Question

In: Finance

Sam, a friend of Ken and Anna (married couple) has recommended that they set up a...

Sam, a friend of Ken and Anna (married couple) has recommended that they set up a Self Managed Superannuation Fund (SMSF), as it will provide them with “better returns”. Sam has suggested that the SMSF purchase a property and that Karunesh and Asha can live in that property and pay the rent directly to the SMSF by making tax-deductible salary sacrifice contributions.

1. Does an SMSF provide better investment returns than an industry or retail fund? Provide a detailed explanation for your answer and quote and explain any relevant statistics that you may have sourced to support your argument.

2. List the amount and type of fees that Ken and Anna pay, in the first year, to set up and maintain their SMSF. What is the amount of GST that will be applicable on these fees? Cleary show all your workings.

3. Ken and Anna seek your advice on the recommendation provided by their friend Sam. In relation to this, what advice would you provide to them and why? Clearly list any breaches of relevant codes and/or legislations.

4. Tren, another friend of Ken and Anna, suggest that they should purchase an investment property via an SMSF structure. The property can be rented out to a tenant. Tom suggests rolling over all their existing superannuation’s and setting up an SMSF. The property is listed on the market for $550,000. Tren further suggests, that they set up another company as a corporate trustee to assist in this process. Assuming that they purchase it for that price

i. Clearly list and place an approximate dollar value on all other relevant incidental and additional costs associated with purchasing this property via the SMSF structure described above

ii. Explain to Ken and Anna, how they could go about this process – i.e. how to purchase the property via the SMSF via a loan etc. Support your explanation with a diagram or flow chart depicting the process.

5. What are the pros and cons of setting up a corporate trustee as opposed to Ken and Anna being individual trustees of their SMSF?

6. In relation to the above:

i. Explain LBRA to Ken and Anna

ii. What interest rate could their SMSF obtain for the property loan and how does this compare with a loan for a similar property that was the outside superannuation? (You will need to research existing home loans and interest rates for this purpose – clearly provide your sources and references!)

7. Assume the property generates a rental income of $600 per week net of associated costs. Based on their personal incomes and other details provided in the fact find:

i. Calculate the amount the clients would receive net of tax, if the property was acquired in their personal names (in joint ownership).

ii. Now calculate this with how much they would receive if the property were acquired via their SMSF.

Assume this is for the period July 1 2019 to 30 June 2020 only

Solutions

Expert Solution

Answer : When you manage your own super, you put the money you would normally put in a retail or industry super fund into your own SMSF. You choose the investments and the insurance.

Your SMSF can have up to four members, who are friends or family. Most SMSFs have two or more. As a member, you are a trustee of the fund — or you can get a corporate trustee. In either case, you are responsible for the fund.

While having control over your own super can be appealing, it's a lot of work and comes with risk.

Only set up your own super fund if you're 100% committed and understand what's involved.

Managing an SMSF is a lot of work. Even if you get professional help, it's time-consuming.

You need enough time to set up the fund, and time to manage ongoing activities, such as:

- researching investments

- setting and following an investment strategy

- accounting, keeping records, and arranging an audit each year by an approved SMSF auditor.

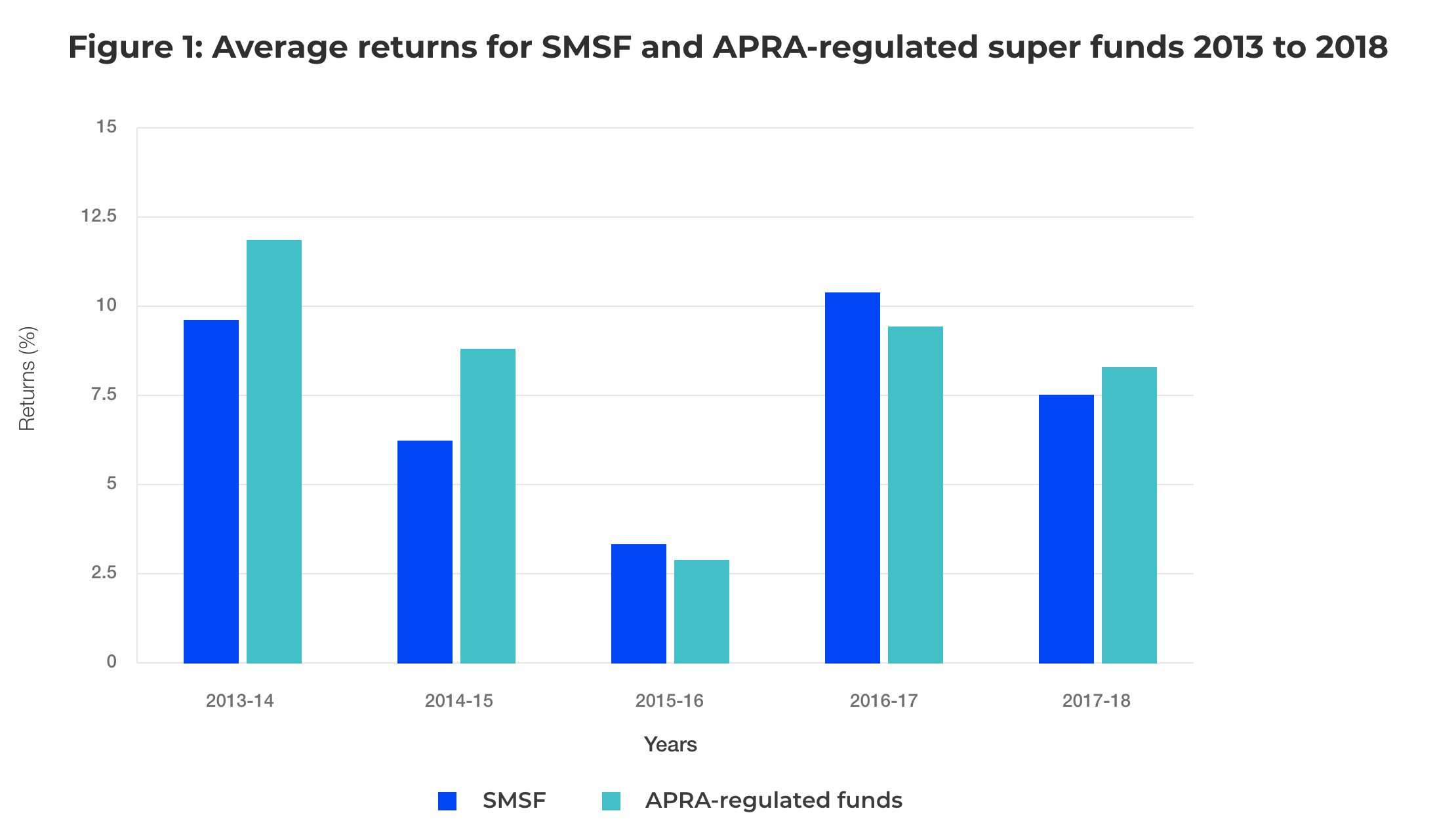

On average, SMSFs haven't beaten APRA-regulated funds

Historically SMSFs have not performed as well as retail or industry super funds, also known as 'APRA-regulated funds' (APRA is the Australian Prudential Regulation Authority).

APRA-regulated funds use highly skilled professionals to manage their investments. You need to be confident that the investments you choose will perform better.

The table below compares the average returns for SMSFs with APRA-regulated super funds over a five-year period. On average, APRA-regulated super funds achieved higher returns than SMSFs.

Source: Self-managed super funds: a statistical overview 2017–18, Australian Taxation Office

Related Solutions

Karen and Paul are a married couple who work as accountants. They set up their own...

29). In December of this year, Sam and Esterina, a married couple, redeemed qualified Series EE...

COUPLE INTERVIEW You are asked to interview a couple who has been married or cohabitating for...

(THE PROBABILITIES ABOUT X) : Set up and ind the indicated probability; a diagram is recommended....

Hilda and Horace, a married couple, were both previously married to others. Horace has an estate...

Mary Poppins, a friend of yours, has recently set up a small business making curtains. She...

Mary Poppins, a friend of yours, has recently set up a small business making curtains. She...

Mary Poppins, a friend of yours, has recently set up a small business making curtains. She...

Set up - You were hired in the role of accounting lead a couple of years...

Your friend Sam has been asked to prepare appetizers for the university reception. She has an...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

jeff jeffy answered 3 years ago

jeff jeffy answered 3 years ago