Question

In: Finance

Return on a risk-free investment is 3 percent and the expected market return is 6 percent....

Return on a risk-free investment is 3 percent and the expected market return is 6 percent. Annualized stdev of the return on the market is 15 percent.

Project 1: IRR = 7 percent. SD(ri) = .45 Corr (Ri, Rm) = .25

Project 2: IRR = 11 percent. SD(ri) = .30 Corr (Ri, Rm) = .90

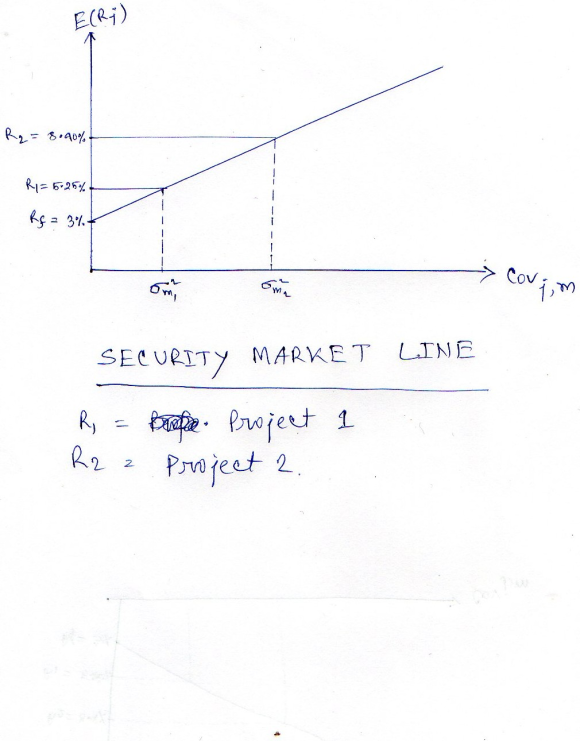

Please find and graph the security market line

Please find the index of systematic risk of each project and plot the IRR combinations on a graph and rank the projects according to a measure of their total risk and then their index of systematic risk.

Solutions

Expert Solution

SML(Security Market Line) Equation:-

Here, E(Rj) = Expected Portfolio Return

Rf = Risk-Free Return = 0.03

E(Rm) = Expected Market Return = 0.06

SDj = Standard Deviation of Return = SD(ri)

SDm = Standard Deviation of Market Return = SD(m) = 0.15

For Project 1:-

E(Rj) = 0.03 + [0.06 - 0.03] * (0.45 / 0.15) * 0.25 = 0.03 + 0.03 * 3 * 0.25 = 0.0525

So, Portfolio Return = 5.25 %

For Project 2:-

E(Rj) = 0.03 + [0.06 - 0.03] * (0.30 / 0.15) * 0.90 = 0.03 + 0.03 * 2 * 0.9 = 0.084

So, Portfolio Return = 8.40 %

We can get the systematic risk from the value of "Beta".

If Beta is greater than 1, that means the project is riskier than the market portfolio. We can also use Beta as to compare risk of two projects. Whichever has a higher Beta, has high Risk.

Systematic Risk of Project 1,

Systematic Risk of Project 2,

So, here we can say that Project 2 is more Riskier.

Related Solutions

The risk-free rate of return is 4 percent, and the expected return on the market is...

The risk-free rate of return is 2 percent, and the expected return on the market is...

The risk-free rate of return is 2 percent, and the expected return on the market is...

The risk-free rate of return is 4 percent, and the expected return on the market is...

The expected return on the market is 11.44 percent, the risk-free rate is 3.82 percent, and...

The risk-free rate of return is 6%, the expected rate of return on the market portfolio...

The risk-free rate of return is 6%, the expected rate of return on the market portfolio...

Consider the CAPM. The risk-free rate is 3% and the expected return on the market is...

Assume that the risk-free rate is 3% and the expected return on the market is 8.5%....

Suppose the risk-free rate is 5.2 percent and the market portfolio has an expected return of...

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

jeff jeffy answered 1 year ago

jeff jeffy answered 1 year ago