Question

In: Accounting

On June 1, 2008, Coltec Industry purchased $503,000, 11% bonds, with interest payable on January 1...

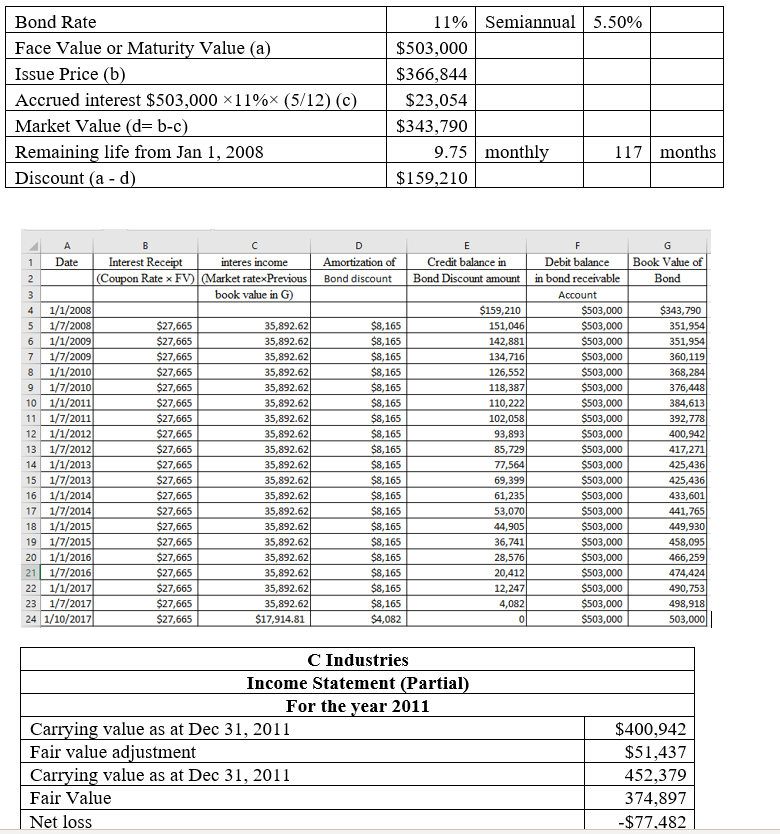

On June 1, 2008, Coltec Industry purchased $503,000, 11% bonds, with interest payable on January 1 and July 1, for $366,844, INCLUDING accrued interest. The bonds mature on October 1, 2017. Amortization is recorded using the straight-line method and the bonds are classified as available-for-sale. On December 31, 2011, the bonds were adjusted to their proper carrying value when their fair value was $374,897. The fair market value of the bonds on December 31, 2010 was $436,050. What is the NET INCOME or LOSS recorded on the Income Statement of Coltec Industry for 2011 solely as a result of these bonds? Note: Accrue interest and amortize premium/discount on a monthly basis. Round your answer to the nearest whole dollar. If NET INCOME results, enter your answer as a positive number. If NET LOSS results, place a minus sign '-' prior to the amount of the loss.

Solutions

Related Solutions

On May 1, 2021, Sheffield Corp. purchased $1,530,000 of 12% bonds, interest payable on January 1...

On May 1, 2021, Sunland Company purchased $1,550,000 of 12% bonds, interest payable on January 1...

On May 1, 2014, Kymier Corp. purchased $1,500,000 of 12% bonds—with interest payable on January 1...

Metro Company purchased $100,000, 10%, 5-year bonds on January 1, 20x1, with interest payable on July...

Bonds Payable: On January 1, 2014 – ABC issued $800,000.00 of 20-year, 11% bonds for $739,814.81,...

Sunland, Inc. had outstanding $5,460,000 of 11% bonds (interest payable July 31 and January 31) due...

Culver, Inc. had outstanding $5,460,000 of 11% bonds (interest payable July 31 and January 31) due...

Avadi Ltd. purchased $200,000 face value 7% bonds on June 1, 2019. Interest on the bonds...

On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year...

On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year...

- Investigation B, The Braun Electroscope The Braun electroscope consists of a metal disc at the...

- Direct Labor Variances The following data relate to labor cost for production of 7,200 cellular telephones:...

- **C++ only, standard library. We are supposed to create a tower of hanoi program and do...

- The pKa of the α-carboxyl group of phenylalanine is 1.83, and the pKa of its α-amino...

- On June 1, 2008, Coltec Industry purchased $503,000, 11% bonds, with interest payable on January 1...

- What code would I add to the following program to have it print out the runtime...

- How do you think eMarketing should fit into the overall marketing picture? And How do some...

ekkarill92 answered 2 hours ago

ekkarill92 answered 2 hours ago