Question

In: Economics

Two investments involving a virtual mold apparatus for producing dental crowns qualify for different property classes....

Two investments involving a virtual mold apparatus for producing dental crowns qualify for different property classes. Investment A has a cost of $52,500, lasts 9 years with no salvage value, and costs $150,000 per year in operating expenses. It is in the 3-year property class. Investment B has a cost of $79,000.00, lasts 9 years with no salvage value, and costs $125,000 per year. Investment B, however, is in the 7-year property class. The company marginal tax rate is 25%, and MARR is an after-tax 10%.

a. Based upon the use of MACRS-GDS depreciation, compare the AW of each alternative.Which should be selected? (Investment A; Investment B)

b. What must be Investment B's cost of operating expenses for these two investments to be equivalent?

Solutions

Expert Solution

-

Step 1 of 6

(a)

Two alternative projects are given, and one is required to be selected.

Comment

-

Step 2 of 6

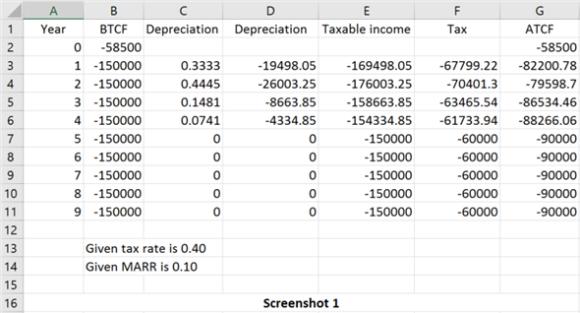

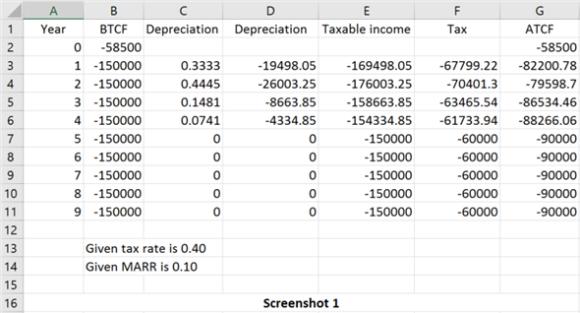

Alternative 1 : The cost of the project is $58,500. The life of the project is 9 years. It is given that MACRS-GDS 3-year property class is applicable here for depreciation. The rates are 33.33%, 44.45%, 14.81%, and 7.41%. E.g. the depreciation for year 1 is $19,498.05 (which is 33.33% of $58,500.) Write the after-tax cash flows in a spreadsheet, as shown in Screenshot 1.

Taxable income is calculated by summing up values in columns B and D. Tax is calculated by multiplying taxable income by 0.40. After-tax cash flow is calculated by subtracting tax from before-tax cash flow.

Comment

-

Step 3 of 6

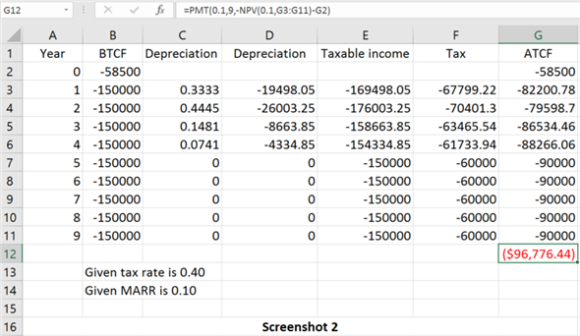

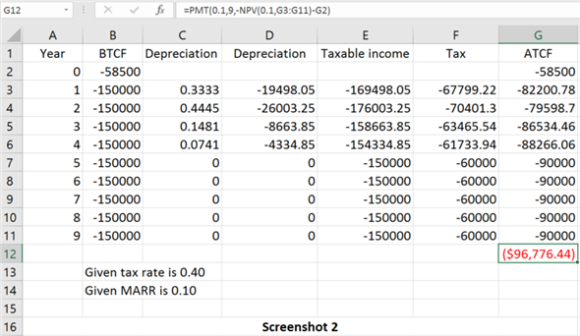

Now calculate AW. To do that, click on any empty cell and type: =PMT(0.1,9,-NPV(0.1,G3:G11)-G2). And press Enter.

As shown in the screenshot above, the annual worth Annual Worth of Alternative A is

.

.Comment

-

Step 4 of 6

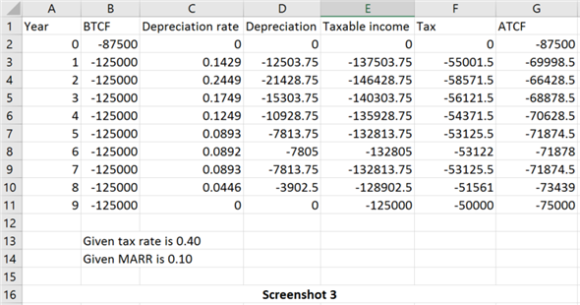

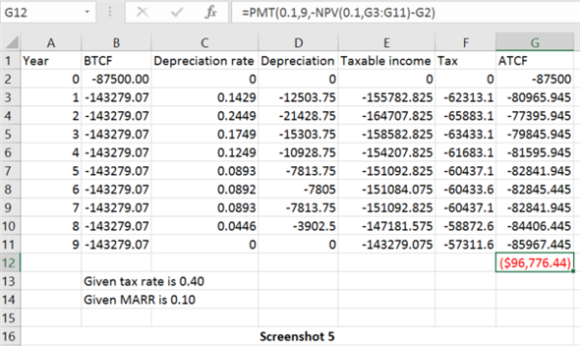

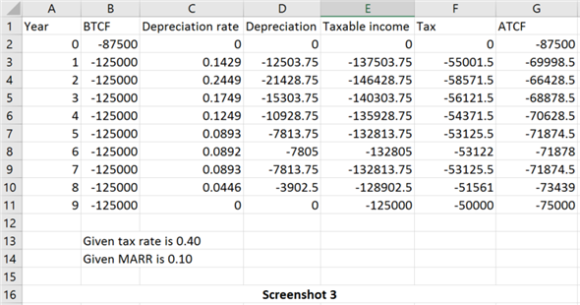

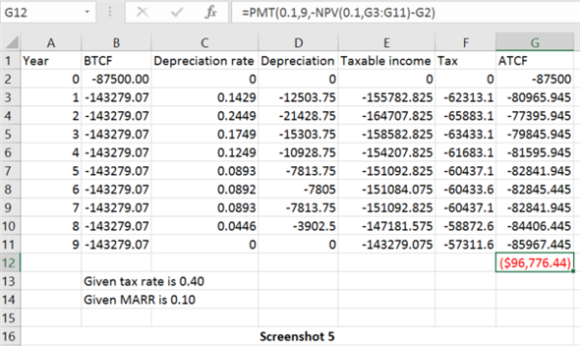

Alternative 2 : The cost of the project is $87,500. The life of the project is 9 years. It is given that MACRS-GDS 9-year property class is applicable here for depreciation. The rates are 14.29%, 24.49%, 17.49%, 12.49%, 8.93%, 8.92%, 8.93%, and 4.46%. E.g. the depreciation for year 1 is $12,503.75 (which is 14.29% of $87,500.) Write the after-tax cash flows in a spreadsheet, as shown in Screenshot 3.

Taxable income is calculated by summing up values in columns B and D. Tax is calculated by multiplying taxable income by 0.40. After-tax cash flow is calculated by subtracting tax from before-tax cash flow.

Comment

-

Step 5 of 6

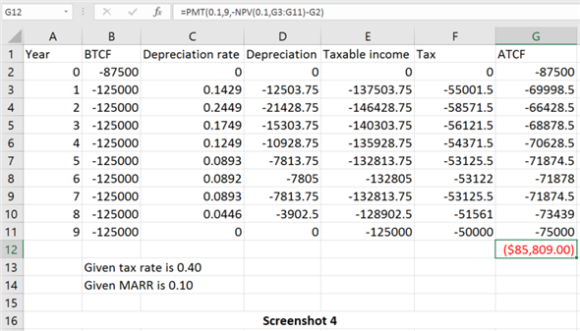

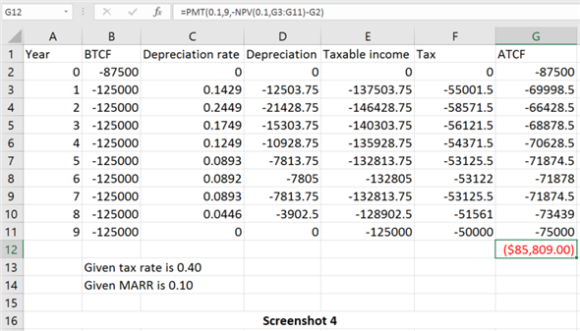

Now calculate AW. To do that, click on any empty cell and type: =PMT(0.1,9,-NPV(0.1,G3:G11)-G2). And press Enter.

As shown in the screenshot above, the annual worth Annual Worth of Alternative B is

.

.Since the annual worth of alternative B is higher than the annual worth of alternative A (i.e.

), Alternative

B should be selected.

), Alternative

B should be selected.Comment

-

Step 6 of 6

(b)

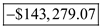

Currently, Alternative B’s operating expenses are $125,000. The level of operating expenses that make the two alternatives equivalent is required to be calculated.

To do this, “What if analysis” is required.

Go to the spreadsheet as shown in screenshot 4. Now type “=B3” (without quotes) in cell B4 and press Enter. Do the same for cells B5, B6, B7, B8, B9, B10, and B11. That is, type “=B3” (without quotes) in each of these cells and press Enter. Doing this will help us in our “What if analysis,” although no change will be observed in the spreadsheet values as of now.

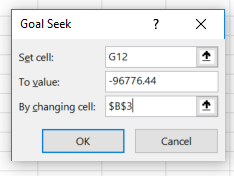

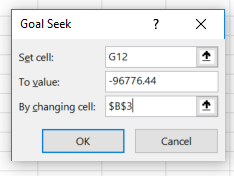

Now press on “Data” tab and then press on “What if analysis” tab and select “Goal Seek.” A small goal seek window will come up. Fill up the required fields as follows:

Press OK. The value in cell B3 has changed to

as shown in Screenshot 5, and the annual

worth of alternative B is now the same as that of alternative

A.

as shown in Screenshot 5, and the annual

worth of alternative B is now the same as that of alternative

A.

Hence, the two alternatives will be equivalent in value if the operating expenses of Alternative B were

.

.

Related Solutions

1. Identify the three classes of noninfluential and two classes of influential investments in securities. 2....

Identify two chemical classes of hormones, how do these different hormone classes affect the way these...

Two different compilers are being tested for a 4 GHz. machine with three different classes of...

There are two different formulas for producing an oxygenated fuel for engines, which provide different octane...

1. Cap rates vary considerably across the different property types/classes. Please explain in detail what is...

Assume that there two investments of different risk. A return of 0.05 is required on one...

#4 **Below are two samples of test scores from two different calculus classes. It is believed...

Given the two sequences below, there are five possible DNA alignments involving different placements of a...

A person wants to invest $14,000 for 3 years and is considering two different investments. The...

Consider two different implementations of the same ISA. There are four classes of instructions, Arithmetic, Store,...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

.

.

.

. ), Alternative

B should be selected.

), Alternative

B should be selected.

as shown in Screenshot 5, and the annual

worth of alternative B is now the same as that of alternative

A.

as shown in Screenshot 5, and the annual

worth of alternative B is now the same as that of alternative

A.

.

. Rahul Sunny answered 3 years ago

Rahul Sunny answered 3 years ago