Question

In: Accounting

National Co. manufactures and sells three products: red, white, and blue. Their unit sales prices...

|

National Co. manufactures and sells three products: red, white, and blue. Their unit sales prices are red, $65; white, $95; and blue, $120. The per unit variable costs to manufacture and sell these products are red, $50; white, $70; and blue, $90. Their sales mix is reflected in a ratio of 2:2:1 (red:white:blue). Annual fixed costs shared by all three products are $160,000. One type of raw material has been used to manufacture all three products. The company has developed a new material of equal quality for less cost. The new material would reduce variable costs per unit as follows: red, by $7; white, by $17; and blue, by $7. However, the new material requires new equipment, which will increase annual fixed costs by $30,000. |

| Required: | |

| 1. |

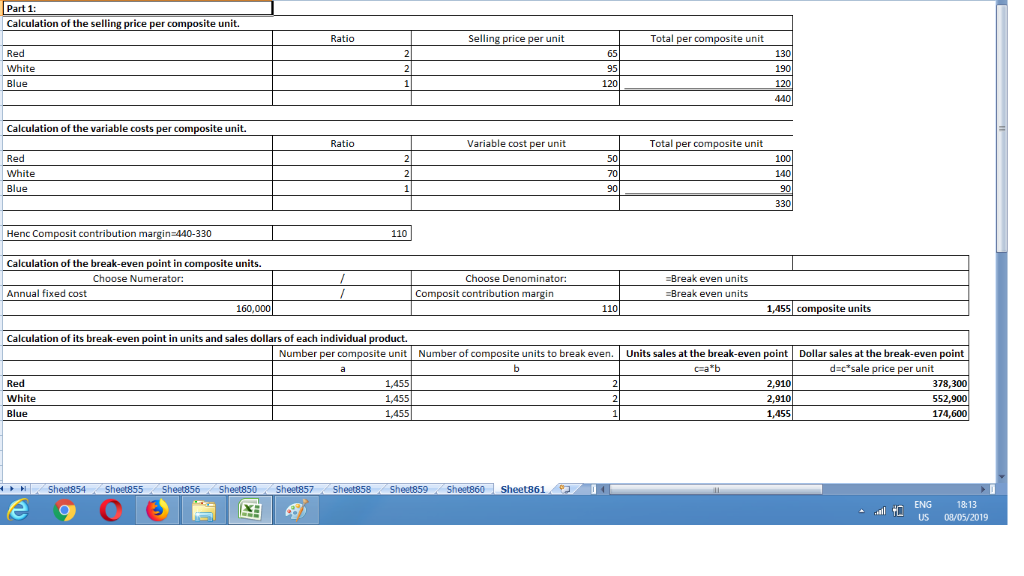

Assume if the company continues to use the old material, determine its break-even point in both sales units and sales dollars of each individual product. (Round up your composite units to whole number. Omit the "$" sign in your response.) |

| Break-Even Points | Sales Units | Sales Dollars |

| Red at break-even | $ | |

| White at break-even | $ | |

| Blue at break-even | $ | |

| 2. |

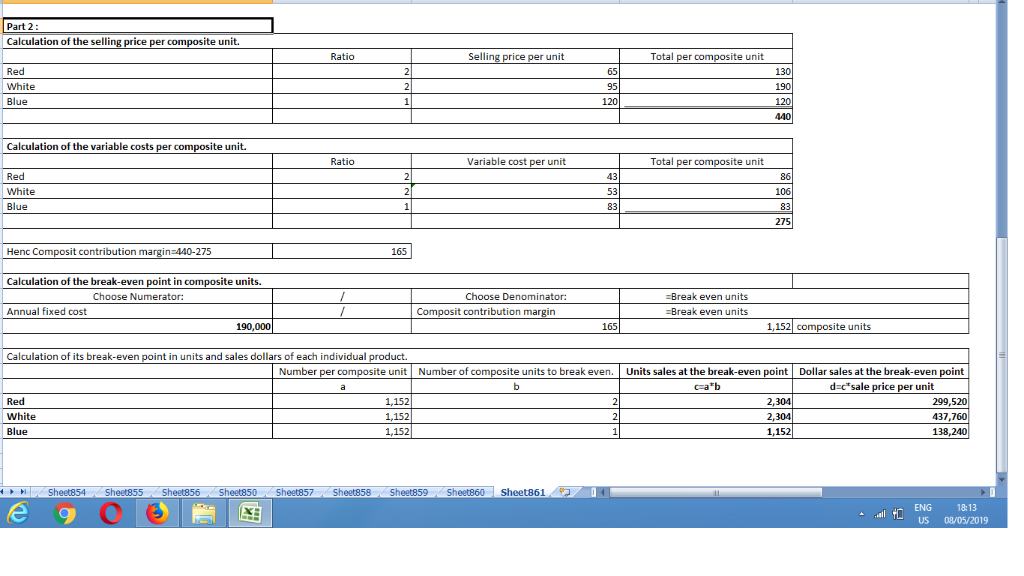

Assume if the company uses the new material, determine its new break-even point in both sales units and sales dollars of each individual product. (Round up your composite units to whole number. Omit the "$" sign in your response.) |

| Break-Even Points | Sales Units | Sales Dollars |

| Red at break-even | $ | |

| White at break-even | $ | |

| Blue at break-even | $ |

Solutions

Related Solutions

National Co. manufactures and sells three products: red, white, and blue. Their unit sales prices are...

National Co. manufactures and sells three products: red, white, and blue. Their unit sales prices are...

National Co. manufactures and sells three products: red, white, and blue. Their unit sales prices are...

National Co. manufactures and sells three products: red, white, and blue. Their unit sales prices are...

National Co. manufactures and sells three products: red, white, and blue. Their unit sales prices are...

National Co. manufactures and sells three products: red, white, and blue. Their unit sales prices are...

Patriot Co. manufactures and sells three products: red, white, and blue. Their unit selling prices are...

Patriot Co. manufactures and sells three products: red, white, and blue. Their unit selling prices are...

An urn contains 6 red balls, 7 white balls, and 8 blue balls. a) If three...

Thermodynamics and Statistical Mechanics problem: A system comprises three distinguishable marbles (red, white, and blue) each...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

ekkarill92 answered 2 months ago

ekkarill92 answered 2 months ago