Question

In: Economics

The world has been attacked by COVID - 19 virus, causing dramatic changes in: The level...

The world has been attacked by COVID - 19 virus, causing dramatic changes in:

- The level of economic activities.

- The priorities of different sectors and activities.

- In the patterns of spending and lifestyles of people.

Explain the above statement, and mention your expectations for life after COVID - 19 in terms of the above three points.

Solutions

Expert Solution

- COVID-19 has changed nearly every aspect of our daily lives, and consumer spending is no exception.

- Generally, spending is down across all industries, as lockdown measures have restricted what we can spend money on, due to restaurants and shops being shut and air travel suspended.

- Equally, the economic consequences of the coronavirus pandemic have meant consumers are less inclined to spend more, with many expecting their household income to continue to fall in the coming months.

- Time spent indoors however, has caused us to spend more on home entertainment and groceries.

Coronavirus (COVID-19) and global growth

The IMF’s estimate of the global economy growing at -3 per cent in 2020 is an outcome “far worse” than the 2009 global financial crises. Economies such as the US, Japan, the UK, Germany, France, Italy and Spain are expected to contract this year by 5.9, 5.2, 6.5, 7, 7.2, 9.1 and 8 per cent respectively.

Advanced economies have been hit harder, and together they are expected to grow by -6 per cent in 2020. Emerging markets and developing economies are expected to contract by -1 per cent. If China is excluded from this pool of countries, the growth rate for 2020 is expected to be -2.2 per cent.

China’s GDP dropped by 36.6 per cent in the first quarter of 2020, while South Korea’s output fell by 5.5 per cent, since the country didn’t impose a lockdown but followed a strategy of aggressive testing, contact tracing and quarantining.

In Europe, the GDPs of France, Spain and Italy fell by 21.3, 19.2 and 17.5 per cent respectively.

Oil and natural gas

Due to the fall in travel, global industrial activity has been affected. Oil prices fell further in March as the transportation section, which accounts for 60 per cent of the oil demand, was hit due to several countries imposing lockdowns.

Not only oil, early this year in China, due to Covid-19-related containment measures, the demand for natural gas fell, as a result of which many Chinese LNG buyers halted their imports as storage tanks filled.

Industrial Metals

Due to lockdowns in China, followed by in the US and Europe, the demand for industrial metals reduced as factories shut down. As per IMF, China accounts for roughly half of the global demand for industrial metals.

Food and beverages

IMF projects a decrease in food prices by 2.6 per cent in 2020, caused by supply chain disruptions, border delays, food security concerns in regions affected by Covid-19 and export restrictions.

In the lockdown period, while the price of cereals, oranges, seafood and arabica coffee has increased, prices of tea, meat, wool and cotton have declined. Further, the decline in oil prices has put a downward pressure on the prices for palm oil, soy oil, sugar and corn.

The Link Between Sentiment and Intent to Spend

As consumers grapple with uncertainty, their buying behavior becomes more erratic. What is clear however, is that they have reduced spending on all non-essential products and services.

But as each country moves along the COVID-19 curve, we can see a glimmer of increasing optimism levels, which in turn is linked to higher spending.

Optimism is promotes higher household spending.

Image: Visual Capitalist

India’s consumers, for example, are displaying higher levels of optimism, with more households planning to increase spend—a trend that is also evident in China, Indonesia, and Nigeria.

Meanwhile, American consumers are still more optimistic about the future than Europeans. 37% of Americans believe the country will recover in 2 or 3 months—albeit with optimism levels at the highest for people who earn over $100K.

Strategic Consumer Spending

Globally, consumers continue to spend—and in some cases, spend more compared to pre-pandemic levels—on some necessities such as groceries and household supplies.

Due to changes in media consumption habits, consumers in almost all countries surveyed say they will increase their spend on at-home entertainment. This is especially true for Korea, a country that already boasts a massive gaming culture.

As restrictions in China lift, many categories such as gasoline, wellness, and pet-care services appear to be bouncing back, which could be a positive sign for other countries following a similar trajectory. But while consumers amp up their spending on the things they need, they also anticipate spending less in other categories.

Travel and Transport

The inevitable decline in the travel and transportation industry is a reflection of mass social isolation levels and tightening travel restrictions.

In fact, the U.S. travel industry can expect to see an average decline in revenue of 81% for April and May. Throughout 2020, losses will equate to roughly $519 billion—translating to a broader $1.2 trillion contraction in total economic impact.

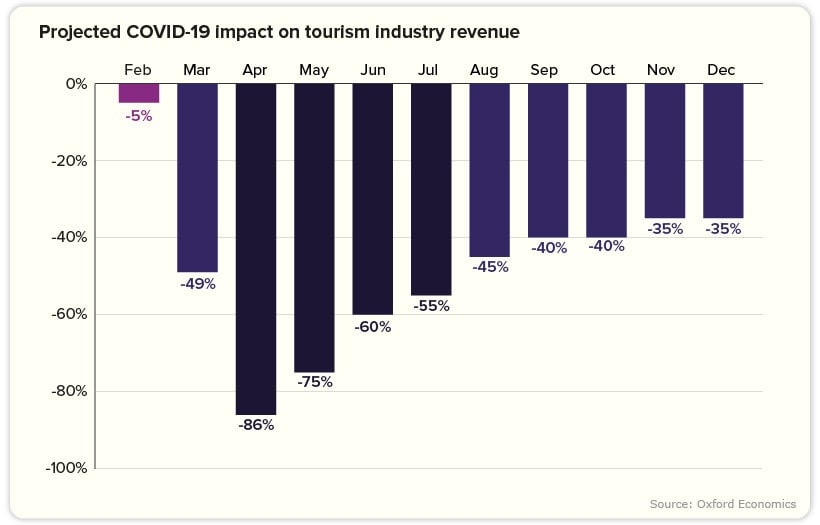

Tourism has suffered heavy losses due to COVID-19.

According to the World Travel and Tourism Council, a staggering 50 million jobs are at risk in the industry, with 30 million of those jobs belonging to employees in Asia.

Considering the travel and tourism industry accounts for 10.4% of global GDP, a slow recovery could have serious ramifications.

we can conclude that after covid 19 the people spent money only for most needed things,and we can also expect less travellings and a total change in pattern of spending and lifestyle.

Related Solutions

A virus has attacked a patient’s adrenal glands, causing the cells of the medulla to die....

The Virus has been blamed for causing much economic havoc in the world and in the...

The Virus has been blamed for causing much economic havoc in the world and in the...

Corona Virus Disease Pandemic (COVID-19) has a devastated impact on many economies of the world. COVID-19...

The Impact of the Corona Virus (COVID - 19) on the World Economy: (1) Can It...

develop a proposal to create a vaccine for SARS-Cov2 (the virus causing Covid-19) What do you...

Covid-19 virus is primarily affecting certain respiratory organs and causing tissue damage. From your study in...

Describe the structure of the COVID-19 virus

The world has been struggling to contain the spread of the Covid-19 pandemic using measuring such...

How has mining, tourism and agriculture been affected by the Covid-19 corona virus In African countries...

- Cane Company manufactures two products called Alpha and Beta that sell for $150 and $110, respectively....

- What’s the cost of each component of capital and which need to be adjusted? What do...

- Answer the following questions 1) How does ASC 606 — Revenue From Contracts With Customers(new standard...

- Project 7-6: Sales Tax Calculator Create a program that uses a separate module to calculate sales...

- On June 30, Sharper Corporation’s stockholders' equity section of its balance sheet appears as follows before...

- In this journal you are asked to take the role of a mayor or congressional representative...

- Answer correctly the below 25 multiple questions on Software Development Security. Please I will appreciate the...

Rahul Sunny answered 1 year ago

Rahul Sunny answered 1 year ago