Question

In: Computer Science

The First National Bank of Parkville recently opened up a new “So You Want to Be...

The First National Bank of Parkville recently opened up a new “So You Want to Be a Millionaire” savings account. The new account works as follows:

- The bank doubles the customer’s balance every year until the customer’s balance reaches one million.

- The customer isn’t allowed to touch the money (no deposits or withdrawals) until the customer’s balance reaches one million. If the customer dies before becoming a millionaire, the bank keeps the customer’s balance.

- Note:Customers close to $1,000,000 tend to get “accidentally” run over in the bank’s parking lot.

Write a java program that prompts the user for a starting balance and then prints the number of years it takes to reach $100,000 and also the number of years it takes to reach $1,000,000.

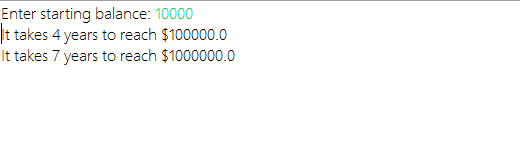

Sample session:

Enter starting balance: 10000

It takes 4 years to reach $100,000.

It takes 7 years to reach $1,000,000.

Solutions

Expert Solution

/*Java program that prompts user to enter the

starting balance and then find a number of years to reach 100000$

and number of years to reach 1000000$

*/

//Millionaire.java

import java.util.Scanner;

public class Millionaire

{

public static void main(String[] args)

{

//create an instance of Scanner

class

Scanner kboard=new

Scanner(System.in);

//declare variables

double balance=0;

double amount=0;

int year=0;

boolean run=true;

//set one lack

final double

ONE_LACK=1_000_00;

//set one million

final double

ONE_MILLION=1_000_000;

System.out.print("Enter starting

balance: ");

//read balance from keyboard

balance=Double.parseDouble(kboard.nextLine());

//set balance

amount=balance;

//Loop to reach one lack

while(amount<=ONE_LACK

&& run )

{

//double the

amount

amount=2*amount;

//increment the

year by 1

year++;

if(amount>=ONE_LACK)

//set run to false if amount reached

100000

run=false;

}

//print the years to reach one lack

dollars

System.out.println("It takes

"+year+" years to reach $"+ONE_LACK);

//Reset year to 0

year=0;

//Reset run to true

run=true;

//set balance to amount

amount=balance;

//Loop to reach one million

while(amount<=ONE_MILLION

&& run )

{

//double the

amount

amount=2*amount;

//increment the

year by 1

year++;

//set run to

false if amount reached 1000000

if(amount>=ONE_MILLION)

run=false;

}

//print the years to reach one

million dollars

System.out.println("It takes

"+year+" years to reach $"+ONE_MILLION);

}

}

--------------------------------------Sample

Run#---------------------------------------------------------------

Related Solutions

In 2009, New York First National Bank acquired New Jersey National Bank. In an exchange, New...

The Clearwater National Bank is planning to set up a new branch.This new branch is...

Recently, the Smithsonian Museum in Washington DC has opened a new national museum of African American...

You are the employed by the First National Bank. This bank has $5 million in capital....

You are the employed by the First National Bank. This bank has $5 million in capital....

You opened an account and deposited X Dollars on January 1, 2002 in National City Bank....

You are a new company that have just opened up. You need to implement a privileged...

First National Bank Balance sheet Assets &

You have an opportunity to acquire a property from First Capital Bank. The bank recently obtained...

a) On the first day of the month Javier opened a bank account in the name...

- In long paragraphs answer the questions below: Discuss the key components (where, when, what) and causes...

- Sinkal Co. was formed on January 1, 2018 as a wholly owned foreign subsidiary of a...

- Larry’s best friend, Garfield, owns a lasagna factory. Garfield’s financial skills are not very strong, so...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

venereology answered 4 months ago

venereology answered 4 months ago