Question

In: Accounting

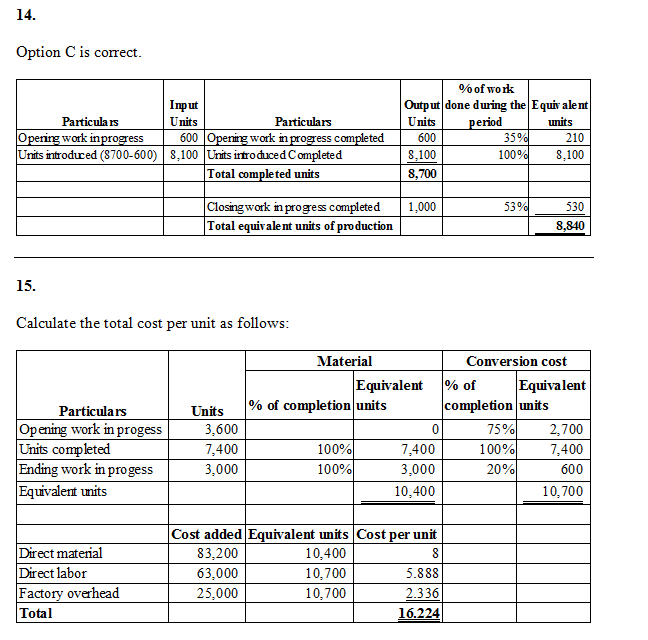

Department S had 600 units 65% completed in process at the beginning of the period; 8,700...

Department S had 600 units 65% completed in process at the beginning of the period; 8,700 units completed during the period; and 1,000 units 53% completed at the end of the period. What was the number of equivalent units of production for the period for conversion if the first-in, first-out method is used to cost inventories? Assume the completion percentage applies to both direct materials and conversion cost.

a.8,100

b.8,310

c.8,840

d.9,840

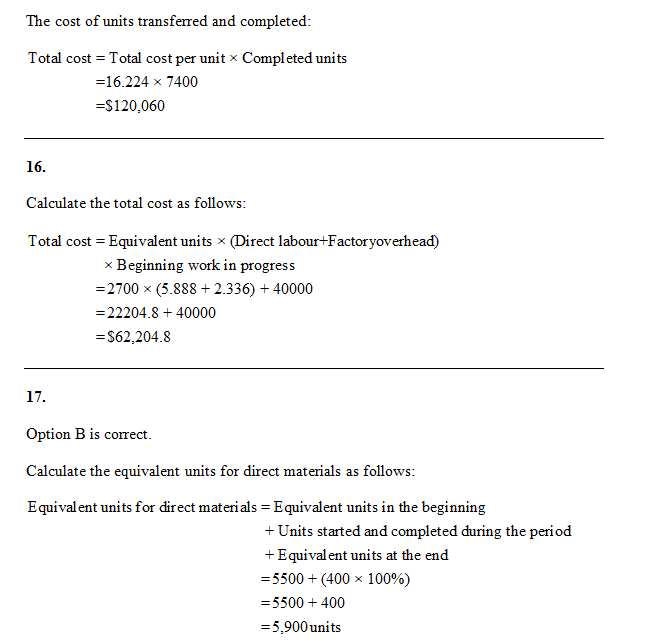

15.

Department G had 3,600 units 25% completed at the beginning of

the period, 11,000 units were completed during the period; 3,000

units were 20% completed at the end of the period, and the

following manufacturing costs debited to the departmental work in

process account during the period:

| Work in process, beginning of period | $40,000 |

| Costs added during period: | |

| Direct materials (10,400 units at $8) | 83,200 |

| Direct labor | 63,000 |

| Factory overhead | 25,000 |

All direct materials are placed in process at the beginning of

production and the first-in, first-out method of inventory costing

is used. What is the total cost of 3,600 units of beginning

inventory which were completed during the period (round unit cost

calculations to four decimal places)?

a.$16,163

b.$62,206

c.$19,275

d.$40,000

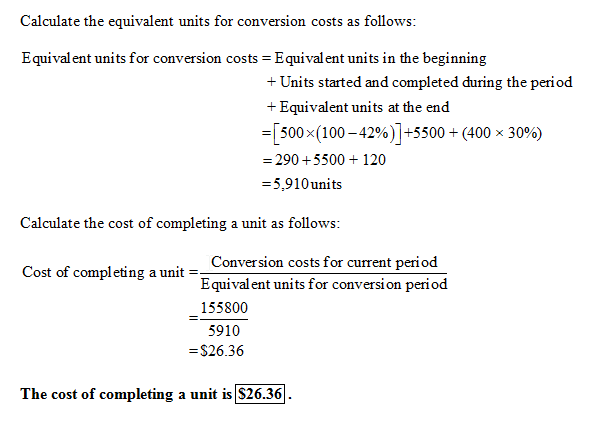

17.

Carmelita Inc., has the following information available:

| Costs from Beginning Inventory | Costs from current Period | |

| Direct materials | $6,000 | $22,900 |

| Conversion costs | 5,200 | 155,800 |

At the beginning of the period, there were 500 units in process that were 42% complete as to conversion costs and 100% complete as to direct materials costs. During the period, 5,500 units were started and completed. Ending inventory contained 400 units that were 30% complete as to conversion costs and 100% complete as to materials costs. The company uses the FIFO process cost method.

The cost of completing a unit during the current period was

a.$45.37

b.$26.36

c.$30.24

d.$36.29

The debits to Work in Process—Assembly Department for May, together with data concerning production, are as follows:

| May 1, work in process: | |

| Materials cost, 3,000 units | $7,500 |

| Conversion costs, 3,000 units, 50% completed | 5,500 |

| Materials added during May, 10,000 units | 25,300 |

| Conversion costs during May | 34,800 |

| Goods finished during May, 11,500 units | 0 |

| May 31 work in process, 1,500 units, 50% completed | 0 |

19. All direct materials are placed in process at the beginning of the process and the first-in, first-out method is used to cost inventories. The materials cost per equivalent unit for May is

a.$3.48

b.$2.20

c.$4.23

d.$2.53

25.

Mocha Company manufactures a single product by a continuous process, involving three production departments. The records indicate that direct materials, direct labor, and applied factory overhead for Department 1 were $100,000, $125,000, and $150,000, respectively. The records further indicate that direct materials, direct labor, and applied factory overhead for Department 2 were $50,000, $60,000, and $70,000, respectively. Department 2 has transferred-in costs of $390,000 for the current period. In addition, work in process at the beginning of the period for Department 2 totaled $75,000, and work in process at the end of the period totaled $90,000. The journal entry to record the flow of costs into Department 3 during the period is

a.

Work in Process—Department 3555,000

Work in Process—Department 2555,000

b.

Work in Process—Department 3375,000

Work in Process—Department 2375,000

c.

Work in Process—Department 3490,000

Work in Process—Department 2490,000

d.

Work in Process—Department 3570,000

Work in Process—Department 2570,000

29. If a department that applies FIFO process costing starts the reporting period with 50,000 physical units that were 25% complete with respect to direct materials and 40% complete with respect to conversion, it must add 12,500 equivalent units of direct materials and 20,000 equivalent units to direct labor to complete them.

True or False

30. Carmelita Inc., has the following information

available:

| Costs from Beginning Inventory | Costs from current Period | |

| Direct materials | 2,000 | $ 22,252 |

| Conversion costs | 6,200 | 150,536 |

At the beginning of the period, there were 500 units in process

that were 60% complete as to conversion costs and 100% complete as

to direct materials costs. During the period, 4,500 units were

started and completed. Ending inventory contained 340 units that

were 30% complete as to conversion costs and 100% complete as to

materials costs. The company uses the FIFO process cost

method.

The equivalent units of production for direct materials and

conversion costs, respectively, were

a.4,602 for direct materials and 4,802 for conversion costs

b.4,902 for direct materials and 4,802 for conversion costs

c.4,840 for direct materials and 4,802 for conversion costs

d.5,340 for direct materials and 4,902 for conversion costs

Solutions

Related Solutions

Department S had 500 units 67% completed in process at the beginning of the period; 7,500...

Department A had 10,000 units in the beginning work in process that is 100% completed with...

The Converting Department of Worley Company had 600 units in work in process at the beginning...

Department W had 2,940 units, one-third completed at the beginning of the period.

Department G had 1,800 units 25% completed at the beginning of the period, 13,200 units were...

Department G had 2,280 units 25% completed at the beginning of the period, 13,900 units were...

Department G had 1,920 units 25% completed at the beginning of the period, 12,800 units were...

Department G had 2,040 units 25% completed at the beginning of the period, 13,800 units were...

Department G had 2,160 units 25% completed at the beginning of the period, 12,300 units were...

Department G had 2,280 units 25% completed at the beginning of the period, 13,400 units were...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

ekkarill92 answered 3 months ago

ekkarill92 answered 3 months ago