Question

In: Finance

Please show work.......thanks! Fixed Income HW due 6/29/19 Assume today is June 19, 2019 and that...

Please show work.......thanks!

Fixed Income HW due 6/29/19

Assume today is June 19, 2019 and that all bonds pay interest annually with a face value of $1,000.

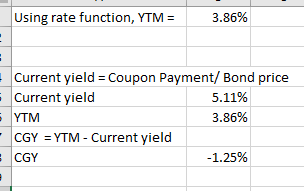

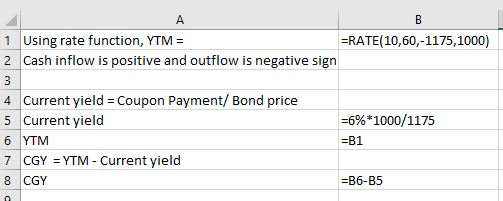

YTM = Current yield + Capital Gains yield; CY = Annual Interest/Current Price

GE is A rated; AA Treasuries yield 3-year is 1.90%, 10-year 2.10%

5 Years ago GE issued 6% coupon paying bonds with a face value set to mature on June 19, 2029. Growth concerns have forced monetary authorities throughout the world to lower interest rates during the past several years and as such, the price of these GE bonds has risen to 1175.00

- What is yield to maturity for an investor who buys the bonds today at the current price?

- Is the bond trading at a premium, discount or at par? Explain what your answer means

- What is the capital gains yield of this bond and interpret what the sign of the CGY means?

Solutions

Expert Solution

Bond is trading at

a premium if the current market price of the bond is higher than its face value

a discount if the current market price of the bond is lower than its face value

par if the current market price of the bond is equal to its face value

In our case, the bond price is 1175 which higher than the face value of 1000. So, the bond is trading at a premium.

In the case of price appreciation, the CGY is positive. But, in this case as the bond is trading above its face value, there would be a capital loss at maturity equivalent to 1175-1000. So, the CGY is negative at this point.

Related Solutions

Fixed Income HW due 6/29/19 Assume today is June 19, 2019 and that all bonds pay...

Fixed Income HW due 6/29/19 Assume today is June 19, 2019 and that all bonds pay...

[Please show all work - thanks] Suppose an agent has $100,000 today that he wants to...

19. PLEASE SHOW EXCEL WORK AND ANSWER ONLY B THANKS! Use future value and present value...

This is a engineering analysis hw question please show your work I will use it to...

You are trying to value “A2M” share today (End of June 2019). Assume the current price...

Please show all work and formulas used. Thanks! The following data are given for an activated...

<Vector Calculus> Please show all step by step work and formulas. Thanks A current in a...

Please answer the problem below for all parts. Please show all work and write clearly. Thanks....

I need this computer typed so I can read it, and please show work. thanks! You...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

jeff jeffy answered 2 years ago

jeff jeffy answered 2 years ago