Question

In: Accounting

Project the EBIT for the FY2020 using the projected values of EBITDA and depreciation You are...

Project the EBIT for the FY2020 using the projected values of EBITDA and depreciation

- You are an intern with an equity research organization. You have been given the task to project the values of certain income statement and balance sheet items for the next year (FY2020) for ABC Ltd (Your current time=0 is FY ending 2019). You have collected information about the historical income statement and balance sheet items. The historical information is provided in Table 1.

Table 1

|

PARTICULARS (All values in INR crores) |

FY2019 |

FY2018 |

FY2017 |

FY2016 |

|

Sales Revenue |

17273.00 |

15463.00 |

14789.00 |

13636.00 |

|

EBITDA |

12213.00 |

9385.00 |

10237.00 |

Not given |

|

Depreciation expense |

1811.00 |

745.00 |

645.00 |

Not given |

|

EBIT |

10402.00 |

8640.00 |

9592.00 |

Not given |

|

Interest |

0.00 |

0.00 |

0.00 |

Not given |

|

EBT |

10402.00 |

8640.00 |

9592.00 |

Not given |

|

Tax |

2600.50 |

2160.00 |

2398.00 |

Not given |

|

Net Profit |

7801.50 |

6480.00 |

7194.00 |

Not given |

|

Net PPE |

17032.00 |

14522.00 |

13064.00 |

12813.00 |

Net PPE: Net Property Plant and equipment (Balance sheet item)

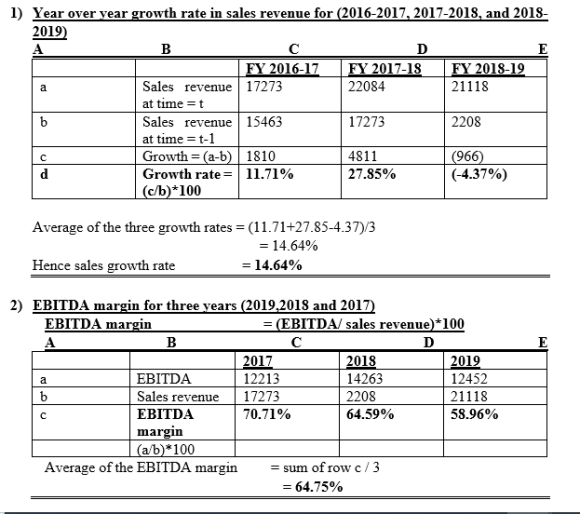

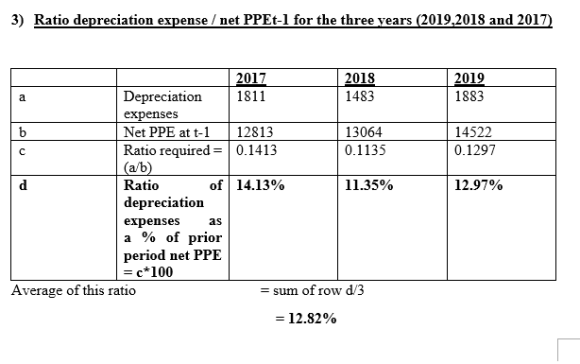

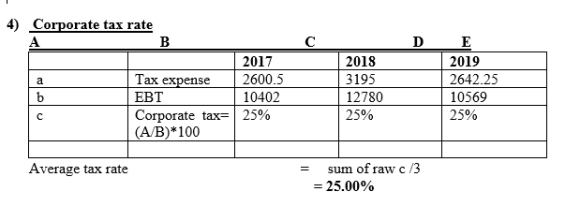

Solutions

Expert Solution

note: if you have any doubts comment me i am here to help you dont give direct thumbs down if you are satisfied with the answer hit the like button.

Related Solutions

EBITDA 220.00 Depreciation (49.50) EBIT 170.50 Interest (17.25) EBT 153.25 Tax...

Given the following for MD: EBIT = EBITDA = $870 million rU = 15% tc =...

Given the following for MD: EBIT = EBITDA = $870 million rU = 15% tc =...

A proposed new project has projected sales of $198,900, costs of $100,620, and depreciation of $7,020....

A proposed new project has projected sales of $171,700, costs of $86,860, and depreciation of $6,060....

A proposed new project has projected sales of $219,000, costs of $96,000, and depreciation of $26,000....

A proposed new project has projected sales of $189,000, costs of $91,000, and depreciation of $25,000....

A proposed new project has projected sales of $141,100, costs of $71,380, and depreciation of $4,980....

The Mason Corporation’s income before interest, depreciation, and taxes (i.e., EBITDA) was $2.05 million in the...

How do I calculate EBT, EBIT, & EBITDA from this income statement? 2017 2018 2019 Total...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

ekkarill92 answered 3 years ago

ekkarill92 answered 3 years ago