Question

In: Biology

Using the Arizona Wuhan seafood market virus isolate, MN997409.1, run BLAST against the RefSeq Representative genomes...

Using the Arizona Wuhan seafood market virus isolate, MN997409.1, run BLAST against the RefSeq Representative genomes (refseq_representative_genomes) database, limiting the search to Viruses (taxid: 10239) in the “Organism” field. From the hits returned, construct a phylogenetic tree (Distance tree of results). Examining the BLAST results and the Distance Tree select all that apply:

a)The non-Wuhan virus genome with the lowest E-value and highest identity is the SARS coronavirus

b)The distance tree suggests the Arizona virus is very different from the reference Wuhan seafood market virus isolate

c)The Distance tree suggests that the Wuhan viruses show similarity to a Bat coronavirus – BM48-31/BGR/2008

d)The White-eye corona virus show a significant hit, but with very low Query coverage

Solutions

Expert Solution

Question

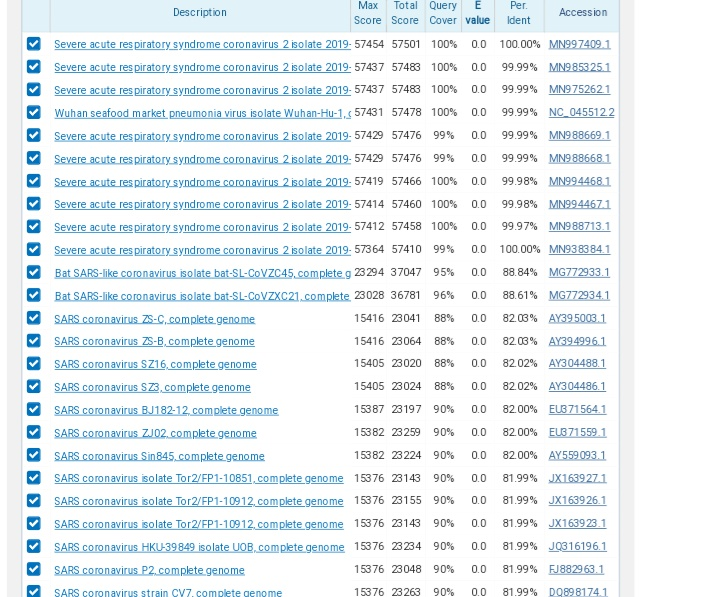

The result from blastn alignment is following:

Figure: BLASTn result

This result show that non-wuhan virus show similarity with SARS coranavirus. Hence, option a is correct.

Related Solutions

Carry out a BLAST search against the UniProt database using the following sequence as input: MASTHQSSTEPSSTGKSEETKKDASQGSGQDSKNVTVTKGTGSSATSAAIVKTGGSQGKDSSTTAGSSSTQGQKFSTTPTDPKTFSSDQKEKSKSPAKEVPSGGDSKSQGDTKSQSDAKSSGQSQGQSKDSGKSSSDSSKSHSVIGAVKDVVAGAKDVAGKA

Consider a representative firm in the perfectly competitive market. This firm has the following total long-run...

Describe a strategy for how you would make a vaccine against a virus using genetic engineering...

Research the methods attackers are using to bypass virus scanners to get users to run malicious...

You run a regression of X’ Company stock's returns against the market returns over a five-year...

You run a regression of X’ Company stock's returns against the market returns over a five-year...

You have run a regression of payout ratios against expected growth and risk (beta) for all companies in the market and arrived at the following equation:

Using ONLY a single market model, compare and contrast the long run equilibrium outcomes of perfectly...

A BLAST search using the amino acid sequence of human parathyroid hormone (PTH) against the protein and DNA sequence databases returned close homologs in many vertebrate species ranging from primates to fish

9 using cobweb behavior show the long run adjustment path in an agricultural market when demand...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

gladiator answered 1 month ago

gladiator answered 1 month ago