Question

In: Finance

You have $600 in an account which pays 4.5 % compounded annually. How many additional dollars...

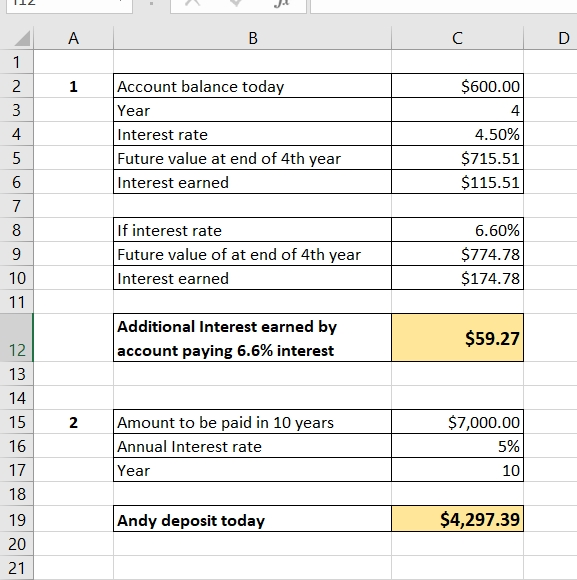

You have $600 in an account which pays 4.5 % compounded annually. How many additional dollars of interest would you earn over 4 years if you moved the money to an account earning 6.6 %?

How many additional dollars of interest would you earn over 4 years from the account that pays 6.6 %?

$___ (Round to the nearest cent.)

Andy promises to pay Opie $7,000 when Opie graduates from Mayberry University in 10 years. How much must Andy deposit today to make good on his promise, if he can earn 5 % on his investments?

How much must Andy deposit today to make good on his promise?

$ ___(Round to the nearest cent.)

Solutions

Expert Solution

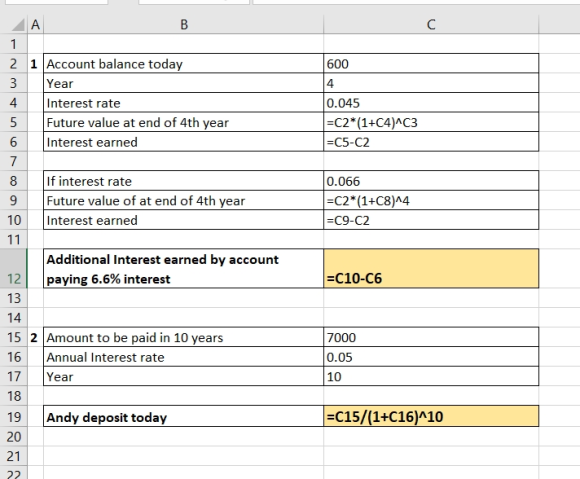

Please refer to below spreadsheet for calculation and answer. Cell reference also provided.

Cell reference -

Related Solutions

if you have $21,000 in an account which pays 2.9% compounded annually how many additional dollars...

You deposit $600 in an account earning 3% interest compounded annually. How much will you have...

Would you rather have a savings account that pays 5% compounded annually, or an account that...

Your investment account pays 8.2%, compounded annually. If you invest $5,000 today, how many years will...

You plan to make a deposit today to an account that pays 6% compounded annually that...

you deposit $500 today in a savings account that pays 6% interest, compounded annually. How much...

Your savings account is currently worth $5,000. The account pays 2.5% interest compounded annually . How...

after depositing 23795890.29 today into an account which offers 12% compounded annually, how many times will...

Suppose you have an opportunity to invest in a fund that pays 13% interest compounded annually....

A person invested 2,000,000 SR in an account that pays 10% compounded annually. The first withdraw...

- Redox/Oxidation lab with Metals and Halogens So basically we were testing different reactions and observing changes....

- CORAL LANGUAGE ONLY Write a function DrivingCost with parameters drivenMiles, milesPerGallon, and dollarsPerGallon, that returns the...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

jeff jeffy answered 1 year ago

jeff jeffy answered 1 year ago