Question

In: Finance

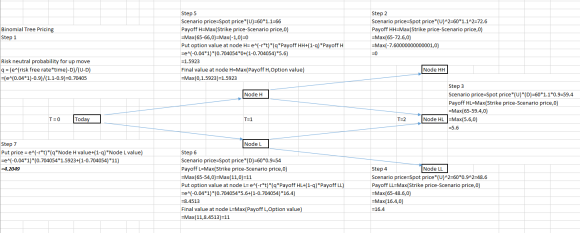

Stock FBN is selling at 60. The risk-free rate is 4 percent per period. Each period,...

Stock FBN is selling at 60. The risk-free rate is 4 percent per period. Each period, the stock price can either go up by 10 percent or down by 10 percent.

Fill in the price sequence as listed below, labeling each stock price and the 65 put values for an American put. (Draw out the tree first to help your calculations, of course. And copy-paste the price sequence to your answer space so you can just fill it in)

S0 = 60

P0 =

_________

Su =

Sd =

Pu =

Pd =

_________

Suu =

Puu =

Sud =

Pud =

Sdd =

Pdd =

Solutions

Expert Solution

P0 =4.2049

_________

Su =66

Sd =54

Pu =1.5923

Pd =11

_________

Suu =72.6

Puu =0

Sud =59.4

Pud =5.6

Sdd =48.6

Pdd =16.4

Related Solutions

Show formula A. Spot is $60 for a stock. The risk free rate at time of...

Show formula

A. Spot is $60 for a stock. The risk free rate at time of spot

is 4%. And there is no convenience yield or carrying cost. What is

the 18-month Forward price for the stock?

B. A barrel of oil is trading in at $304. If the

convenience yield is 12% and the bowing rate (risk free) is 4%,

then what is the 6-month Futures price for this asset?

C.Using the information above, is this asset said to be...

The current risk-free rate is 2 percent and the market risk premium is 4 percent. You...

The current risk-free rate is 2 percent and the market risk

premium is 4 percent. You are trying to value ABC company and it

has an equity beta of 0.8. The company earned $3.50 per share in

the year that just ended. You expect the company's earnings to grow

4 percent per year. The company has an ROE of 13 percent.

a. What is the value of the stock? Do not round intermediate

calculations. Round your answer to the nearest...

A stock index is currently 1,500. Its volatility is 18%. The risk-free rate is 4% per...

A stock index is currently 1,500. Its volatility is 18%. The

risk-free rate is 4% per annum for all maturities and the dividend

yield on the index is 2.5% (both continuously compounded).

Calculate values for u, d, and p when a 6-month time step is used.

What is value of a 12-month European put option with a strike price

of 1,480 given by a two-step binomial tree?

The current risk-free rate is 4 percent and the market riskpremium is 6 percent. You...

The current risk-free rate is 4 percent and the market risk premium is 6 percent. You are trying to value ABC company and it has an equity beta of 0.7. The company earned $3.00 per share in the year that just ended. You expect the company's earnings to grow 4 percent per year. The company has an ROE of 12 percent.What is the value of the stock? Do not round intermediate calculations. Round your answer to the nearest cent.$ What is...

The risk-free rate of return is 4 percent, and the expected return on the market is...

The risk-free rate of return is 4 percent, and the expected

return on the market is 8.2 percent. Stock A has a beta coefficient

of 1.6, an earnings and dividend growth rate of 6 percent, and a

current dividend of $2.20 a share. Do not round intermediate

calculations. Round your answers to the nearest cent.

What should be the market price of the stock? $

If the current market price of the stock is $32.00, what should

you do? The...

The risk-free rate of return is 4 percent, and the expected return on the market is...

The risk-free rate of return is 4 percent, and the expected

return on the market is 7.5 percent. Stock A has a beta coefficient

of 1.6, an earnings and dividend growth rate of 8 percent, and a

current dividend of $2.10 a share. Do not round intermediate

calculations. Round your answers to the nearest cent.

a) What should be the market price of the stock?

b) If the current market price of the stock is $118.00, what

should you do?...

A stock has a beta of 2.2, the risk-free rate is 6 percent, and the expected...

A stock has a beta of 2.2, the risk-free rate is 6 percent, and

the expected return on the market is 12 percent. Using the CAPM,

what would you expect the required rate of return on this stock to

be? What is the market risk premium?

Assume that the risk-free rate is 4.1 percent. If a stock has a beta of 0.5...

Assume that the risk-free rate is 4.1 percent. If a stock has a

beta of 0.5 and a required rate of return of 10.1 percent, and the

market is in equilibrium, what is the return on the market

portfolio? Show your answer to the nearest .1% using whole numbers

(e.g., enter 14.1% as 14.1 rather than .141). Your Answer?

An analyst has estimated how a stock's return will vary

depending on what will happen to the economy. If a Recession...

The risk-free rate is 4.6 percent. Stock A has a beta = 1.2 and Stock B has...

The risk-free rate is 4.6 percent. Stock A has a

beta = 1.2 and Stock B has a

beta = 1. Stock A has a required return of 12.1

percent. What is Stock B’s

required return?

Group of answer choices

11.05%

10.85%

10.95%

11.15%

11.25%

You observe the following yield curve for Treasury

securities:

Maturity Yield

1

Year 3.20%

2

Years 4.40%

3

Years 5.20%

4

Years 5.40%

5

Years 7.40%

Assume that the pure expectations hypothesis

holds. What does the market expect will be

the yield on 3-year securities,...

Stock A has a beta of 1.5, the risk-free rate is 4% and the return on...

Stock A has a beta of 1.5, the risk-free rate is 4% and the

return on the market is 9%. If inflation changes by -2%, by how

much will the required return on Stock A change?

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

ADVERTISEMENT

jeff jeffy answered 1 year ago

jeff jeffy answered 1 year ago