Question

In: Finance

Bill is comparing the risk of two bonds. Both bonds were issued by Whole Giant Foods....

Bill is comparing the risk of two bonds. Both bonds were issued by Whole Giant Foods. The first bond has a 9% coupon and the second bond has a 7% coupon. Both bonds have 6 years remaining until maturity and a yield to maturity of 6%.. If market interest rates decrease by 2%, what is the percent price change for each of these bonds? Please show your work

Annual Coupon

Solutions

Expert Solution

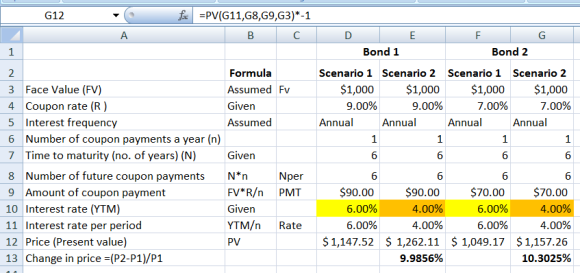

Price is calculated using the PV function of Excel.

Percentage change in price is assessed as follows:

Bond 1: 9.9856%

Bond 2: 10.3025%

Details of calculation as follows:

Related Solutions

Bonds, for a federal treasury bill, were issued with a face value of $250,000 and a...

Bonds, for a federal treasury bill, were issued with a face

value of $250,000 and a coupon rate of 0.20% per quarter, and

payments are quarterly. This bond is bought in the bond market

before maturation, and there are only 16 payments remaining. The

next payment is due after three months (one quarter), which you

collect if you buy this bond now. How much are you ready to pay for

this bond today if the next interest payment is due...

The telecom EarthCOM issued bonds to finance a new wireless product. The bonds were issued for...

The telecom EarthCOM issued bonds to finance a new wireless

product. The bonds were issued for 30 years, with a face value of

$1000, and semiannual coupons. The coupon rate on these bonds is 8%

APR. Over the last four years, the company has experienced

financial difficulty as the market has grown more competitive.The

risk associated with EarthCOM bonds has increased dramatically, as

investors now want a 15% return to hold the bonds. At what price

should the bonds trade...

Eureka Company issued $290,000 in bonds payable on January 1, 2016. The bonds were issued at...

Eureka Company issued $290,000 in bonds payable on January 1,

2016. The bonds were issued at face value and carried 4-year term

to maturity. They had a 5% stated rate of interest that was payable

in cash on January 1st of each year beginning January 1, 2017.

Based on this information, the amount of total liabilities

appearing on the December 31, 2016 balance sheet would be:

$290,000. $288,550. $304,500. $14,500.

The Kell Company issued $600,000 of 10 year, 12% bonds at 99. The bonds were issued...

The Kell Company issued $600,000 of 10 year, 12% bonds at 99.

The bonds were issued on January 1, 20x1, with interest payable

semiannually on June 30 and December 31.

REQUIRED: Present the journal

entries for each of the following:

The issuance of the bonds.

The payment of interest for the first six months.

Amortization for the first six months.

The retirement of 1/2 the bonds at 102 on January 1, 20x5.

Trevor Price bought 10-year bonds issued by Harvest Foods five years ago for $974.70. The bonds...

Trevor Price bought 10-year bonds issued by Harvest Foods five

years ago for $974.70. The bonds make semiannual coupon payments at

a rate of 8.4 percent. If the current price of the bonds is $1,000,

what is the yield that Trevor would earn by selling the bonds

today? (Round intermediate calculations to 4 decimal places, e.g.

1.2514 and final answer to 2 decimal places, e.g. 15.25%.)

Effective annual yield %

Trevor Price bought 10-year bonds issued by Harvest Foods five years ago for $6,809.76. The bonds...

Trevor Price bought 10-year bonds issued by Harvest Foods five

years ago for $6,809.76. The bonds make semiannual coupon payments

at a rate of 8.4 percent. If the current price of the bonds is

$10,390, what is the yield that Trevor would earn by selling the

bonds today? (Round intermediate calculations to 4 decimal places,

e.g. 1.2514 and final answer to 2 decimal places, e.g. 15.25%.)

Effective annual yield ? %

Trevor Price bought 10-year bonds issued by Harvest Foods five years ago for $4,532.35. The bonds...

Trevor Price bought 10-year bonds issued by Harvest Foods five

years ago for $4,532.35. The bonds make semiannual coupon payments

at a rate of 8.4 percent. If the current price of the bonds is

$6,750, what is the yield that Trevor would earn by selling the

bonds today?

(Round intermediate calculations to 4 decimal places, e.g. 1.2514

and final answer to 2 decimal places, e.g. 15.25%.)

1000

Trevor Price bought 10-year bonds issued by Harvest Foods five years ago for $4,532.35. The bonds...

Trevor Price bought 10-year bonds issued by Harvest Foods five

years ago for $4,532.35. The bonds make semiannual coupon payments

at a rate of 8.4 percent. If the current price of the bonds is

$6,750, what is the yield that Trevor would earn by selling the

bonds today?

(Round intermediate calculations to 4 decimal places, e.g. 1.2514

and final answer to 2 decimal places, e.g. 15.25%.)

Venezuela Inc. issued $2,000,000 5-year bonds at 9%. These bonds were issued on January 1, 2017...

Venezuela Inc. issued $2,000,000 5-year bonds at 9%. These

bonds were issued on January 1, 2017 and pay interest on January 1

and July 1. The YTM of the bond is 11%, i.e. the effective interest

rate for the company is 11%.

a. Calculate the value of the bonds and prepare the journal

entry to record the issuance of the bonds on January 1, 2017.

b. Prepare a bond amortization schedule up to and including

January 1, 2022.

c. Assume...

Venezuela Inc. issued $2,000,000 5-year bonds at 9%. These bonds were issued on January 1, 2017...

Venezuela Inc. issued $2,000,000 5-year bonds at 9%. These bonds

were issued on January 1, 2017 and pay interest on January 1 and

July 1. The YTM of the bond is 11%, i.e. the effective interest

rate for the company is 11%.

a. Calculate the value of the bonds and prepare the journal

entry to record the issuance of the bonds on January 1, 2017.

b. Prepare a bond amortization schedule up to and including

January 1, 2022.

c. Assume...

ADVERTISEMENT

ADVERTISEMENT

Latest Questions

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

ADVERTISEMENT

jeff jeffy answered 1 year ago

jeff jeffy answered 1 year ago