Question

In: Accounting

The following adjusted trial balance information (with accounts in alphabetical order) for Willis Tour Co. Inc....

The following adjusted trial balance information (with accounts

in alphabetical order) for Willis Tour Co. Inc. as at December 31,

2017, was made available after its second year of

operations:

| Account | Debit | Credit | |||

| Accounts Payable | $ | 2,500 | |||

| Accumulated Depreciation, Office Equipment | 8,000 | ||||

| Cash | $ | 17,500 | |||

| Common Shares, 20,000 authorized; 10,000 issued and outstanding |

12,500 | ||||

| Dividends Payable | 4,500 | ||||

| Gain on Expropriation of Land and Building | 25,000 | ||||

| Income Tax Expense | 12,000 | ||||

| Income Tax Payable | 2,000 | ||||

| Loss on Sale of Office Equipment | 13,500 | ||||

| Notes Payable (due in 18 months) | 8,500 | ||||

| Office Equipment | 56,000 | ||||

| Operating Expenses | 195,500 | ||||

| Preferred Shares, $0.25 non-cumulative; 5,000

shares authorized; 2,000 shares issued and outstanding |

10,000 | ||||

| Prepaid Rent | 22,500 | ||||

| Retained Earnings | 14,500 | ||||

| Ticket Sales | 229,500 | ||||

| Totals | $ | 317,000 | $ | 317,000 | |

Required:

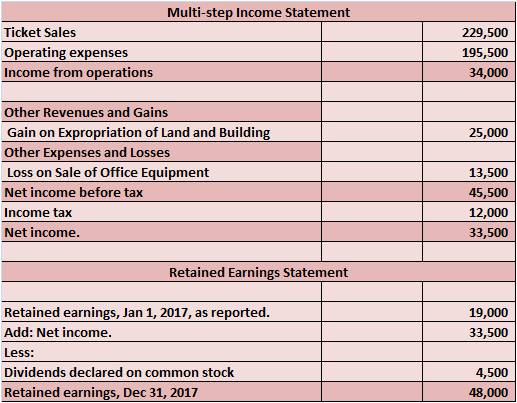

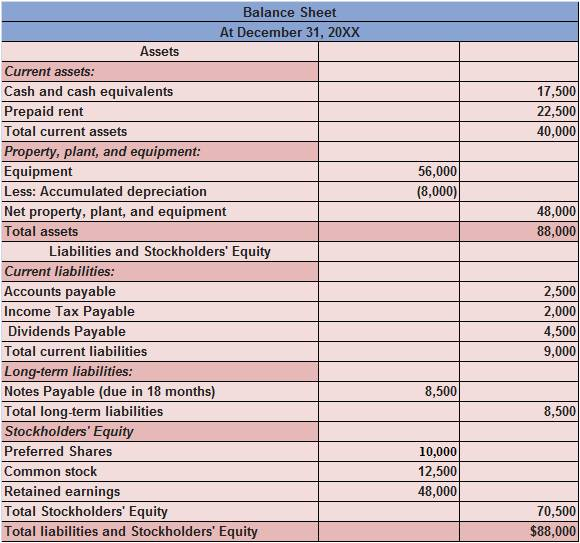

The dividends declared by Willis in the amount of $4,500 during the

year ended December 31, 2017, were debited directly to retained

earnings. Prepare an income statement (in multi-step format), and a

classified balance sheet for Willis Tour Co. Inc. using the

information provided. Include the appropriate presentation for

earnings per share. (Round the "Earnings per Share" answers

to 2 decimal places. Negative amounts should be indicated by a

minus sign.)

|

Solutions

Related Solutions

Following is the adjusted trial balance, with accounts in alphabetical order, for TRN Magazine as at...

Following is the adjusted trial balance, with accounts in

alphabetical order, for TRN Magazine as at January 31, 2017: Debit

Credit Accounts receivable $ 21,300 Accumulated depreciation,

equipment $ 12,300 Cash 8,800 Depreciation expense, equipment 1,650

Equipment 19,300 Interest income 480 Rent expense 17,800 Salaries

expense 61,300 Subscription revenues 71,300 Trish Norris, capital

46,470 Trish Norris, withdrawals 19,700 Unearned subscription

revenue 19,300 Totals $ 149,850 $ 149,850 Required: Prepare the

closing entries. (If no entry is required for a transaction/event,...

Balance Sheet from Adjusted Trial Balance The following is the alphabetical adjusted trial balance of the...

Balance Sheet from Adjusted Trial Balance

The following is the alphabetical adjusted trial balance of the

Meadows Company on December 31, 2016:

Debits

Credits

Accounts Payable

$ 9,800

Accounts Receivable

$ 19,000

Accrued Payables

7,100

Accumulated Depreciation

44,000

Additional Paid-in Capital

50,600

Cash

7,900

Common Stock, $5 par

29,600

Cost of Goods Sold

179,500

Current Portion of Long-Term Debt

6,200

Deferred Taxes Payable

12,500

Dividends Distributed

7,000

General Expenses

27,560

Income Tax Expense

12,340

Income Taxes Payable

7,500

Interest Expense...

The following is a list of the accounts and balances taken from the adjusted trial balance at December 31, 2014 for Meilleur Merchants. The list of accounts is in alphabetical order.

The following is a list of the accounts and balances taken from the adjusted trial balance at December 31, 2014 for Meilleur Merchants. The list of accounts is in alphabetical order.Meilleur uses a periodic inventory system. Account Balance Dec. 31 1 Accounts payable (15,000)2 Accounts receivable 30,000 3 Accumulated depreciation—building (15,500)4 Accumulated depreciation—equipment (10,000)5 Advertising expense 4,100 6 Building 84,600 7 S. Meilleur, capital (75,000)8 S. Meilleur, drawings 28,300 9 Cash 8,790 10 Depreciation expense 5,700 11 Equipment 24,500 12 ...

The following is a list of the accounts and balances taken from the adjusted trial balance at December 31, 2014 for Meilleur Merchants. The list of accounts is in alphabetical order.

The following is a list of the accounts and balances taken from the adjusted trial balance at December 31, 2014 for Meilleur Merchants. The list of accounts is in alphabetical order.Meilleur uses a periodic inventory system. Account Balance Dec. 31 1 Accounts payable (15,000)2 Accounts receivable 30,000 3 Accumulated depreciation—building (15,500)4 Accumulated depreciation—equipment (10,000)5 Advertising expense 4,100 6 Building 84,600 7 S. Meilleur, capital (75,000)8 S. Meilleur, drawings 28,300 9 Cash 8,790 10 Depreciation expense 5,700 11 Equipment 24,500 12 ...

Sunshine Sushi, a Japanese restaurant, has the following adjusted trial balance with accounts listed in alphabetical...

Sunshine Sushi, a Japanese restaurant, has the following adjusted

trial balance with accounts listed in alphabetical order.

Prepare a classified balance sheet for the year-ended

December 31, 2017. For the bank loan, $50,000 is due in

2018. For Notes receivable, $30,000 will be collected in 2018.

Accounts

Debit

Credit

Accounts payable

$57,321

Accumulated depreciation, equipment

98,000

Accumulated depreciation, furniture

48,600

Bank

loan

687,536

Cash

$305,687

Equipment

450,300

Operating expenses

45,987

Furniture

160,000

Merchandise inventory

30,000

Natsuki Miyakawa, capital

32,241

Natsuki...

Sunshine Sushi, a Japanese restaurant, has the following adjusted trial balance with accounts listed in alphabetical...

Sunshine Sushi, a Japanese restaurant, has the following adjusted

trial balance with accounts listed in alphabetical order.

Prepare a classified balance sheet for the year-ended

December 31, 2017. For the bank loan, $50,000 is due in

2018. For Notes receivable, $30,000 will be collected in 2018.

Account Title

Debit

Credit

Accounts payable

$57,321

Accumulated depreciation, equipment

98,000

Accumulated depreciation, furniture

48,600

Bank

loan

687,536

Cash

$305,687

Equipment

450,300

Operating expenses

45,987

Furniture

160,000

Merchandise inventory

30,000

Natsuki Miyakawa, capital

32,241...

Below is an alphabetical list of the adjusted accounts of Cullumber Tour Company at its year...

Below is an alphabetical list of the adjusted accounts of

Cullumber Tour Company at its year end, December 31, 2021. All

accounts have normal balances.

Accounts payable

$7,310

Interest receivable

$100

Accounts receivable

3,510

Interest revenue

1,100

Accumulated depreciation—equipment

15,000

Notes payable

40,000

Cash

4,500

Notes receivable

18,450

Depreciation expense

10,000

Patents

15,070

Equipment

50,000

Prepaid insurance

2,900

F. Cullumber, capital

17,370

Service revenue

65,050

F. Cullumber, drawings

33,000

Short-term investments

2,700

Insurance expense

1,500

Supplies

3,100

Interest expense

2,840...

Below is an alphabetical list of the adjusted accounts of Sheridan Tour Company at its year...

Below is an alphabetical list of the adjusted accounts of

Sheridan Tour Company at its year end, December 31, 2021. All

accounts have normal balances.

Accounts payable

$7,370

Interest receivable

$100

Accounts receivable

3,570

Interest revenue

1,100

Accumulated depreciation—equipment

15,000

Notes payable

40,000

Cash

4,500

Notes receivable

18,430

Depreciation expense

10,000

Patents

15,070

Equipment

50,000

Prepaid insurance

2,900

F. Sheridan, capital

17,370

Service revenue

65,030

F. Sheridan, drawings

33,000

Short-term investments

2,700

Insurance expense

1,500

Supplies

3,100

Interest expense

2,830...

An alphabetical list of the adjusted trial balance accounts for North Country Rentals after its first...

An alphabetical list of the adjusted trial balance accounts for

North Country Rentals after its first year of operations ending

March 31, 2014, is shown below:

Account

Adjusted

Account Balance*

Accounts

payable

$

8,300

Accumulated

depreciation, building

24,200

Accumulated

depreciation, furniture

2,700

Advertising

expense

15,400

Building

583,000

Cash

16,200

Depreciation

expense, building

24,200

Depreciation

expense, furniture

2,700

Furniture

41,200

Interest

expense

10,180

Interest

payable

720

Janitorial

expense

40,200

...

This is a partial adjusted trial balance of Wildhorse Co.. WILDHORSE CO. Adjusted Trial Balance January...

This is a partial adjusted trial balance of Wildhorse

Co..

WILDHORSE

CO.

Adjusted Trial Balance

January 31, 2017

Debit

Credit

Supplies

$780

Prepaid Insurance

1,620

Salaries and Wages Payable

$1,040

Unearned Service Revenue

710

Supplies Expense

910

Insurance Expense

540

Salaries and Wages Expense

1,770

Service Revenue

4,350

Prepare the closing entries at January 31, 2017. (If no

entry is required, select "No Entry" for the account titles and

enter 0 for the amounts. Credit account titles are automatically

indented...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- Using your book and outside sources research various sterilization process discussed in chapter 10. Write a...

- On January 1, 2015 IBM leases an equipment from Omaha Inc. for an annual lease rental...

- A beaker with 115mL of an acetic acid buffer with a pH of 5.000 is sitting...

- A uranium nucleus 238U may stay in one piece for billions of years, but sooner or...

- calculate the solubility in g/l of AgBr in (a) pure water and (b) 0.0066 M NaBr....

- A faulty model rocket moves in the xy-plane (the positive y-direction is vertically upward). The rocket's...

- A charged nonconducting rod, with a length of 3.68 m and a cross-sectional area of 2.79...

ADVERTISEMENT

ekkarill92 answered 1 day ago

ekkarill92 answered 1 day ago