Question

In: Economics

What is the impact of a business cycle recession on the interest rate? Show graphically using...

- What is the impact of a business cycle recession on the interest rate? Show graphically using S and D for bonds and using Liquidity preference framework. How are the results different?

Solutions

Expert Solution

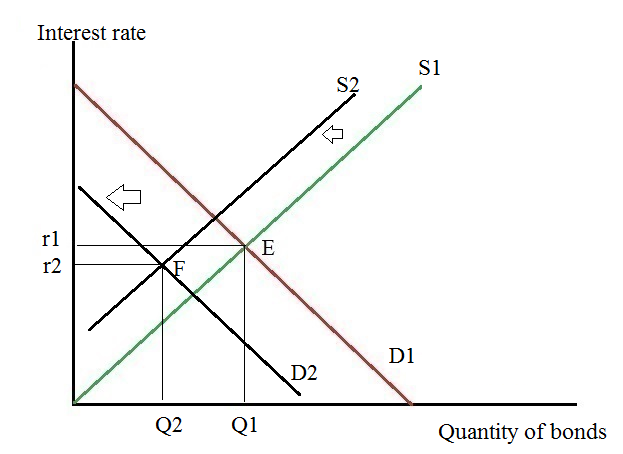

When there is a recession, income of consumers is reduced. Hence both consumption and savings are reduced. Business also consider investing later as expected returns are reduced. Now on one side reduction in private saving would decrease the supply of bonds and on the other reduced expected returns decreases the demand for bonds. Together these two may or may not change the rate of interest on bonds. However it is observed that the supply shift is smaller than demand shift so that interest rate is decreased and price of bonds is increased

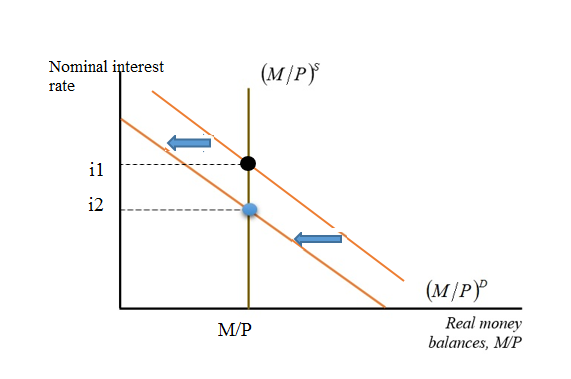

In Liquidity preference framework, reduced income decreases demand for money so that money demand curve shifts down. At the current rate of interest, there is an excess supply of money which implies that there is a downward pressure on the interest to decline. Eventually the money market settles with a lower rate of interest

Hence in both cases, recessions are likely to reduce the rate of interest.

Related Solutions

Following the Great Recession the U.S. Federal Reserve decreased interest rate targets drastically. Show graphically and...

. Following the Great Recession the U.S. Federal Reserve decreased interest rate targets drastically. Show graphically...

ii) Using the market for loanable fund diagram, show graphically and explain how the interest rate...

The bond price and interest rate fall during an economic (business cycle) recession. Do you agree?...

Use the bond market equilibrium to graphically show what will happen to the bond interest rate...

a. Suppose that the rest of the world goes through an economic recession. Show graphically and...

Using an AD- AS model and the classical business cycles framework, show graphically and explain the...

The U.S. economy entered the recession phase of the business cycle in December 2007. The recession...

critical review of the impact of exchange rate and interest rate changes on the business/organisation.

What is meant by the "business cycle"? What are the four stages of this cycle? What is the Trend? Show a diagram.

- C PROGRAMMIMG I want to check if my 2 input is a number or not all...

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

Rahul Sunny answered 3 months ago

Rahul Sunny answered 3 months ago