Question

In: Accounting

Construction project requires an intial investment of $900,000, has a nine-year life, and salvage value is...

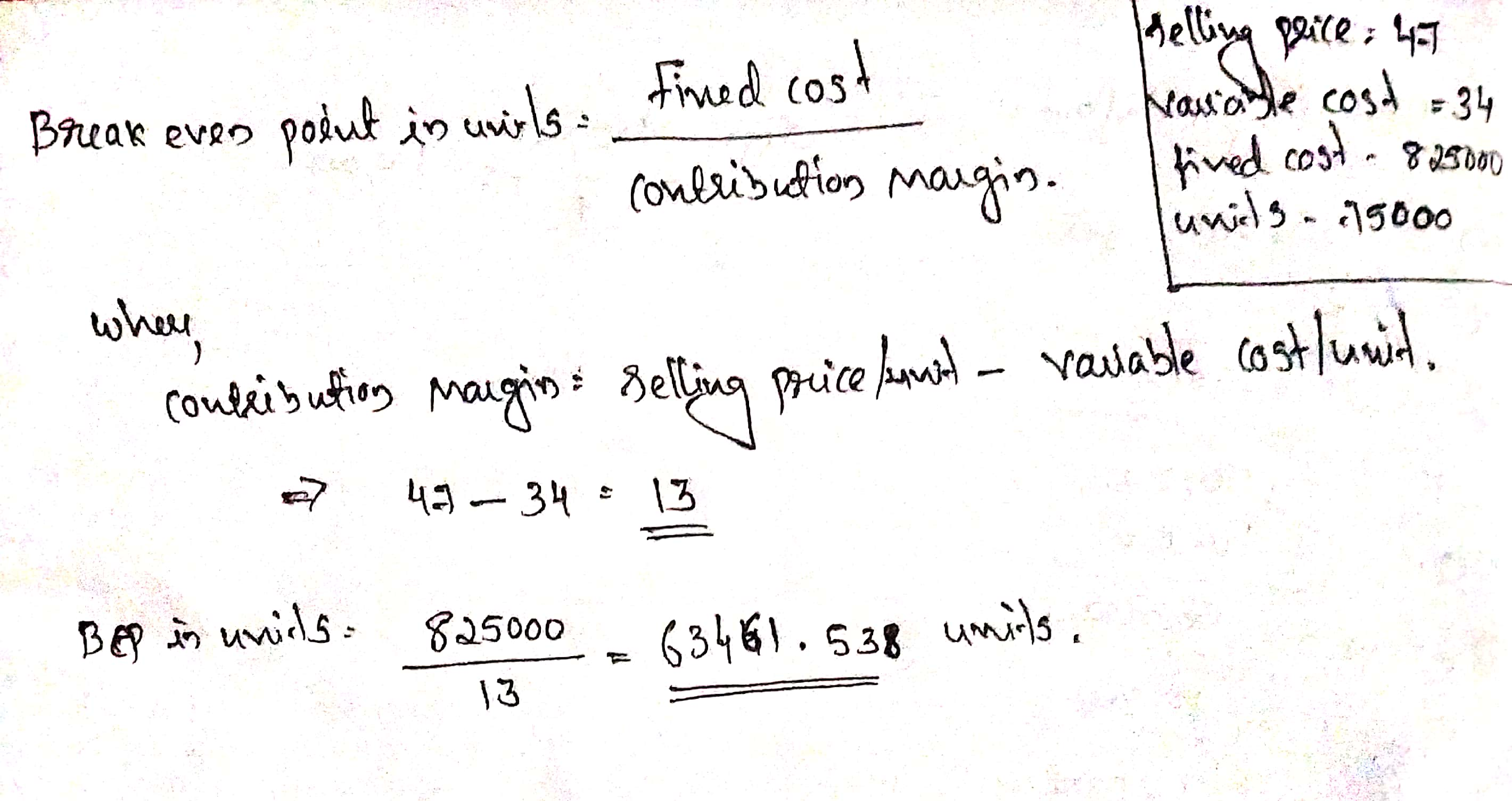

Construction project requires an intial investment of $900,000,

has a nine-year life, and salvage value is Zero. Sales are

projected at 75,000 units per year. Price per unit is $47, variable

cost per unit is $34, and fixed costs are $825,000 per year. The

tax rate is 35%, and discount rate is 15%. Using straight-line

depreciation method:

1. Calculate the accounting break-even point in number of units,

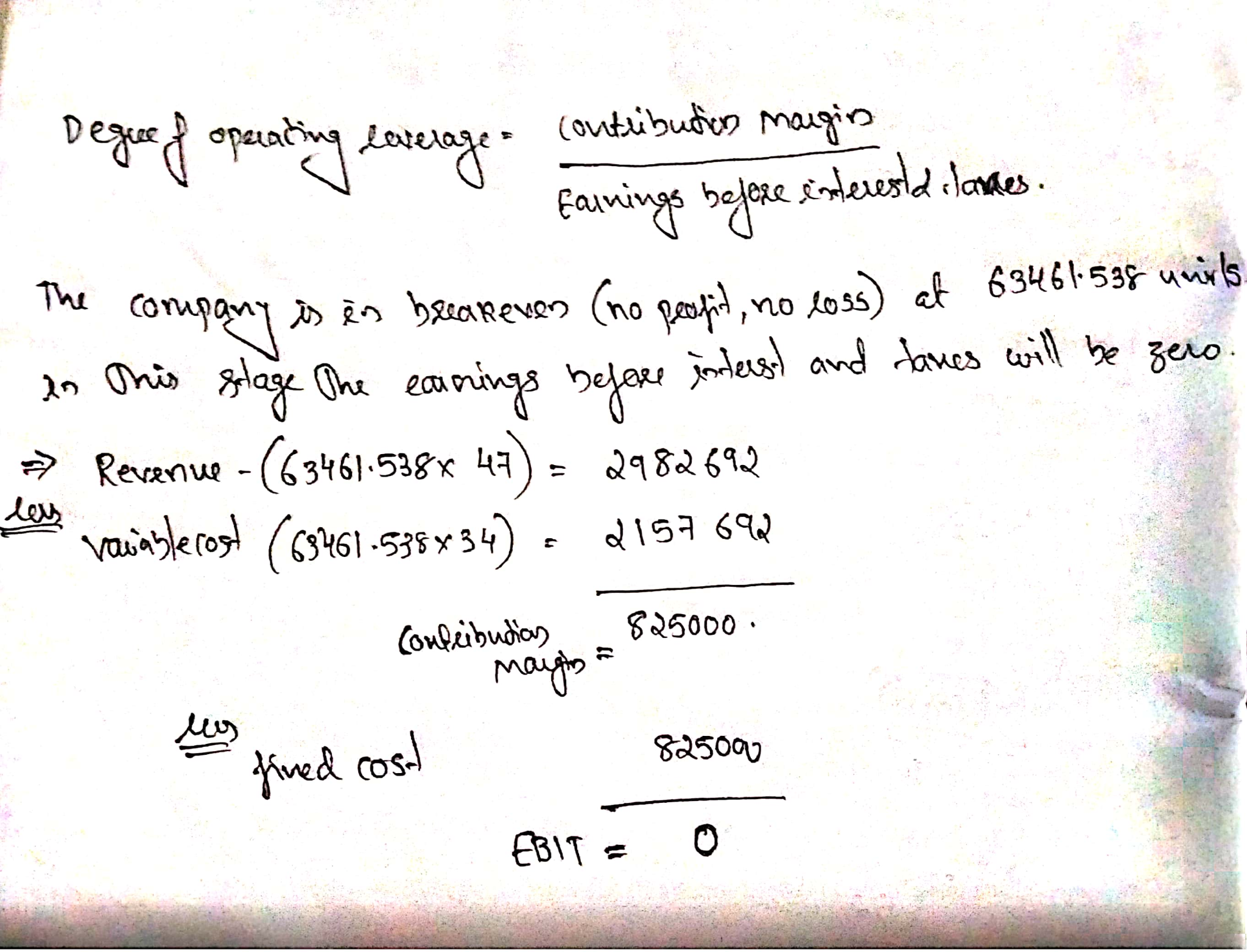

what is the degree of operating leverage at the accounting

break-even point

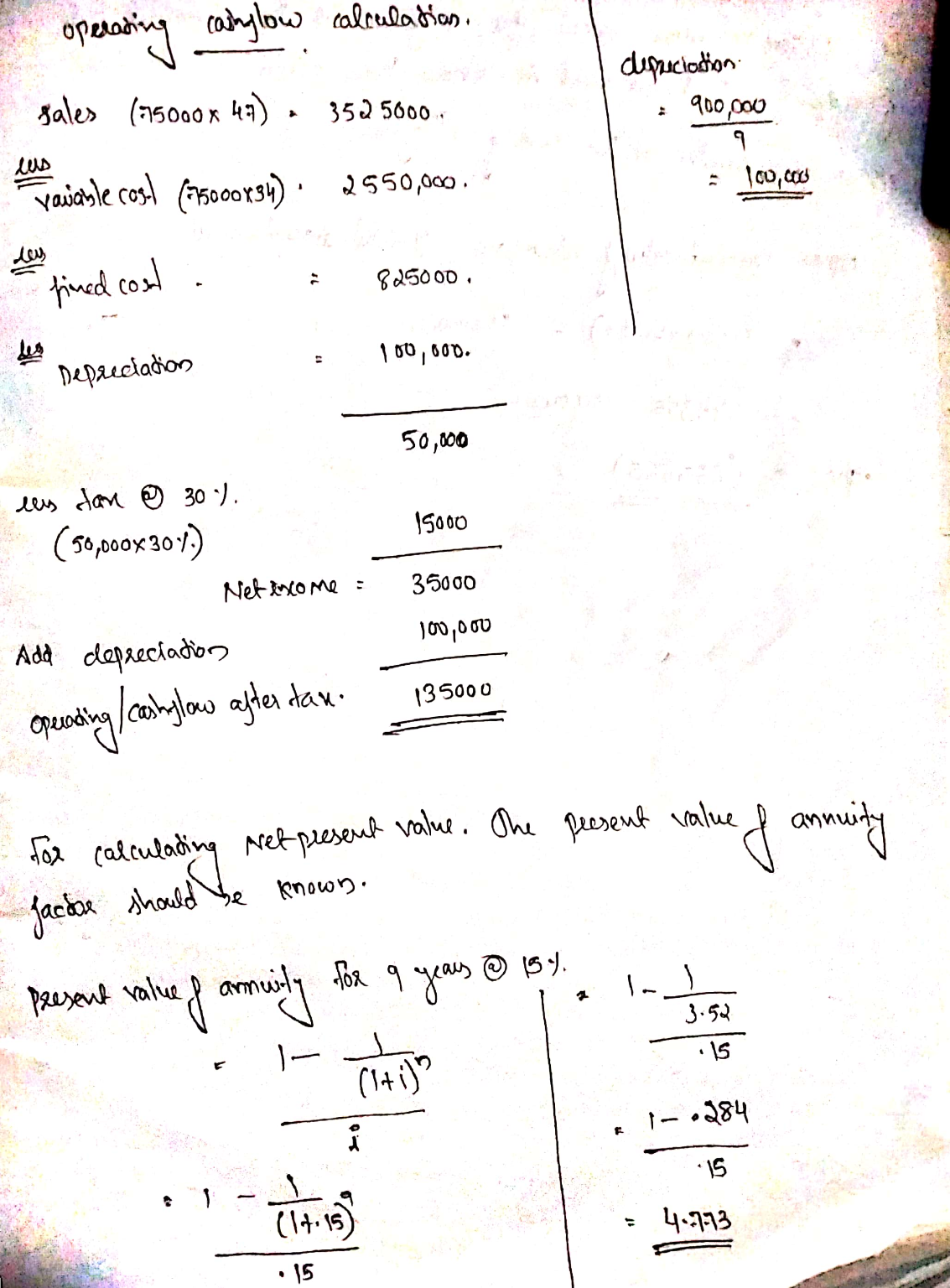

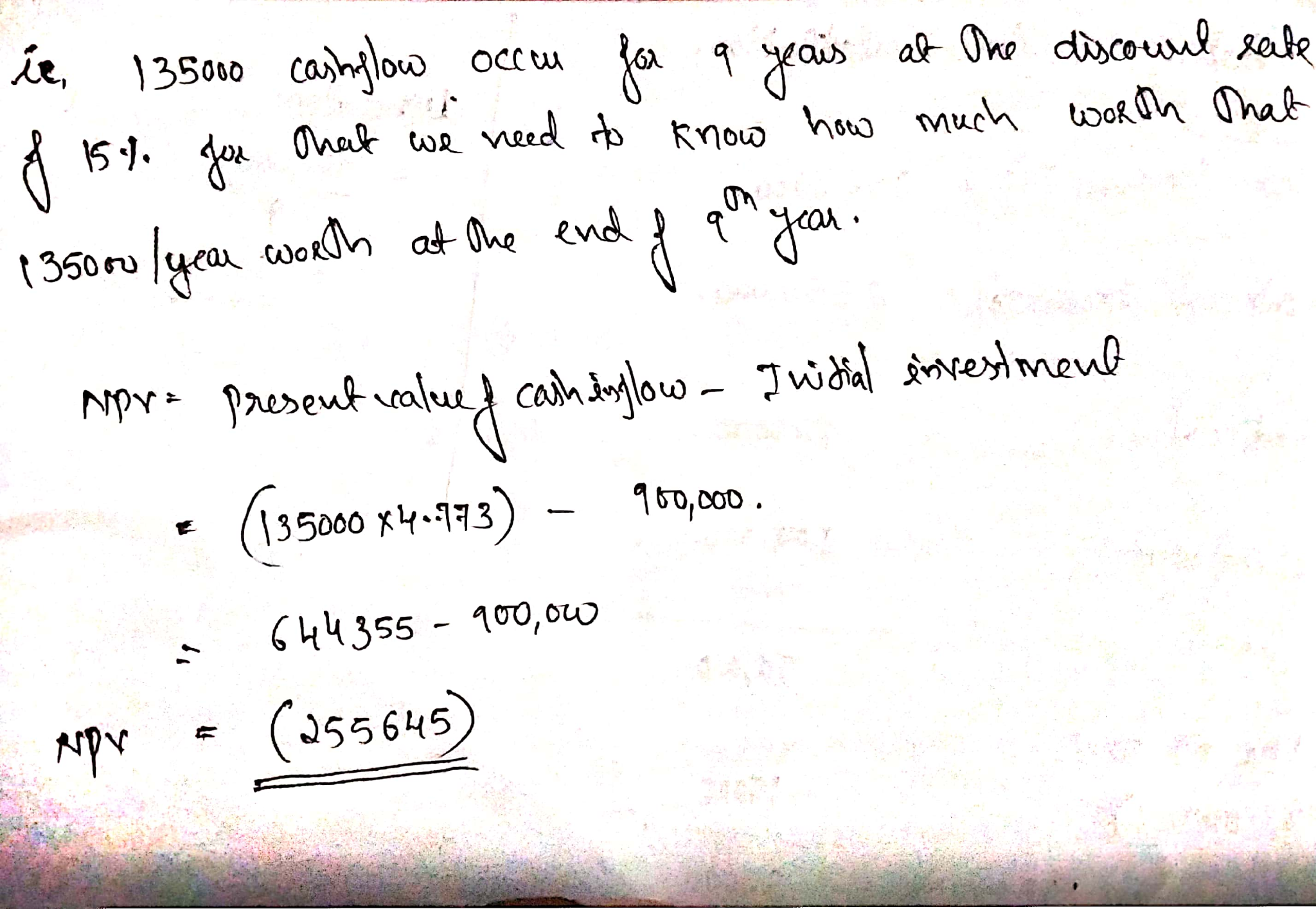

2. Calculate the OCF, NPV

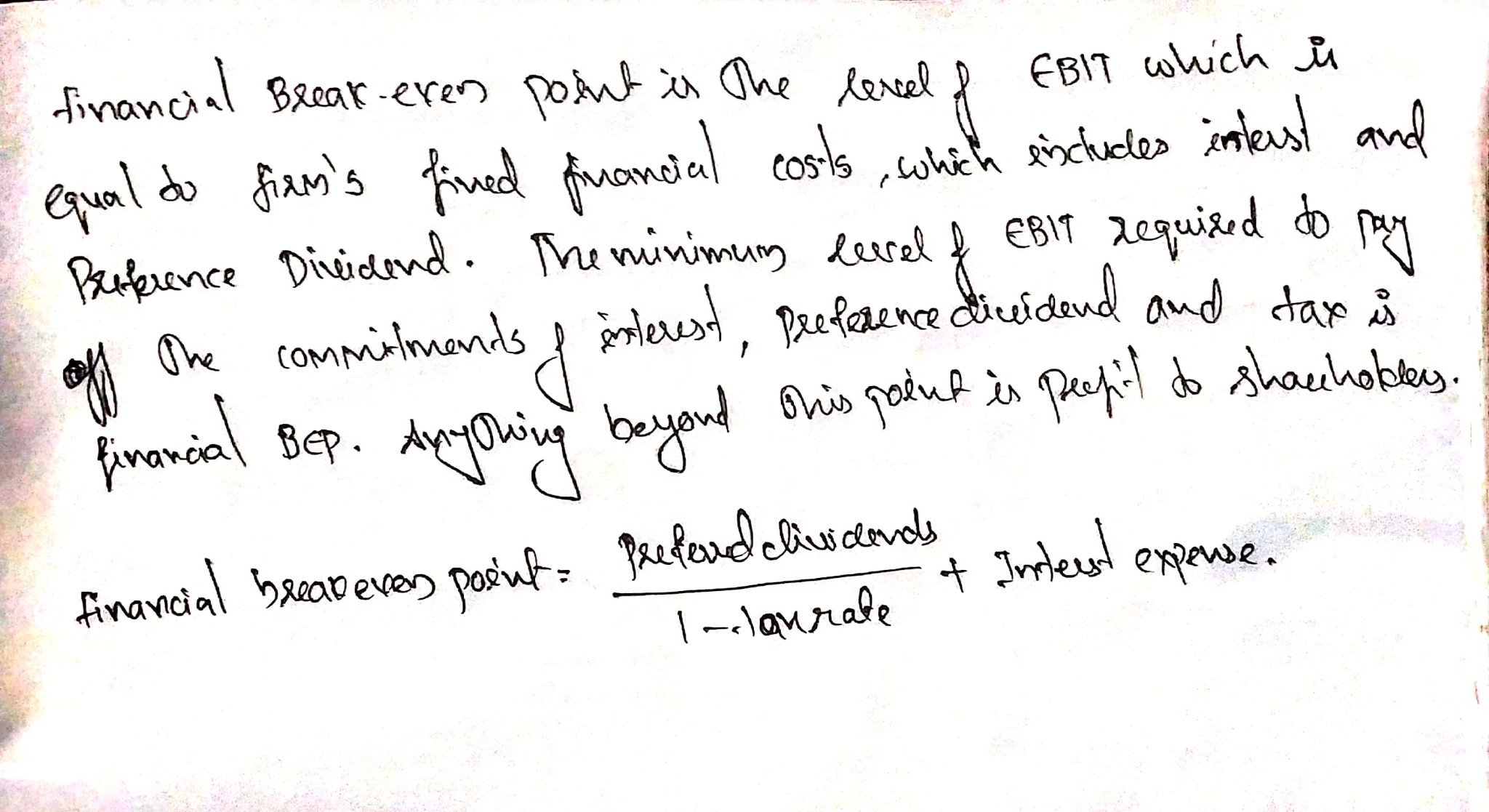

3. Calculate the financial break-even point in number of

units

Solutions

Related Solutions

We are evaluating a project that costs $937,000, has a nine-year life, and has no salvage...

We are evaluating a project that costs $937,000, has a nine-year

life, and has no salvage value. Assume that depreciation is

straight-line to zero over the life of the project. Sales are

projected at 115,000 units per year. Price per unit is $42,

variable cost per unit is $23, and fixed costs are $947,307 per

year. The tax rate is 38 percent, and we require a 12 percent

return on this project.

Requirement 1:

Calculate the accounting break-even point.(Round your...

We are evaluating a project that costs $874,800, has a nine-year life, and has no salvage...

We are evaluating a project that costs $874,800, has a nine-year

life, and has no salvage value. Assume that depreciation is

straight-line to zero over the life of the project. Sales are

projected at 85,000 units per year. Price per unit is $55, variable

cost per unit is $39, and fixed costs are $765,000 per year. The

tax rate is 24 percent, and we require a return of 11 percent on

this project. Suppose the projections given for price, quantity,...

We are evaluating a project that costs $874,800, has a nine-year life, and has no salvage...

We are evaluating a project that costs $874,800, has a nine-year

life, and has no salvage value. Assume that depreciation is

straight-line to zero over the life of the project. Sales are

projected at 85,000 units per year. Price per unit is $55, variable

cost per unit is $39, and fixed costs are $765,000 per year. The

tax rate is 24 percent, and we require a return of 11 percent on

this project. a-1. Calculate the accounting break-even point. (Do...

We are evaluating a project that costs $926,000, has a nine-year life, and has no salvage...

We are evaluating a project that costs $926,000, has a nine-year

life, and has no salvage value. Assume that depreciation is

straight-line to zero over the life of the project. Sales are

projected at 110,000 units per year. Price per unit is $41,

variable cost per unit is $22, and fixed costs are $930,630 per

year. The tax rate is 36 percent, and we require a 16 percent

return on this project.

Requirement 1:

Calculate the accounting break-even point.(Round your...

We are evaluating a project that costs $739,000, has an nine-year life, and has no salvage...

We are evaluating a project that costs $739,000, has an

nine-year life, and has no salvage value. Assume that depreciation

is straight-line to zero over the life of the project. Sales are

projected at 110,000 units per year. Price per unit is $41,

variable cost per unit is $21, and fixed costs are $741,956 per

year. The tax rate is 38 percent, and we require a 13 percent

return on this project. The projections given for price, quantity,

variable costs,...

We are evaluating a project that costs $788,400, has a nine-year life, and has no salvage...

We are evaluating a project that costs $788,400, has a nine-year

life, and has no salvage value. Assume that depreciation is

straight-line to zero over the life of the project. Sales are

projected at 75,000 units per year. Price per unit is $52, variable

cost per unit is $36, and fixed costs are $750,000 per year. The

tax rate is 21 percent, and we require a return of 12 percent on

this project. Suppose the projections given for price, quantity,...

We are evaluating a project that costs $788,400, has a nine-year life, and has no salvage...

We are evaluating a project that costs $788,400, has a nine-year

life, and has no salvage value. Assume that depreciation is

straight-line to zero over the life of the project. Sales are

projected at 75,000 units per year. Price per unit is $52, variable

cost per unit is $36, and fixed costs are $750,000 per year. The

tax rate is 21 percent, and we require a return of 12 percent on

this project. Suppose the projections given for price, quantity,...

We are evaluating a project that costs $788,400, has a nine-year life, and has no salvage...

We are evaluating a project that costs $788,400, has a nine-year

life, and has no salvage value. Assume that depreciation is

straight-line to zero over the life of the project. Sales are

projected at 75,000 units per year. Price per unit is $52, variable

cost per unit is $36, and fixed costs are $750,000 per year. The

tax rate is 21 percent, and we require a return of 12 percent on

this project.

a-1.

Calculate the accounting break-even point....

We are evaluating a project that costs $856,800, has a nine-year life, and has no salvage...

We are evaluating a project that costs $856,800, has a nine-year

life, and has no salvage value. Assume that depreciation is

straight-line to zero over the life of the project. Sales are

projected at 90,000 units per year. Price per unit is $56, variable

cost per unit is $40, and fixed costs are $770,000 per year. The

tax rate is 25 percent, and we require a return of 12 percent on

this project. Suppose the projections given for price, quantity,...

We are evaluating a project that costs $964,000, has a nine-year life, and has no salvage...

We are evaluating a project that costs $964,000, has a nine-year

life, and has no salvage value. Assume that depreciation is

straight-line to zero over the life of the project. Sales are

projected at 87,000 units per year. Price per unit is $43, variable

cost per unit is $24, and fixed costs are $982,316 per year. The

tax rate is 33 percent, and we require a 14 percent return on this

project.

Requirement 1:

Calculate the accounting break-even point.(Round your...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

ADVERTISEMENT

ekkarill92 answered 2 months ago

ekkarill92 answered 2 months ago