Question

In: Operations Management

1. Cap rates vary considerably across the different property types/classes. Please explain in detail what is...

1. Cap rates vary considerably across the different property types/classes. Please explain in detail what is responsible for these differences. (i.e., what is driving the differences in cap rates across the different property types)

Solutions

Expert Solution

Ans:

Capitalization rate is the real estate price valuation measure used to compare different properties and different real estate investment.

Factors responsible for these differences are:

(i) Age, Location of property: If the property is very old than the cap rate will be different comapred to new property.

(ii) Type of property: For office use, Manufacturing, industrial, commercial, residential, etc.

(iii) Lease and rental receipts.

(iv) Market rate of property prevaling in the market.

(v) Term and structure of tanent's lease

(vi) Income status of buyer.

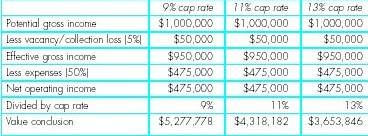

From the above table we can see that there is different percentage of cap rate. first, cap rate is 9%. secondly 11% and lastly 13% and the potential growth income remains same in all three situations.

Now we can arrive at conclude from the above that the value or price is more when cap rate is 9% as compared to the price when cap rate is 11% and 13%. Thus cap rate vary considerably across the different property types/classes.

Related Solutions

Explain with reference to Expectation Theory that how interest rates vary across maturities.

Using*************** C++ **************** explain what Objects and Classes are. Please describe in detail.

What are the different types of unemployment? List them, Please discuss in detail.

1) Explain the different types of ion channels. 2) Explain in detail the glucose symporter. How...

Each type of business entity is affected by taxation. However, tax rates vary among the many different types...

What are different types of retails and the wholesalers? Discuss in detail

What are the core causes of Social Problem? Explain why they vary across societies, in historical...

1) How do individual beliefs about afterlife vary across countries? What factors impact these variations? please...

In a brief paragraph, please explain what are the different types of polymerization reactions and give...

please explain in detail What is the PCAOB? Please explain what is the law, a describiton...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

- 1. The activation energy of a certain reaction is 41.5kJ/mol . At 20 ?C , the...

- Give TWO pieces of evidence that you've successfully made methyl salicylate. Remember when you cite TLC...

- Describe briefly the evolution of Craniata and Vertebrata.

keosha answered 1 year ago

keosha answered 1 year ago