Question

In: Finance

John Doe has just been offered a home loan towards purchase of house that is being...

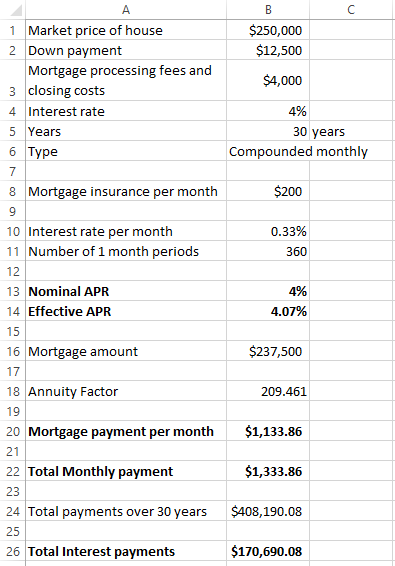

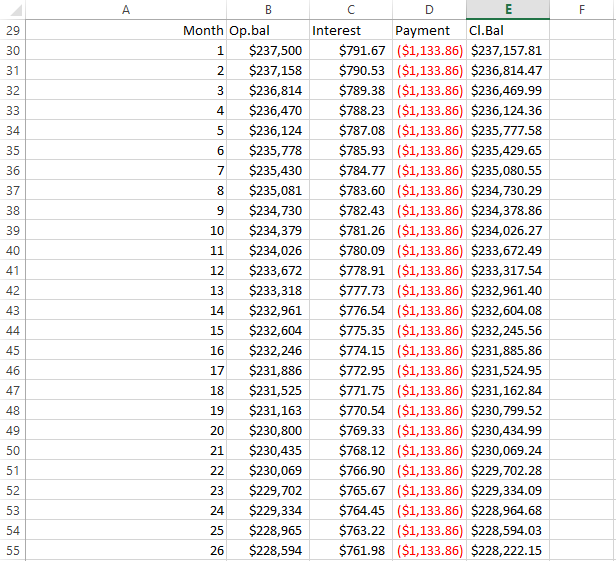

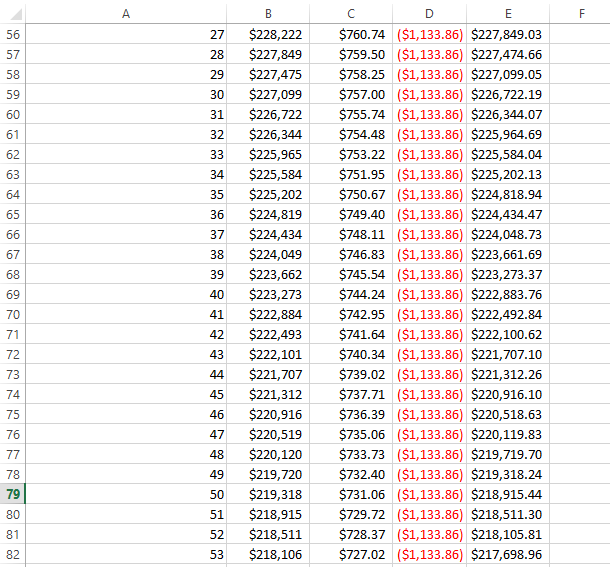

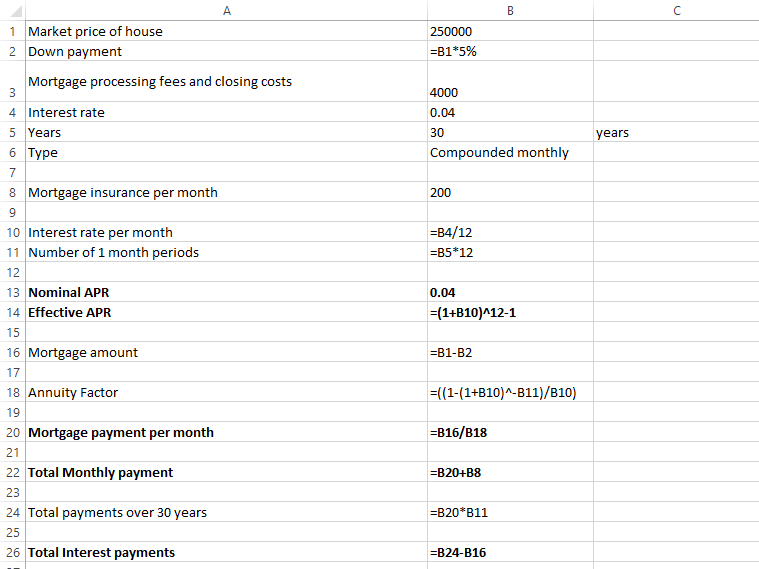

John Doe has just been offered a home loan towards purchase of house that is being sold for $250,000.He will be required to make a 5% down payment, as well as mortgage processing fees and closing costs of $4,000. The loan has to be paid off in monthly payments over a 30-year period at a fixed interest rate of 4% per year compounded monthly. He will also be required to pay an additional $200 per month as mortgage insurance. Using Excel, answer the following questions:(PLEASE SHOW FORMULA)

The monthly mortgage payment is _______

The total monthly payment is _________

The nominal APR is________

The effective APR is_________

Over the 30-year period, the total amount of interest paid on the loan is__________

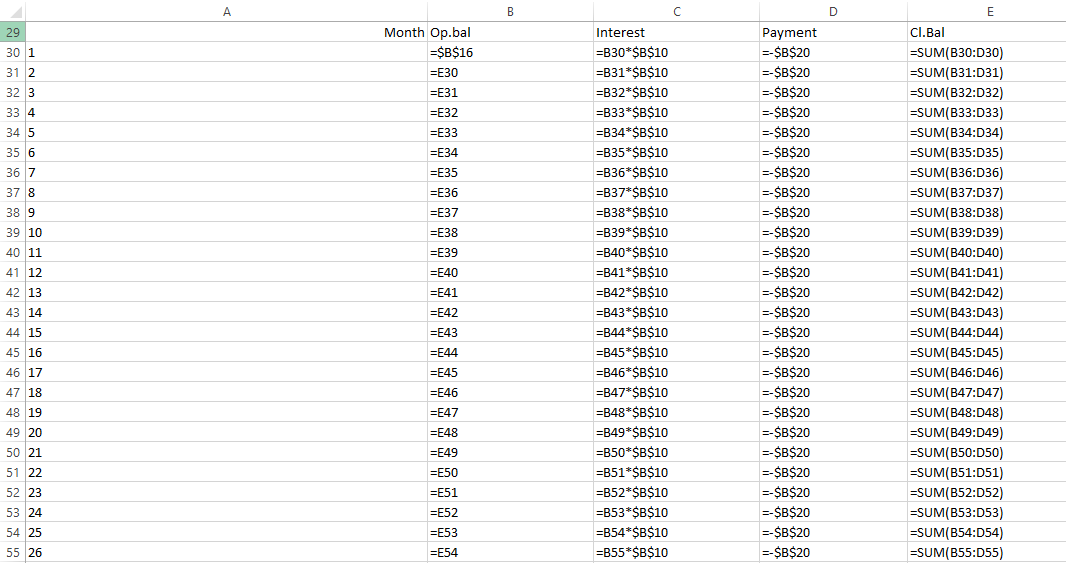

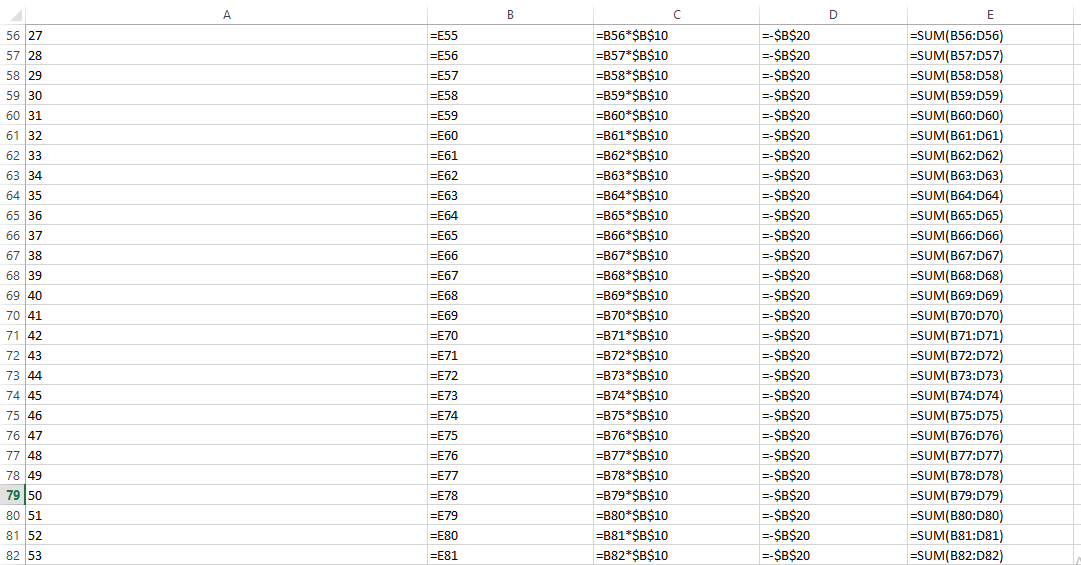

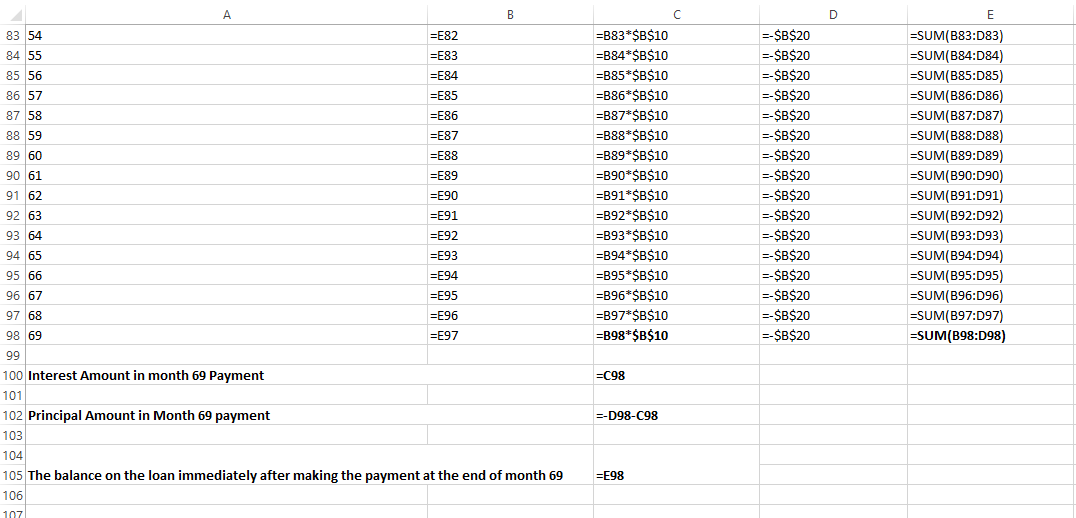

The interest amount in the month 69 payment is __________

The principal amount in the month 69 payment is _________

The balance on the loan immediately after making the payment at the end of month 69 is___________

Solutions

Expert Solution

The same images with formulas shown:

The monthly mortgage payment is $1,133.86

The total monthly payment is $1,333.86

The nominal APR is 4%

The effective APR is 4.07%

Over the 30-year period, the total amount of interest paid on the loan is $170,690.08

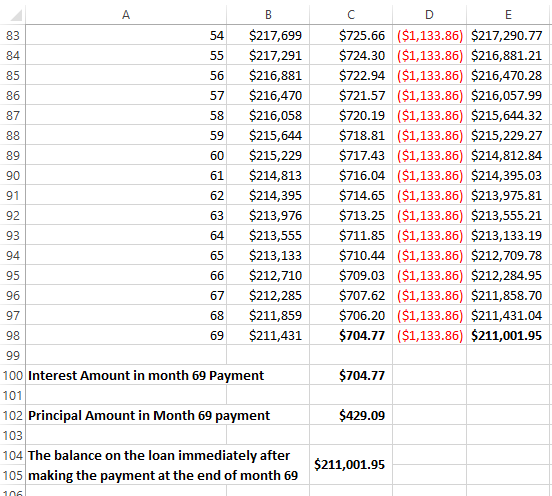

The interest amount in the month 69 payment is $704.77

The principal amount in the month 69 payment is $429.09

The balance on the loan immediately after making the payment at the end of month 69 is $211,001.95

Related Solutions

John Doe has just been offered a home loan towards purchase of house that is being...

Jane has been offered a Price Level Adjusted Mortgage Loan of 100,000 to purchase a small...

John decides to purchase a home from Mary. Mary has John move in, pay $10,000 as...

Loan rates of interest Personal Finance Problem John Flemming has been shopping for a loan to...

In public school there has been a new contract system that is being offered to teachers,...

Michael Jordan has just arranged to purchase an $825,000vacation home in the Bahamas with a...

Brooks Bright (BB) has applied for a loan of $800,000 to purchase a residential house from...

A) A bond with 30 detachable warrants has just been offered for sale at $1,000. The...

Sarah secured a bank loan of $155,000 for the purchase of a house. The mortgage is...

Sarah secured a bank loan of $185,000 for the purchase of a house. The mortgage is...

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

jeff jeffy answered 4 months ago

jeff jeffy answered 4 months ago