Question

In: Economics

Answer the following questions concerning covered and uncovered interest rate differentials and parity conditions: a. Suppose...

- Answer the following questions concerning covered and uncovered interest rate differentials and parity conditions:

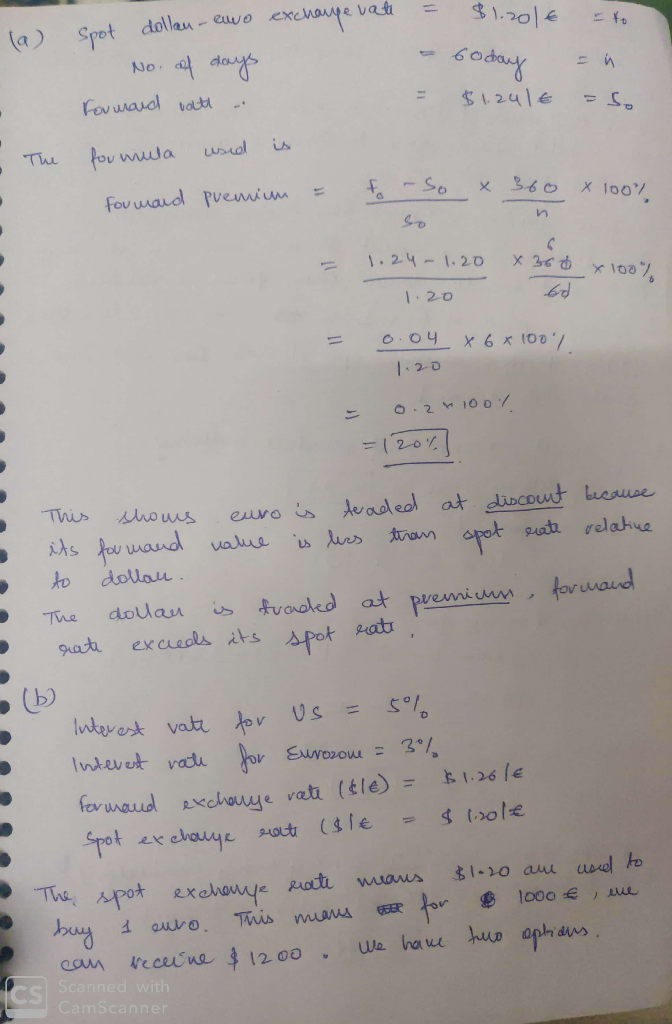

a. Suppose the spot dollar-euro exchange rate is $1.20/€ , and the 60-day forward rate is $1.24/€. Is the euro selling at a forward discount or premium? What about the dollar?

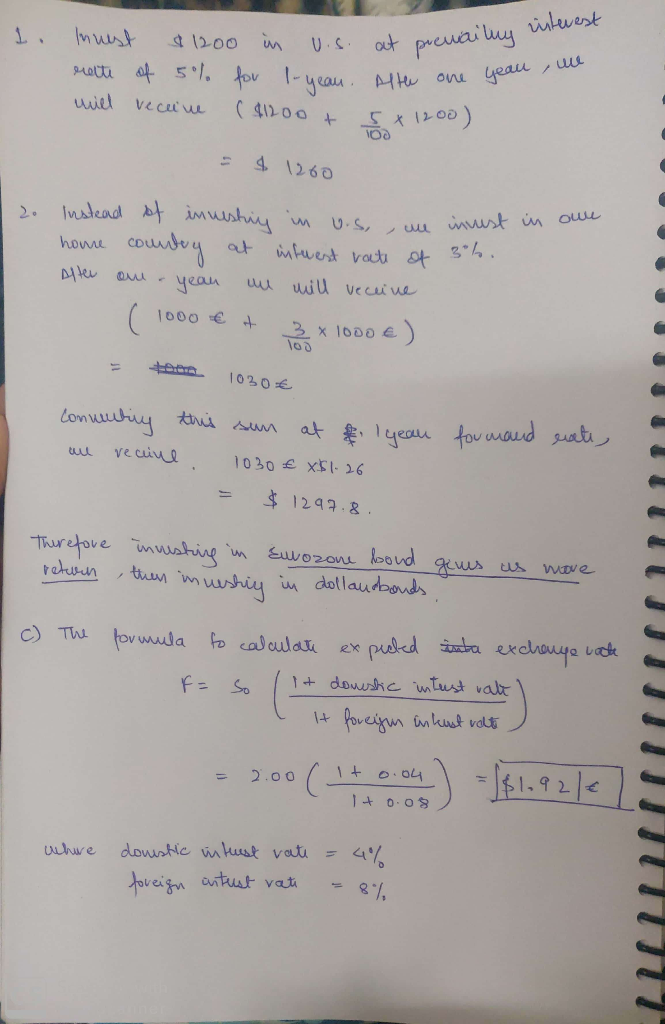

b. Now suppose the interest rates on one-year U.S. and Eurozone (EMU) bonds are rUS = 5% and rEMU = 3%. You expect that, one year from now, the dollar-euro exchange rate will be at $1.26/€. Today the rate is $1.20/€. Which should you invest in, the U.S. or EMU bond? Explain Hint use uncovered interest rate parity to get your answer.

c. Suppose the interest rate is 4% in the US and 8% in the UK. If the actual exchange rate is e = $2.00/£1 (home is the US), what must the expected exchange rate ee be?

Solutions

Related Solutions

covered and uncovered interest rate parity

What is the difference between covered and uncovered interest rate parity? What are the formulas?

Questions 1 and 2 will use the results of uncovered interest rate parity. Uncovered interest rate parity...

Questions 1 and 2 will use the results of uncovered interest

rate parity. Uncovered interest rate parity states that

the domestic return must equal the foreign return (FR), where FR =

- i* + (Ee– E)/E. This

relationship can also be solved for the spot rate, which would

yield E = Ee/ (1 + i -

i*)

1. This question concerns the determination of the

foreign return. Assume that the expected exchange rate is equal to

2.5 and that the foreign interest rate is equal...

Covered and uncovered interest rate parity, Purchasing Power Parity (25) Explain the difference between the covered...

Covered and uncovered interest rate

parity, Purchasing Power Parity (25)

Explain the difference between the covered and the uncovered

interest rate parity. What is the underlying idea behind these

concepts? How does it relate to the Purchasing Power Parity and

what are the differences? (10)

Suppose the one-year interest rate in the US is 5.5% and in

Germany is 6.0%. The dollar per Euro exchange rate is 1.20. What is

the current forward exchange rate on a 1-year contract? (5)...

Questions 1 and 2 will use the results of uncovered interest rate parity. Uncovered interest rate...

Questions 1 and 2 will use the results of uncovered interest

rate parity. Uncovered interest rate parity states that the

domestic return must equal the foreign return (FR), where FR = -

i* + (Ee – E)/E. This relationship can also

be solved for the spot rate, which would yield E = Ee /

(1 + i - i*)

1. This question concerns the determination of the foreign

return. Assume that the expected exchange rate is equal to 2.5 and...

If the purchasing power parity and uncovered interest parity conditions simultaneously hold true, then it is...

If the purchasing power parity and uncovered interest parity

conditions simultaneously hold true, then it is unambiguously true

that:

Select one:

a. people can profit from arbitrage in goods and financial

markets.

b. real interest rates are equalized.

c. foreign exchange markets are efficient.

d. there is covered interest parity.

If country X has a relative abundance of capital and country Y

has a relative abundance of labor, then the factor proportions

theory predicts that:

Select one:

a. if the...

Explain the theory of uncovered and uncovered interest rate parity. If you borrow Euros at 0.5%...

Explain the theory of uncovered and uncovered interest rate

parity. If you borrow Euros at 0.5% interest, convert to dollars

and deposit at 2.35% what future spot exchange rate would make

uncovered interest rate parity hold?

essay question: Discuss the difference between covered and uncovered interest parity and explain both concepts

essay question: Discuss the difference between covered and

uncovered interest parity and explain both concepts

Interest Rate Parity and Covered Interest Arbitrage Suppose you are a currency trader and you have...

Interest Rate Parity and Covered Interest

Arbitrage

Suppose you are a currency trader and you have the following

information:

Spot rate:

$1.30/£

One year interest rate for the U.S.

dollar:

3%

One year interest rate for the pound:

2%

Please calculate the one-year forward rate based on the

Interest Rate Parity.

2. If the actual one-year forward is quoted at $1.28/£, do you

find a covered interest arbitrage opportunity? Please explain.

3. If there exists a covered interest...

Part III: Interest Rate Parity and Covered Interest Arbitrage Assume the following information: Current spot rate...

Part III: Interest Rate Parity and Covered Interest

Arbitrage

Assume the following information:

Current spot rate of Australian

dollar

=

$.65

Forecasted spot rate of Australian dollar 1 year from now

=

$.69

1-year forward rate of Australian dollar

=

$.68

Annual interest rate for Australian dollar deposit

=

5%

Annual interest rate in the United States

=

8%

According to Interest Rate Parity, is the covered interest

arbitrage feasible to U.S. investors and Australian investors?

Please explain your answers...

Covered Interest Parity a.Show how the equation in covered interest parity is derived. Explain the theory....

Covered Interest Parity

a.Show how the equation in covered interest parity is derived.

Explain the theory.

b.Assume the current $/Euro exchange rate on the $/Euro exchange

rate on the FORWARD market is 1.05 dollars per Euro. If the US

interest rate is 6% and the EU interest rate is 10%, show what the

current $/Euro SPOT market exchange would be under the theory of

covered interest rate parity.

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

- How many grams are in a 0.10 mol sample of ethyl alcohol?

ADVERTISEMENT

Rahul Sunny answered 4 months ago

Rahul Sunny answered 4 months ago