Question

In: Anatomy and Physiology

3. Calculate a numerical value for net filtration pressure in the glomerulus under each of the...

3. Calculate a numerical value for net filtration pressure in the glomerulus under each of the following conditions. Don’t forget to include units with each answer.

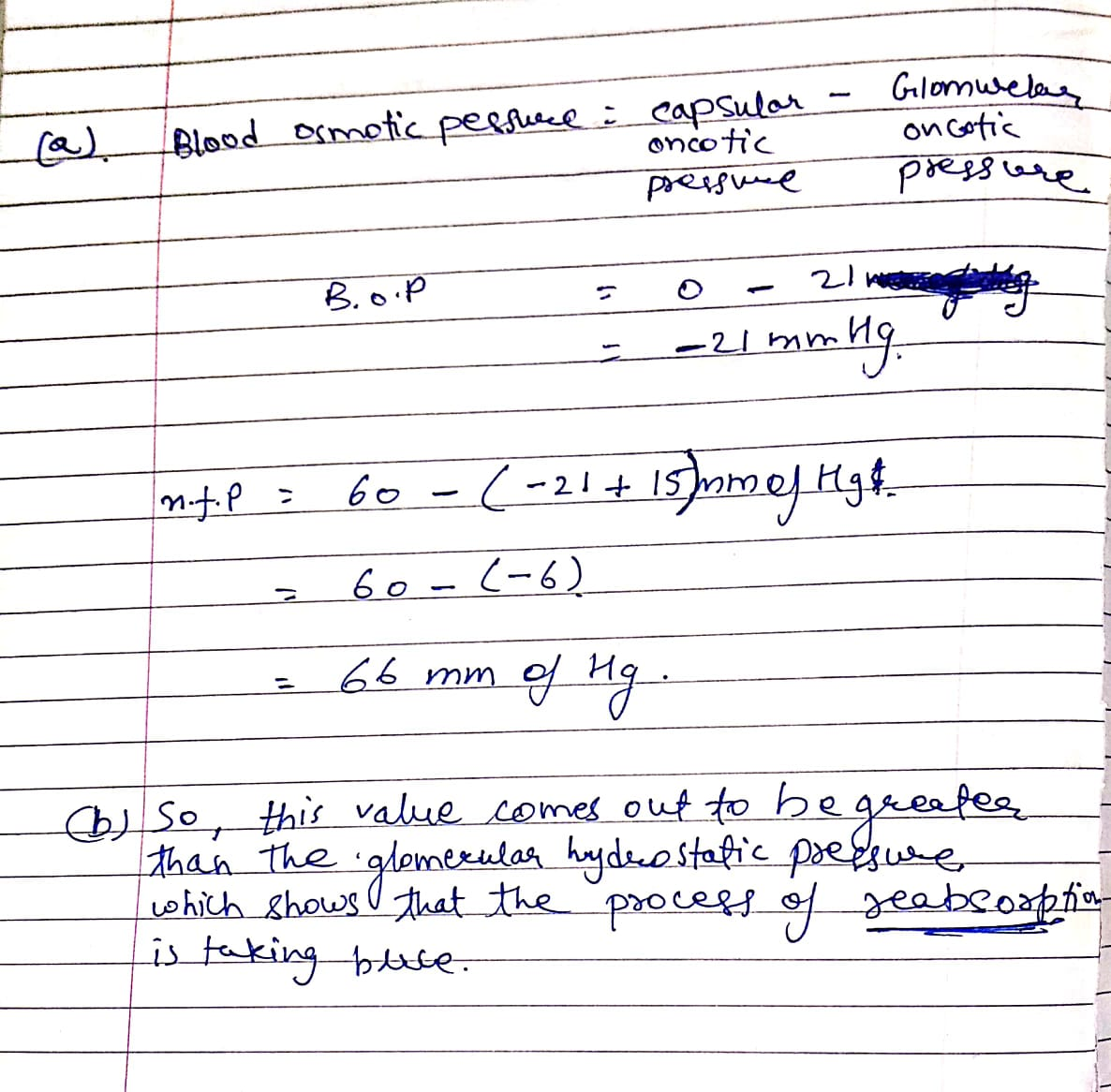

a. At the afferent end of the glomerular capillaries: glomerular capillary blood (hydrostatic or hydraulic) pressure is 60 mm Hg; hydrostatic (hydraulic) pressure in Bowman’s capsule is 15 mm Hg; oncotic pressure in the glomerular capillaries at the afferent end is 21 mm Hg; and oncotic pressure in Bowman’s capsule is 0 mm Hg. Please show your work.

b. Does your answer to the above question indicate that filtration or reabsorption is occurring across the glomerular capillaries at their afferent end?

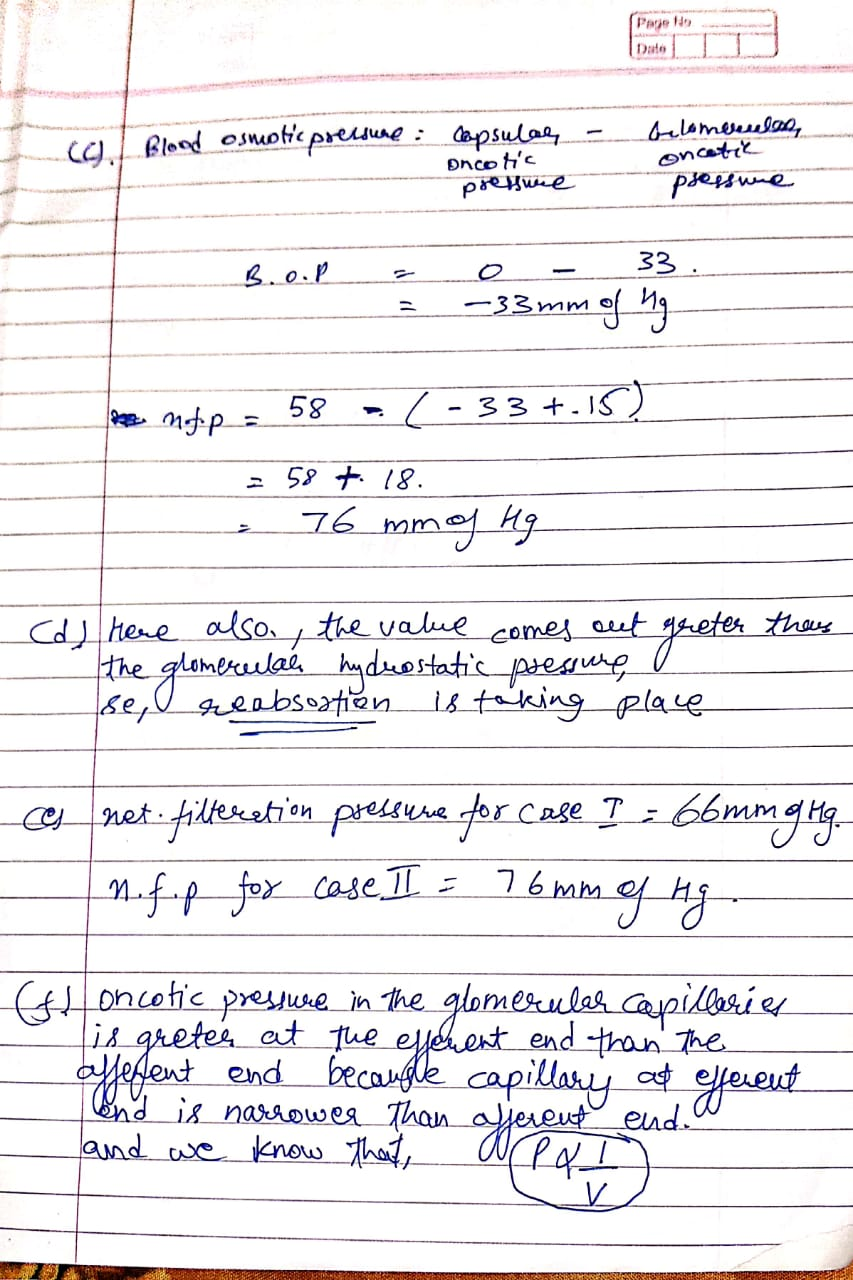

c. At the efferent end of the glomerular capillaries: glomerular capillary blood (hydrostatic or hydraulic) pressure is 58 mm Hg; hydrostatic (hydraulic) pressure in Bowman’s capsule is 15 mm Hg; oncotic pressure in the glomerular capillaries at the efferent end is 33 mm Hg; and oncotic pressure in Bowman’s capsule is 0 mm Hg. Please show your work.

d. Does answer to the above question indicate that filtration or reabsorption is occurring across the glomerular capillaries at their efferent end?

e. What is the average net filtration pressure across the glomerular capillaries in the above 2 problems? Show your work and include units.

f. Explaining why oncotic pressure in the glomerular capillaries is greater at the efferent end than at the afferent end.

Solutions

Expert Solution

I HAVE ANSWERED YOUR QUESTION IN DETAIL BUT IF YOU HAVE ANY

DOUBT YOU CAN DEFINITELY ASK IN THE COMMENT SECTION.

Related Solutions

3). Calculate the numerical value of cross elasticity in each of the following situations using the...

4). Calculate the numerical value of income elasticity in each of the following situations using the...

5). Calculate the numerical value of the price elasticity of supply I each of the following...

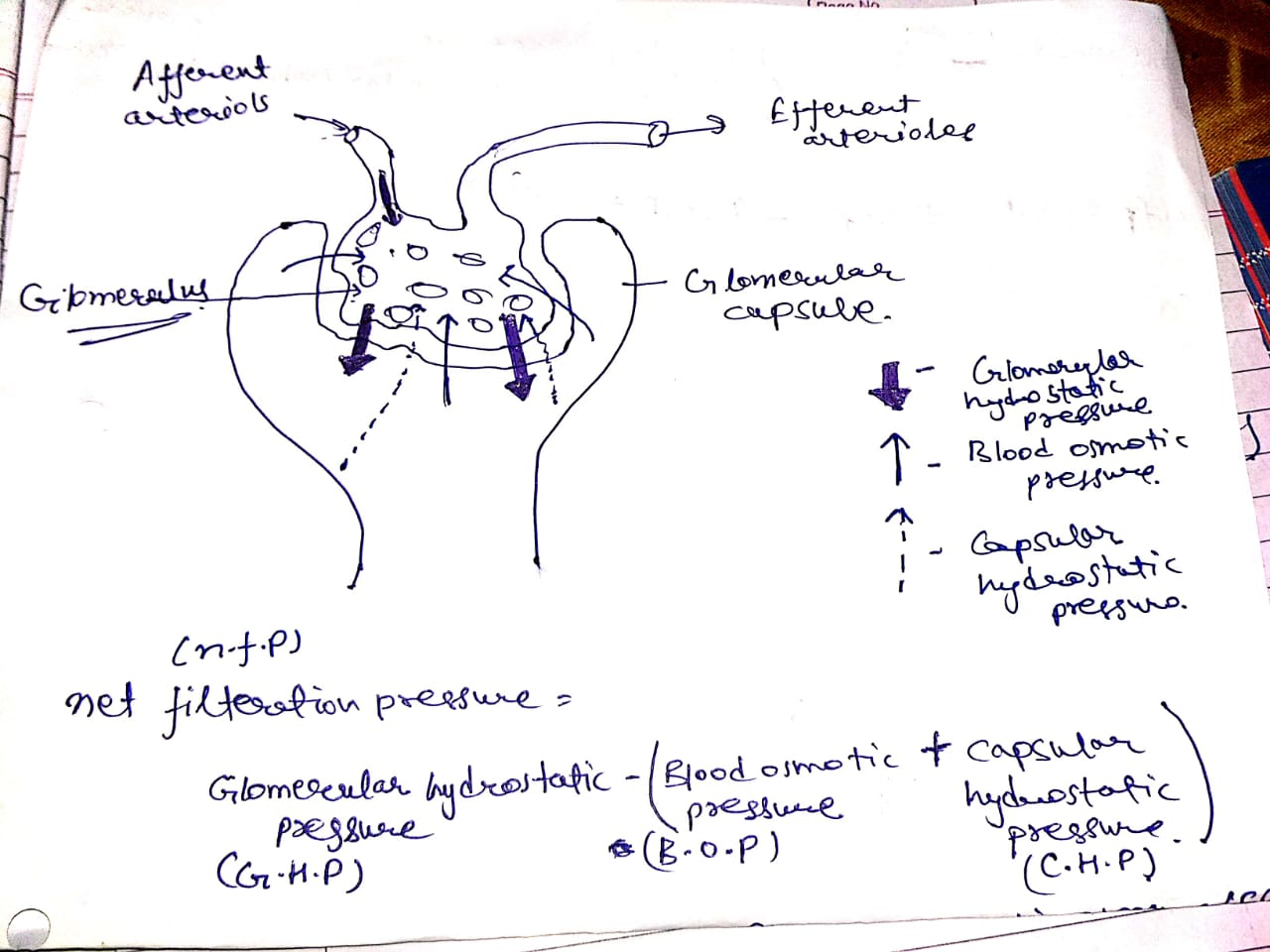

Explain the net glomerular filtration pressure in terms of the three underlying pressures that lead to...

Explain the concept of net filtration pressure. Describe the two main forces that drive the direction...

For each example, calculate the present value, or net present value, of the future amount(s) to...

Net present value Using a cost of capital of 11%, calculate the net present value for...

Using the data provided, calculate the capitalization rate and the value using direct capitalization under each...

3.For each of the following variables, determine whether the variable is categorical or numerical. If the...

Net present value. Independent projects Using a 14% cost of capital, calculate the net present value...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

Sydney Mullin answered 2 months ago

Sydney Mullin answered 2 months ago