Question

In: Finance

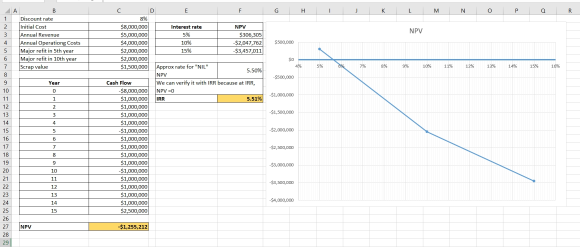

Halcyon Lines is considering the purchase of a new bulk carrier for $8 million. The forecasted...

Halcyon Lines is considering the purchase of a new bulk carrier

for $8 million. The

forecasted revenues are $5 million a year and operating costs are

$4 million. A major

refit costing $2 million will be required after both the fifth and

tenth years. After 15

years, the ship is expected to be sold for scrap at $1.5 million.

If the discount rate is 8%,

what is the ship’s NPV?

Recalculate the NPV of the previous problem at interest rates of

5, 10, and 15%. Plot the points on a

graph with NPV on the vertical axis and the discount rates on the

horizontal axis. At what discount rate

(approximately) would the project have zero NPV? Please explain how

you can check your answer.

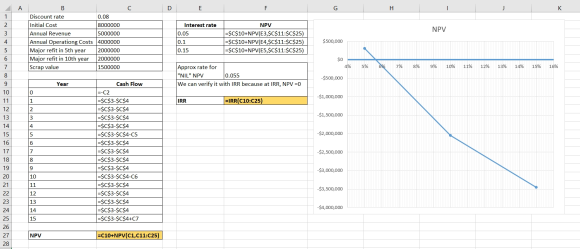

Solutions

Expert Solution

Please refer to below spreadsheet for calculation and answer. Cell reference also provided.

Cell reference -

Related Solutions

Halcyon Lines is considering the purchase of a new bulk carrier for $8.7 million. The forecasted...

Problem 2 Halcyon Lines is considering the purchase of a new bulk carrier for $10 million....

You are considering the purchase of a new stock. The stock is forecasted to pay a...

Toyota is considering installing a new production line which is forecasted to start earning $5 million...

Toyota is considering installing a new production line which is forecasted to start earning $5 million...

RSM Co is considering a project which will require the purchase of $2.7 million in new...

The company's management is considering a new 8 year project. The project will require the purchase...

Veridian Dynamics is considering the purchase of a new cloning machine, which will cost $390 million...

The Chilean flagship carrier LAN agreed to purchase a number of Boeing 787-8 Dreamliner aircraft to...

8 Keller Construction is considering two new investments. Project E calls for the purchase of earthmoving...

- do you believe, as bonilla-silva does, that convert forms of racism are widespread? why or why...

- A bicycle wheel has a diameter of 63.9 cm and a mass of 1.86 kg. Assume...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

jeff jeffy answered 1 year ago

jeff jeffy answered 1 year ago