Question

In: Accounting

A company is evaluating two independent projects for capital investment purposes. If the company has only...

A company is evaluating two independent projects for capital investment purposes. If the company has only $85 million to invest, and its required return is 10 percent by how much the company’s value will increase?

All values are in millions.

|

Project 1 |

Project 2 |

|

|

0 |

-50 |

-50 |

|

1 |

30 |

0 |

|

2 |

25 |

0 |

|

3 |

20 |

0 |

|

4 |

20 |

150 |

|

26.62 million |

||

|

60.77 million |

||

|

52.45 million |

||

|

45.33 million |

||

|

79.07 million |

Solutions

Expert Solution

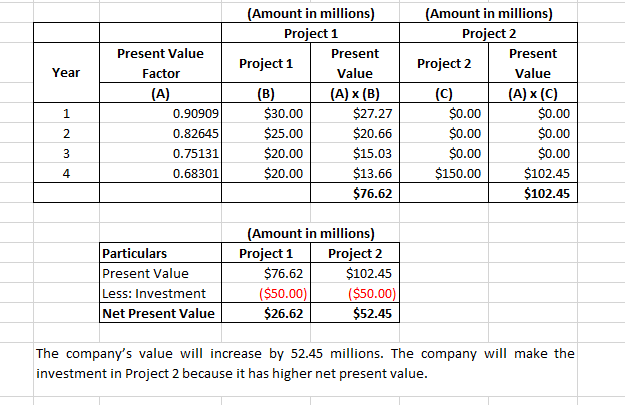

Net Present Value (NPV): It the difference between the present value of cash inflows and initial cash outflow. It helps in making project investment decisions. If the NPV is positive then the project should be accepted and if negative then it should be rejected. Projects with higher NPV should be accepted in case of two projects.

Related Solutions

A company is evaluating two independent projects for capital investment purposes. If the company has only...

A company is evaluating two independent projects for capital

investment purposes. If the company has only $85 million to invest,

and its required return is 10 percent by how much the company’s

value will increase?

All values are in millions.

Project 1

Project 2

0

-50

-50

1

30

0

2

25

0

3

20

0

4

20

150

A) 52.45 million

B) 26.62 million

C) 79.07 million

D) 60.77 million

E) 45.33 million

Proka is evaluating two projects for investment purposes. The required return for each project is 8...

Proka is evaluating two projects for investment purposes. The

required return for each project is 8 percent and the cash flows

are listed below:

YEar

Project A

Project B

Cash flow in $

Cash Flow in $

1

100

300

2

400

400

3

400

400

4

400

400

5

300

100

1. Calculate the net present value for each stream

2. Calculate the net present value of each cash flow stream at 0

percent discount rat

Your company is evaluating the following 9 independent indivisible projects. The company’s capital budgeting for the...

Your company is evaluating the following 9 independent

indivisible projects. The company’s capital budgeting for the year

is limited to a maximum of $20,000.

Use solver with simplex linear programing method to find the set

of projects that should be included in the capital budget. (Mark

all that applies)

Project

NPV

cost

A

500.00

2,000.00

B

2,000.00

7,000.00

C

1,800.00

3,000.00

D

3,000.00

5,000.00

E

800.00

2,200.00

F

1,700.00

5,000.00

G

1,800.00

4,000.00

H

3,500.00

5,800.00

I

2,200.00

4,800.00

The following are two independent projects that you are evaluating. The first project has cash flows...

The following are two independent projects that you are

evaluating. The first project has cash flows of −$161,900, $60,800,

$162,300, and -$75,000 for Years 0 to 3, respectively. The second

project has cash flows of −$175,600, $261,800, -$165,000, $145,000

and -$75,000. Which of these, best summarizes your situation?

A. Project 1 has 2 IRRs and Project 2 has 2 IRRs. Therefore, we

should not use IRR to evaluate the projects.

B. Project 1 has 1 IRR and Project 2 has...

Alternative Capital Investments The investment committee of Sentry Insurance Co. is evaluating two projects, office expansion...

Alternative Capital Investments

The investment committee of Sentry Insurance Co. is evaluating

two projects, office expansion and upgrade to computer servers. The

projects have different useful lives, but each requires an

investment of $490,000. The estimated net cash flows from each

project are as follows:

Net Cash Flows

Year

Office Expansion

Servers

1

$125,000

$165,000

2

125,000

165,000

3

125,000

165,000

4

125,000

165,000

5

125,000

6

125,000

The committee has selected a rate of 12% for purposes of net...

Canadian Metal, Mining, and Petroleum Company are analyzing two projects for possible investment. Only one investment...

Canadian Metal, Mining, and Petroleum Company are analyzing two

projects for possible investment. Only one investment will be made.

The first project is an oil? drilling project in Alberta at a cost

of $500 million that will produce $100 million per year in Years 5

through 10 and $200 million per year in Years 11 through 20. The

second project is an expansion of an aluminum smelter in Mapletree,

Quebec, and will cost $500 million and will produce $87 million...

Canadian Metal, Mining, and Petroleum Company is analyzing two projects for possible investment. Only one investment...

Canadian Metal, Mining, and Petroleum Company is analyzing two

projects for possible investment. Only one investment will be made.

The first project is an oil drilling project in Alberta at a cost

of $620 million that will produce $124 million per year in Years 5

through 10 and $260 million per year in Years 11 through 20. The

second project is an expansion of an aluminum smelter in Mapletree,

Quebec, and will cost $620 million and will produce $111 million...

Moe’s Tablet Warehouse is evaluating two potential projects. Project A has an initial investment of $800...

Moe’s Tablet Warehouse is evaluating two potential projects.

Project A has an initial investment of $800 and yearly cash flows

of $500, $600, and $700. Project B has an initial investment of

$500 and yearly cash flows of $300, $400, and $500. Moe’s has a

rate of return of 8%. Which project has the greater profitability

index and what is its PI?

Group of answer choices Project A. Its PI is 0.916.

Project B. Its PI is 0.823.

Project A....

JK Products is evaluating an investment in either of two competing projects that will allow the...

JK Products is evaluating an investment in either of two

competing projects that will allow the company to eliminate a

production bottleneck and meet the growing demand for its products.

The company’s engineering department narrowed the alternatives down

to two –MD and HD. A project specialist developed the following

estimates of cash flows for MD and HD over the relevant six-year

time horizon. The company has an 11% required return and views

these projects as equally risky.

Project MD

Project...

Petram company is considering two alternative capital budgeting projects. Project A is an investment of $300,000...

Petram company is considering two alternative capital budgeting

projects. Project A is an investment of $300,000 to renovate office

facilities. Project B is an investment of $600,000 to expand

diagnostic capabilities. Relevant cash flow data for the two

projects over their expected two-year lives are as follows:

Year 1

Year 2

Pr.

Cash Flow

Pr.

Cash Flow

Project A

0.18

$ 0

0.08

$ 0

0.64

100,000

0.84

100,000

0.18

200,000

0.08

200,000

Project...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

ADVERTISEMENT

ekkarill92 answered 3 months ago

ekkarill92 answered 3 months ago