper = 30*12 (30 year loan with 12 monthly payments each year)

pv = 435000 (loan amount)

PMT is calculated to be $3,586.52

2]

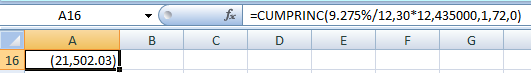

We calculate the principal paid off after 6 years (72 months) using CUMPRINC function in Excel :

rate = 9.275% / 12 (converting annual rate into monthly rate)

nper = 30*12 (30 year loan with 12 monthly payments each year)

pv = 435000 (original loan amount)

start period = 1 (We are calculating principal paid off between 1st and 72nd month)

end period = 72 (We are calculating principal paid off between 1st and 72nd month)

type = 0 (each payment is made at the end of month)

CUMPRINC is calculated to be $21,502.03

The balance loan principal outstanding after 6 years = $435,000 - $21,502.03 = $413,497.97

3]

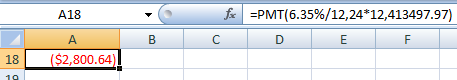

Monthly loan payment is calculated using PMT function in Excel :

rate = 6.35% / 12 (converting annual rate into monthly rate)

nper = 24*12 (24 year loan with 12 monthly payments each year)

pv = 413497.97 (loan amount)

PMT is calculated to be $2,800.64

4]

Monthly saving = $3,586.52 - $2,800.64 = $785.88

Related Solutions

1.Bob and his wife are buying a $300,000 house. They put 20% down and finance the...

Sarah secured a bank loan of $155,000 for the purchase of a house. The mortgage is...

Sarah secured a bank loan of $185,000 for the purchase of a house. The mortgage is...

Sarah secured a bank loan of $175,000 for the purchase of a house. The mortgage is...

Sarah secured a bank loan of $185,000 for the purchase of a house. The mortgage is...

Sarah secured a bank loan of $165,000 for the purchase of a house. The mortgage is...

The Flemings secured a bank loan of $240,000 to help finance thepurchase of a house....

You are buying a new house on a 30-year, 5.2% mortgage loan of $230,000. A) How...

You are buying a new house on a 30-year, 6.2% mortgage loan of $230,000. A. How...

Samantha and Vikas are looking to buy a house in a new development. After looking at...

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

jeff jeffy answered 1 year ago

jeff jeffy answered 1 year ago