Question

In: Accounting

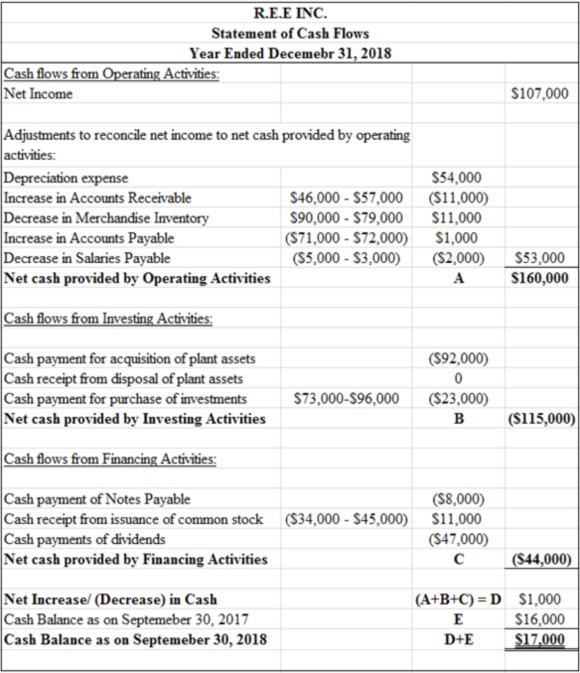

Use the Rouse Exercise Equipment data in Exercise E16-23. Prepare the company’s statement of cash flows—indirect method—for the year ended December 31, 2018

Preparing the statement of cash flows—indirect method

Use the Rouse Exercise Equipment data in Exercise E16-23. Prepare the company’s statement of cash flows—indirect method—for the year ended December 31, 2018. Assume investments are purchased with cash.

Solutions

Expert Solution

A cash flow statement is prepared to identify the reasons for the net increase or decrease in cash within two periods.

A cash flow statement under the indirect method is prepared in 3 sections: cash flow from operating activities, Cash flow from investing activities, and Cash flow from financing activities. This enables the stakeholder to know the exact source on which the cash has been utilized or the source from where the cash has been received during the period.

Prepare a statement of cash flows as provided below:

Cash flows from operating activities:

• Cash flows from Operating activities help ascertain the changes in cash due to the day-to-day operations carried out in an entity. To calculate cash flows from operating income, adjustments related to depreciation, and changes in current assets and current liabilities are made to the Net income.

• Depreciation charged to the income statement during the year is added back to the net income. Further, an increase in current liabilities and a decrease in current assets are also added back.

• Decrease in the current liabilities and increase in the current assets are reduced from such income.

Cash flows from investing activities:

• Cash flows from investing activities show the cash outflow/inflow in an entity due to investments made (or subsequently sold) by it.

• Purchase/acquisition of any fixed asset (like a plant, investments, etc.) would lead to a cash outflow, which reduces the cash balance. Hence, the amount of purchase will be deducted from the investing activities.

• Selling an existing long-term asset would lead to an inflow of cash, which increases the cash balance. Hence, the proceeds from such sale will be added to the investing activities

Cash flow from financing activities:

• Cash flows from financing activities show the cash outflow/inflow in an entity due to its funds. The funds are raised in the form of equity or long-term liabilities; financing activities include payment of dividends and interest on such funds raised.

• Rising of funds by issuing common stock or by issuing notes would lead to an inflow of funds in the entity and would be added.

• Payment of any existing long-term liability or dividend on the common stock would lead to the outflow of funds, and hence, such payment would be deducted.

The cash flow from all the three activities have been added to arrive at the net increase/ (decrease) in cash during the period.

The addition of the opening balance of cash to the net increase/ (decrease) in cash has been done to arrive at the cash account's closing balance.

Related Solutions

Prepare Stoughton's statement of cash flows for the year ended December 31, 2018, using the indirect...

Prepare the statement of cash flows for the year ended December 31,2017 using the indirect method

The Murdock Corporation Statement of Cash Flows For the Year Ended December 31, 2018 Cash flows...

Prepare the financing section of the statement of cash flows for the year ended December 31,...

(a) Using the indirect method, prepare a statement of cash flows for Hinckley SA for the year ended December 31, 2020 with significant non-cash transactions disclosed in the notes.

Prepare a statement of cash flows for Henderson ?Industries, Inc., for the year ended December? 31,...

Use the following data to prepare the Indirect Cash Flow Statement for December 31, 2014: Cash...

In preparation for developing its statement of cash flows for the year ended December 31, 2018,...

Statement of Cash Flows—Indirect Method The comparative balance sheet of Merrick Equipment Co. for December 31,...

Statement of Cash Flows—Indirect Method The comparative balance sheet of Merrick Equipment Co. for December 31,...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

- For this assignment you will write a program with multiple functions that will generate and save...

- How many grays is this?Part A A dose of 4.7 Sv of γ rays in a...

Dr. OWL answered 5 years ago

Dr. OWL answered 5 years ago