Question

In: Finance

Six years from today you need $10,000. You plan to deposit $1,600 annually, with the first...

Six years from today you need $10,000. You plan to deposit $1,600 annually, with the first payment to be made a year from today, in an account that pays a 6% effective annual rate. Your last deposit, which will occur at the end of Year 6, will be for less than $1,600 if less is needed to reach $10,000. How large will your last payment be? Do not round intermediate calculations. Round your answer to the nearest cent.

$

Solutions

Expert Solution

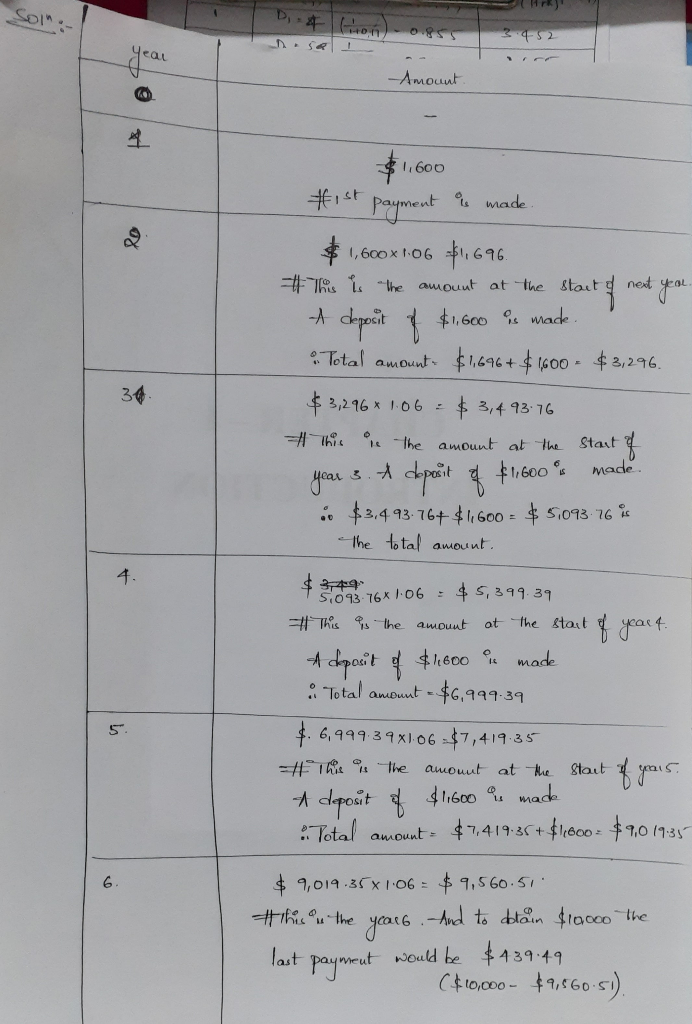

It is required to deposit $1,600 annually every year from a year from today for 6 years to get a total of $10,000. The effective annual rate is given as 6% i.e., it yields an interest of 6% on the total amount every year. If the amount in the account is A, it yields a interest of A*r%, which makes the total amount as A+(A*r%) = A*(1+r%). Here we are considering the initial year as year 0 and the deposits are deposited from year 1 to year 6. All the calculations are shown in the below images:

Related Solutions

3. If you deposit $1,600 in an account paying 8% today and deposit $1,600 every year into...

You plan to make a deposit today to an account that pays 6% compounded annually that...

Quantitative Problem 1: You plan to deposit $1,600 per year for 5 years into a money...

How much will be in an account at the end of 5 years if you deposit $10,000 today at 8.7% annual interest, compounded semi-annually?

You deposit $10,000 annually into a life insurance fund for the next 10 years, at which...

You deposit $10,000 annually into a life insurance fund for the next 10 years, at which...

4. Find the value twenty years from now of a $10,000 deposit today at an annual...

How much money is required now to provide an income of $1,600 per month for six years if the money earns interest at 6% p.a. compounding monthly and the first $1,600 payment is payable 2 years from today?

You deposit $10,000 annually into a life insurance fund for the next 12 years, after which...

You deposit $10,000 annually into a life insurance fund for the next 10 years, after which...

- A faulty model rocket moves in the xy-plane (the positive y-direction is vertically upward). The rocket's...

- A charged nonconducting rod, with a length of 3.68 m and a cross-sectional area of 2.79...

- Please list your 3 most favorite brands and say why. 1. 2. 3. Please list your...

- Six years from today you need $10,000. You plan to deposit $1,600 annually, with the first...

- 1. How did IBM become the dominant IT industry leader? 2. What changed that knocked IBM...

- Rental Shop A. Create an abstract class named SummerSportRental that is to be used with for...

- 1-Suppose a Styrofoam cup that weighs 5 grams was used for this experiment in place of...

jeff jeffy answered 4 hours ago

jeff jeffy answered 4 hours ago