Question

In: Finance

You have applied for a job with a local bank. As part of its evaluation process,...

You have applied for a job with a local bank. As part of its evaluation process, you must take an examination of the time value of money analysis covering the following questions. Please show your work. (Identify N, I/Y, PV, PMT, and FV)

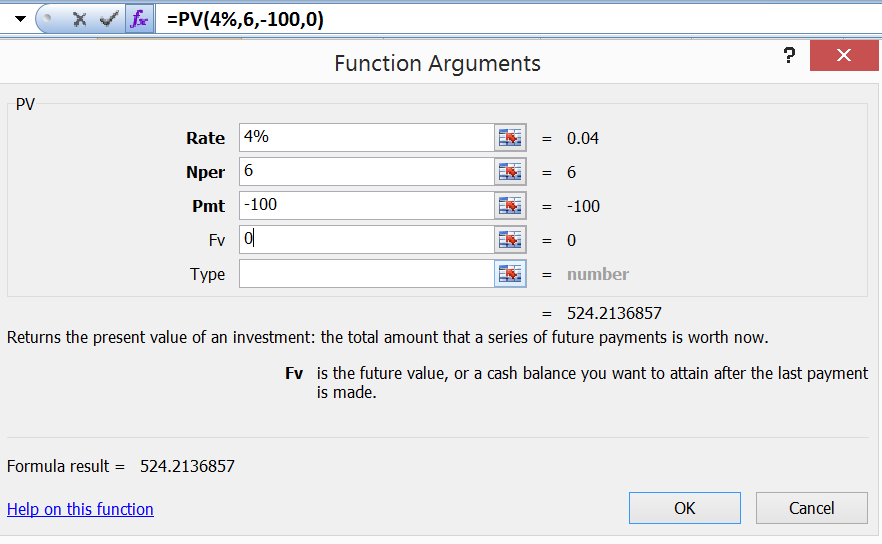

- What is the present value of a 6-year, $100 ordinary annuity if the annual interest rate is 4%?

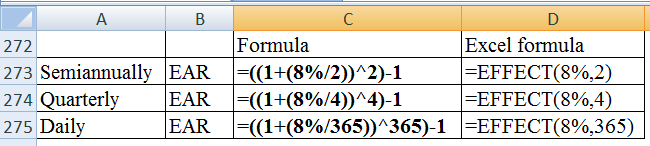

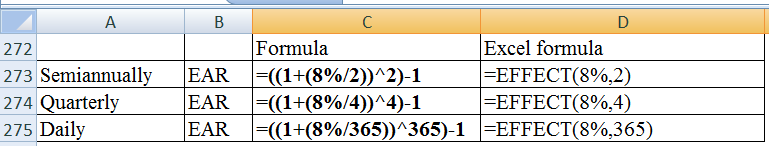

- What is the EAR corresponding to a nominal rate of 8% compounded semiannually? Compounded quarterly? Compounded daily?

Solutions

Expert Solution

Number of years = N = 6

Rate = I/Y = 4%

Present value = PV = ? = $524.21.(Answer)

Payment = PMT = 100

FV = 0

-----------------------------------------------------

By using excel:

Present value = $524.21.

-------------------------------------------------------------

Calculate the effective annual rate as follows:

Formulas:

Related Solutions

You have applied for a job. As part of its evaluation process, you must take an...

You have applied for a job. As part of its evaluation process,

you must take an examination of the time value of money analysis

covering the following questions. Please show your work including

each step by using your calculator OR Excel. (Identify N, I/Y, PV,

PMT, and FV)

A) What’s the future value of $200 after 3 years if it earns 8%,

annual compounding?

B) What’s the present value of $200 to be received in 3 years if

the interest...

You have applied for a job with Abu Dhabi Commercial Bank. As part of its evaluation...

You have applied for a job with Abu

Dhabi Commercial Bank. As part of its evaluation process, you must

take an examination of the time value of money analysis covering

the following question.

Draw timelines for each of the following:

An AED 100 lump sum cash flow at the end of year

2

An ordinary annuity of AED 100 per year for 3

years

An uneven cash flow stream of -50, 100, 75 and 50 at

the end of years...

Assume that you are nearing graduation and have applied for a job with a local bank....

Assume that you are nearing graduation and have applied for a

job with a local bank. The bank’s evaluation process requires you

to take an examination that covers several financial analysis

techniques. Answer the given questions.

Answer the given questions.

Question 1. What is the present value of the following uneven

cash flow stream $50, $100, $75, and -$50 at the end of Years 0

through 3? The appropriate interest rate is 10%, compounded

annually.

Question 2. Suppose that, on...

Job structure development is dependent on a process of job evaluation. Explain this process.

Job structure development is dependent on a process of job

evaluation. Explain this process.

Assume that you are nearing graduation and that you have applied for a job with a...

Assume that you are nearing graduation and that you have applied

for a job with a local bank. As part of the bank’s evaluation

process, you have been asked to take an examination that covers

several financial analysis techniques. The first section of the

test addresses time value of money analysis. See how you would do

by answering the following questions: Questions: (1) What is the

future value of an initial $100 after three years if it is invested

in...

You are on your first audit of a local government and part of your job is...

You are on your first audit of a local government and part of

your job is to evaluate financial ratios. The partner on the job

told you that analysis of financial ratios alone is not sufficient

for assessing the economic condition of the government entity.

Identify at least five other factors that you think should be

considered in assessing the entity’s economic condition and why

they are important.

Ms. Caterina Weldon has applied for a loan from a local bank and the bank has...

Ms. Caterina Weldon has applied for a loan from a local bank

and the bank has agreed to extend to her a personal loan of $

1,500,000/= over a period of 21/2 years. This

loan will be repaid in monthly installments at the end of each

month over the loan period. The proposed interest rate is 14.5%

p.a.

Required:

Prepare a loan repayments schedule for

Ms. Matemo’s loan indicating:

The Model Drivers

The constant payment

Interest payment

Principal payment,...

a. You will need an informed consent process as part of your program evaluation. How will...

a. You will need an informed consent process as part of your

program evaluation. How will you obtain informed consent from your

participants? Will you have them sign a form or just verbally agree

to participate in the evaluation?

suppose that you have applied for a job vacancy for the biggest poultry firm in a...

suppose that you have applied for a job vacancy for the biggest

poultry firm in a country. the interview panel asked you to explain

the relevance of the price elasticity of demand for the firm. how

do you answer

You and have applied for and successful won a job as senior policy analyst for the...

You and have applied for and successful won a job as senior

policy analyst for the Government of Canada (Privy Council) and you

have been well trained to handle all aspects of the job. You will

be the “go to person” for the Prime Minister on ways to make the

economy run more efficiently and fairly, especially from a social

policy perspective. As this is a big job, you have hired a team to

help find solutions to the social...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

ADVERTISEMENT

jeff jeffy answered 1 month ago

jeff jeffy answered 1 month ago